EXHIBIT 96.1

|

|

|

This Amended S-K 1300 Initial Assessment Mineral Resource Report of the “LOST CREEK ISR URANIUM PROPERTY, SWEETWATER COUNTY, WYOMING, USA” dated September 19, 2022 has been prepared under the supervision of, and signed by the following Qualified Persons:

Prepared under the Supervision of:

WWC Engineering

1849 Terra Avenue

Sheridan, WY 82801

USA

Report Prepared for:

10758 W. Centennial Road

Suite 200

Littleton, CO 80127

|

|

|

TABLE OF CONTENTS

| 1.0 | EXECUTIVE SUMMARY |

|

| 1 |

| |||

| 2.0 | INTRODUCTION |

|

| 9 |

| |||

| 2.1 | Registrant |

|

| 9 |

| |||

|

| 2.2 | Terms of Reference |

|

| 9 |

| ||

|

| 2.3 | Information Sources and References |

|

| 9 |

| ||

|

| 2.4 | Inspection of the Property by Each Qualified Person |

|

| 10 |

| ||

|

| 2.4.1 | QP Qualifications |

|

| 10 |

| ||

|

| 2.5 | Previous Technical Report Summaries |

|

| 10 |

| ||

| 3.0 | PROPERTY DESCRIPTION AND LOCATION |

|

| 11 |

| |||

|

| 3.1 | Location and Size |

|

| 11 |

| ||

|

| 3.2 | Mining Claims, Mineral Leases and Surface Use Agreements |

|

| 16 |

| ||

|

| 3.3 | Title to Property |

|

| 20 |

| ||

|

|

| 3.3.1 | Property Boundaries |

|

| 20 |

| |

|

| 3.4 | Royalties, Taxes and Fees |

|

| 20 |

| ||

|

| 3.5 | Significant Encumbrances or Risks to Perform Work on the Property |

|

| 21 |

| ||

|

|

| 3.5.1 | Environmental Liabilities |

|

| 21 |

| |

|

|

| 3.5.2 | Existing and Required Permits |

|

| 21 |

| |

|

|

| 3.5.3 | Significant Risks that May affect Access, Title, or Right to Perform Work |

|

| 22 |

| |

| 4.0 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

|

| 23 |

| |||

|

| 4.1 | Physiography |

|

| 23 |

| ||

|

| 4.2 | Means of Access |

|

| 23 |

| ||

|

| 4.3 | Proximity to Population Centers |

|

| 23 |

| ||

|

| 4.4 | Climate and Operating Season |

|

| 24 |

| ||

|

| 4.5 | Property Infrastructure |

|

| 24 |

| ||

|

|

| 4.5.1 | Water Supply |

|

| 25 |

| |

| 5.0 | HISTORY |

|

| 26 |

| |||

|

| 5.1 | Ownership History |

|

| 26 |

| ||

|

|

| 5.1.1 | Ownership History of Lost Creek Project |

|

| 26 |

| |

|

|

| 5.1.2 | Ownership History of Adjoining Projects |

|

| 27 |

| |

|

|

| 5.1.2.1 | LC East |

|

| 27 |

| |

|

|

| 5.1.2.2 | LC North |

|

| 27 |

| |

|

|

| 5.1.2.3 | LC South |

|

| 28 |

| |

|

|

| 5.1.2.4 | LC West |

|

| 28 |

| |

|

|

| 5.1.2.5 | EN |

|

| 28 |

| |

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page i |

|

|

|

TABLE OF CONTENTS (Continued)

| 5.2 | Exploration History |

|

| 28 |

| |||

|

| 5.3 | Previous Mineral Resource Estimates and Their Reliability |

|

| 30 |

| ||

|

| 5.4 | Production History |

|

| 30 |

| ||

| 6.0 | GEOLOGICAL SETTING AND MINERALIZATION |

|

| 32 |

| |||

|

| 6.1 | Regional Geology |

|

| 32 |

| ||

|

| 6.2 | Project Geology |

|

| 32 |

| ||

|

| 6.3 | Stratigraphy |

|

| 37 |

| ||

|

| 6.4 | Mineralization of the Lost Creek Property |

|

| 41 |

| ||

|

| 6.5 | DEPOSIT TYPE |

|

| 43 |

| ||

| 7.0 | EXPLORATION |

|

| 46 |

| |||

|

| 7.1 | Drilling |

|

| 46 |

| ||

|

|

| 7.1.1 | Historic Drilling |

|

| 46 |

| |

|

|

| 7.1.1.1 | Lost Creek Project: Drilling History |

|

| 46 |

| |

|

|

| 7.1.1.2 | LC East Project: Drilling History |

|

| 47 |

| |

|

|

| 7.1.1.3 | LC North Project: Drilling History |

|

| 47 |

| |

|

|

| 7.1.1.4 | LC South Project: Drilling History |

|

| 48 |

| |

|

|

| 7.1.1.5 | LC West Project: Drilling History |

|

| 48 |

| |

|

|

| 7.1.1.6 | EN Project: Drilling History |

|

| 48 |

| |

|

|

| 7.1.2 | Drilling By URE |

|

| 48 |

| |

|

| 7.2 | Hydrogeology |

|

| 49 |

| ||

|

| 7.2.1 | Hydraulic Properties |

|

| 50 |

| ||

|

|

| 7.2.2 | QP Comment on Results |

|

| 52 |

| |

|

| 7.3 | Geotechnical Data, Testing, and Analysis |

|

| 52 |

| ||

|

| 7.4 | Disequilibrium |

|

| 52 |

| ||

| 8.0 | SAMPLE COLLECTION, PREPARATION, ANALYSIS AND SECURITY |

|

| 54 |

| |||

|

| 8.1 | Down-hole Geophysical Logging |

|

| 54 |

| ||

|

| 8.2 | Coring |

|

| 55 |

| ||

|

| 8.3 | Drill Cuttings |

|

| 55 |

| ||

|

| 8.4 | Analyses and Security |

|

| 55 |

| ||

|

| 8.5 | Quality Control Summary |

|

| 56 |

| ||

|

| 8.6 | Opinion on Adequacy |

|

| 56 |

| ||

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page ii |

|

|

|

TABLE OF CONTENTS (Continued)

| 9.0 | DATA VERIFICATION |

|

| 57 |

| |||

| 10.0 | MINERAL PROCESSING AND METALLURGICAL TESTING |

|

| 58 |

| |||

| 11.0 | MINERAL RESOURCE ESTIMATES |

|

| 59 |

| |||

|

| 11.1 | Assumptions |

|

| 59 |

| ||

|

| 11.2 | Mineral Resource Estimates |

|

| 59 |

| ||

|

|

| 11.2.1 | Cutoff Selection |

|

| 59 |

| |

|

|

| 11.2.2 | Resource Classification |

|

| 60 |

| |

|

|

| 11.2.3 | Methodology |

|

| 61 |

| |

|

|

| 11.2.3.1 | Fundamentals |

|

| 61 |

| |

|

|

| 11.2.3.2 | Mineral Intercepts |

|

| 62 |

| |

|

|

| 11.2.3.3 | GT Contouring and Resource Estimation |

|

| 62 |

| |

|

| 11.2.4 | Summary of Resources |

|

| 64 |

| ||

|

| 11.2.5 | Resource Estimation Auditing |

|

| 66 |

| ||

|

| 11.2.6 | Mineral Resource Estimate Risk |

|

| 67 |

| ||

| 12.0 | MINERAL RESERVE ESTIMATES |

|

| 68 |

| |||

| 13.0 | MINING METHODS |

|

| 68 |

| |||

|

| 13.1 | Mineral Deposit Amenability |

|

| 68 |

| ||

|

| 13.2 | Mine Development |

|

| 68 |

| ||

| 13.3 | Piping |

|

| 73 |

| |||

|

| 13.4 | Header Houses |

|

| 73 |

| ||

|

| 13.5 | Wellfield Reagents, Electricity |

|

| 73 |

| ||

|

| 13.6 | Mining Fleet Equipment and Machinery |

|

| 73 |

| ||

|

| 13.7 | Mining Personnel |

|

| 73 |

| ||

| 14.0 | PROCESSING AND RECOVERY METHODS |

|

| 74 |

| |||

|

| 14.1 | Plant Processing |

|

| 74 |

| ||

|

| 14.2 | Energy, Water and Process Materials |

|

| 76 |

| ||

|

| 14.3 | Liquid Disposal |

|

| 77 |

| ||

|

| 14.4 | Solid Waste Disposal |

|

| 77 |

| ||

|

| 14.5 | Plant Personnel |

|

| 77 |

| ||

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page iii |

|

|

|

TABLE OF CONTENTS (Continued)

| 15.0 | PROJECT INFRASTRUCTURE |

|

| 78 |

| |||

|

| 15.1 | Roads |

|

| 78 |

| ||

|

| 15.2 | Laboratory Equipment |

|

| 78 |

| ||

|

| 15.3 | Electricity |

|

| 78 |

| ||

|

| 15.4 | Water |

|

| 80 |

| ||

|

| 15.5 | Holding Ponds |

|

| 80 |

| ||

| 16.0 | MARKET STUDIES AND CONTRACTS |

|

| 81 |

| |||

| 17.0 | ENVIRONMENTAL STUDIES, PERMITTING, SOCIAL OR COMMUNITY IMPACT |

|

| 82 |

| |||

|

| 17.1 | Environmental Studies |

|

| 82 |

| ||

|

|

| 17.1.1 | Background Radiological Characteristics |

|

| 82 |

| |

|

|

| 17.1.2 | Threatened, Endangered, or Candidate Species |

|

| 83 |

| |

|

|

| 17.1.3 | Cultural and Historic Resources |

|

| 84 |

| |

|

|

| 17.1.4 | Visual and Scenic Resources |

|

| 84 |

| |

|

|

| 17.1.5 | Byproduct Disposal |

|

| 84 |

| |

|

| 17.2 | Permitting Requirements, Permit Status, Financial Assurance |

|

| 84 |

| ||

|

|

| 17.2.1 | Financial Assurance |

|

| 84 |

| |

|

|

| 17.2.3 | Site Monitoring |

|

| 85 |

| |

|

| 17.3 | Community Affairs |

|

| 85 |

| ||

|

| 17.4 | Project Closure |

|

| 86 |

| ||

|

|

| 17.4.1 | Well Abandonment / Groundwater Restoration |

|

| 86 |

| |

|

| 17.4.2 | Demolition and Removal of Infrastructure |

|

| 86 |

| ||

|

|

| 7.4.3 | Site Grading and Revegetation |

|

| 86 |

| |

|

| 17.5 | Adequacy of Current Plans |

|

| 86 |

| ||

| 18.0 | CAPITAL AND OPERATING COSTS |

|

| 87 |

| |||

|

| 18.1 | Capital Cost Estimation (CAPEX) |

|

| 87 |

| ||

|

| 18.2 | Operating Cost Estimation (OPEX) |

|

| 87 |

| ||

|

| 18.3 | Adequacy of Cost Estimates |

|

| 90 |

| ||

|

| 18.4 | Wellfield Development Costs |

|

| 90 |

| ||

| 19.0 | ECONOMIC ANALYSIS |

|

| 91 |

| |||

|

| 19.1 | Assumptions |

|

| 91 |

| ||

|

| 19.2 | Cash Flow Forecast and Production Schedule |

|

| 92 |

| ||

|

| 19.3 | Taxation |

|

| 95 |

| ||

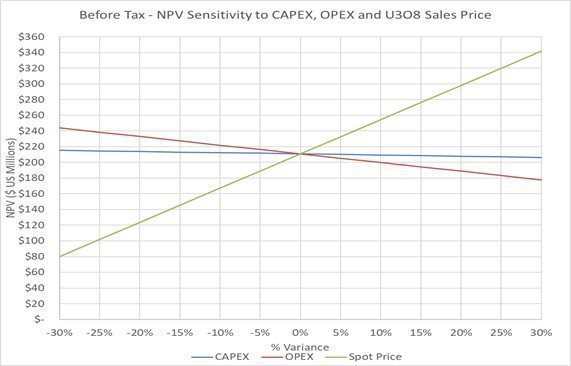

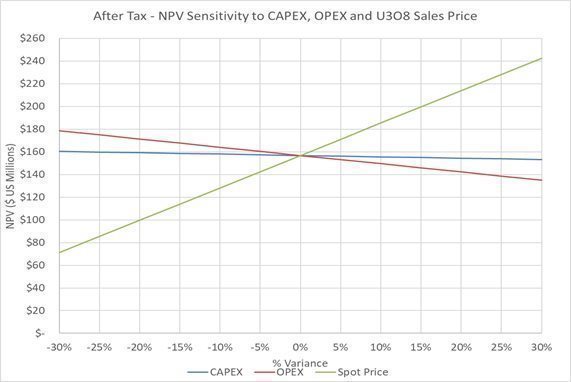

| 19.4 | Sensitivity Analysis |

|

| 95 |

| |||

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page iv |

|

|

|

TABLE OF CONTENTS (Continued)

| 20.0 | ADJACENT PROPERTIES |

|

| 97 |

| |||

| 21.0 | OTHER RELEVANT DATA AND INFORMATION |

|

| 97 |

| |||

| 22.0 | INTERPRETATION AND CONCLUSIONS |

|

| 98 |

| |||

|

| 22.1 | Conclusions |

|

| 98 |

| ||

|

| 22.2 | Risk Assessment |

|

| 98 |

| ||

|

|

| 22.2.1 | Resource and Recovery |

|

| 98 |

| |

|

|

| 22.2.2 | Markets and Contracts |

|

| 99 |

| |

|

|

| 22.2.3 | Operations |

|

| 100 |

| |

| 23.0 | RECOMMENDATIONS |

|

| 101 |

| |||

|

| 23.1 | Continued Wellfield Development |

|

| 101 |

| ||

|

| 23.2 | Continued Permitting |

|

| 101 |

| ||

| 24.0 | REFERENCES |

|

| 102 |

| |||

| 25.0 | RELIANCE ON INFORMATION PROVIDED BY THE REGISTRANT |

|

| 105 |

| |||

| 26.0 | DATE AND SIGNATURE PAGES |

|

| 105 |

| |||

LIST OF TABLES

| Table 1. | Lost Creek Property – Resource Summary |

|

| 4 |

|

| Table 2. | Summary of Economics |

|

| 5 |

|

| Table 3. | Cash Flow Summary |

|

| 7 |

|

| Table 4. | Drill Hole Summary – Historical and Recent |

|

| 29 |

|

| Table 5. | Previous Resource Estimates |

|

| 31 |

|

| Table 6. | KM Horizon - Leach Test Results, 2010 |

|

| 58 |

|

| Table 7. | Lost Creek Property Resources, by Project |

|

| 66 |

|

| Table 8. | Development Summary by Resource Area |

|

| 71 |

|

| Table 9. | Annual Operating Costs (OPEX) Summary |

|

| 88 |

|

| Table 10. | Annual Operating Costs (OPEX) Details |

|

| 89 |

|

| Table 11. | Cash Flow Statement ($US 000s) |

|

| 93 |

|

| Table 12. | Cash Flow Detail ($US 000s) |

|

| 94 |

|

| Table 13. | Net Present Value Discount Rate Sensitivity and IRR |

|

| 95 |

|

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page v |

|

|

|

TABLE OF CONTENTS (Continued)

LIST OF FIGURES

| Figure 1. | General Location Map |

|

| 2 |

|

| Figure 2. | Site Access, Lost Creek Property |

|

| 12 |

|

| Figure 3a. | Lost Creek Project Surface and Mineral Ownership |

|

| 13 |

|

| Figure 3b. | LC East Project Surface and Mineral Ownership |

|

| 14 |

|

| Figure 3c. | LC North Project Surface and Mineral Ownership |

|

| 15 |

|

| Figure 3d. | LC South Project Surface and Mineral Ownership |

|

| 17 |

|

| Figure 3e. | LC West Project Surface and Mineral Ownership |

|

| 18 |

|

| Figure 3f. | EN Project Surface and Mineral Ownership |

|

| 19 |

|

| Figure 4. | Geologic Map of the Great Divide Basin |

|

| 33 |

|

| Figure 5. | Schematic Geologic Cross Section, Lost Creek Project |

|

| 34 |

|

| Figure 6. | Stratigraphic Chart of Lost Creek Project Specific Geology |

|

| 35 |

|

| Figure 7. | Type Log for the Lost Creek Project |

|

| 36 |

|

| Figure 8a. | Stratigraphic Cross Section A-A’ |

|

| 39 |

|

| Figure 8b. | Stratigraphic Cross Section B-B’ |

|

| 40 |

|

| Figure 9. | Resource Map for the Lost Creek Property |

|

| 42 |

|

| Figure 10. | Conceptual Uranium Roll Front Deposit |

|

| 45 |

|

| Figure 11. | GT Contour Resource Polygon |

|

| 64 |

|

| Figure 12. | Resource Areas – Lost Creek Property |

|

| 70 |

|

| Figure 13. | Life of Mine Schedule |

|

| 72 |

|

| Figure 14. | Process Flow Diagram |

|

| 75 |

|

| Figure 15. | Lost Creek Property Existing Infrastructure |

|

| 79 |

|

| Figure 16. | Pre-tax NPV Sensitivity to Price, OPEX and CAPEX |

|

| 96 |

|

| Figure 17. | Post-Tax NPV Sensitivity to Price, OPEX and CAPEX |

|

| 96 |

|

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page vi |

|

|

|

LIST OF ABBREVIATIONS

| AEC | U.S. Atomic Energy Commission |

| ALARA | As Low As Reasonably Achievable |

| AQD | Air Quality Department |

| bgs | Below ground surface |

| BLM | U.S. Bureau of Land Management |

| CAPEX | Capital Expenditure |

| CIM | Canadian Institute of Mining, Metallurgy and Petroleum |

| COC | Chain of Custody |

| CPI | Consumer Price Index |

| DDCT | Density Disturbance Calculation Tool |

| DDW(s) | Deep Disposal Well(s) |

| DEF | Disequilibrium Factor |

| DOE | U.S. Department of Energy |

| eU3O8 | equivalent U3O8 as measured by a calibrated gamma instrument |

| EMC | Energy Metals Corporation |

| EMT | East Mineral Trend, located within the LC East Project |

| EPA | U.S. Environmental Protection Agency |

| ESA | Endangered Species Act |

| ft. | Feet |

| FTE | Full Time Equivalent |

| GDB | Great Divide Basin |

| GIS | Geographic Information System |

| gpm | Gallons Per Minute |

| GT | Grade x Thickness product (% ft.) of a uranium intercept (expressed without units) |

| HDPE | High density polyethylene pipe |

| HH(s) | Header house(s) |

| HPU | High Plains Uranium, Inc. |

| ICP | Inductively Coupled Plasma |

| ISL | In Situ Leach |

| ISR | In Situ Recovery |

| IRR | Internal Rate of Return |

| IX | Ion Exchange |

| K | Thousand |

| kWh | Kilowatt-hours |

| LC | Lost Creek ISR, LLC, operating company for Lost Creek Project; wholly-owned subsidiary of Ur-Energy Inc. |

| lbs. | Pounds |

| LoM | Life of Mine |

| M | Million |

| MMT | Main Mineral Trend, located within Lost Creek Project |

| MOU | Memorandum of Understanding |

| MU1 | Mine Unit 1, Lost Creek Project |

| MU2 | Mine Unit 2, Lost Creek Project |

| NI 43-101 | Canadian National Instrument 43-101 (Standards of Disclosure for Mineral Projects) |

| NPV | Net Present Value |

| NRC | U.S. Nuclear Regulatory Commission |

| OPEX | Operating Expenditure |

| PEA | Preliminary Economic Assessment (per NI 43-101) |

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page vii |

|

|

|

LIST OF ABBREVIATIONS (Continued)

| PFN | Prompt Fission Neutron, logging technology |

| PNC | Power Nuclear Corporation |

| PVC | Polyvinyl chloride pipe |

| QP | Qualified Person or QP Firm |

| R | Range |

| RA | Resource Area |

| SBS | Sage Brush Shale |

| S-K 1300 | Regulation S-K Subpart 1300, “Modernization of Property Disclosures for Mining Registrants” |

| SME | Society for Mining, Metallurgy & Exploration |

| SR | State Route |

| T | Township |

| T&E | Threatened and Endangered Species |

| U | Uranium in its natural isotopic ratios |

| U1 | Uranium One Americas, Inc. |

| UIC | Underground Injection Control (pursuant to U.S. EPA regulations) |

| URE | Ur-Energy Inc. |

| URP | Uranium Recovery Program |

| U.S. | United States |

| USFWS | U.S. Fish and Wildlife Service |

| U3O8 | A standard chemical formula commonly used to express the natural form of uranium mineralization. U represents uranium and O represents oxygen. |

| 235U | Uranium isotope with an atomic mass of 235 |

| WDEQ | Wyoming Department of Environmental Quality WY Wyoming |

| WGFD | Wyoming Game and Fish Division |

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page viii |

|

|

|

1.0 EXECUTIVE SUMMARY

This S-K 1300 Technical Report Summary (Report) for the Lost Creek Property (the Property) has been prepared for Ur-Energy Inc. (URE) and its subsidiaries, Lost Creek ISR, LLC (LC) and NFU Wyoming, LLC under the supervision of Western Water Consultants, Inc., d/b/a WWC Engineering (WWC), pursuant to Regulation S-K Subpart 1300, “Modernization of Property Disclosures for Mining Registrants” (S-K 1300). Its objective is to evaluate the technical and economic viability of the Property using the most current scientific, engineering and technical information. This Report covers resource calculations from drilling activities and production operations information through December 31, 2021.

The Lost Creek PROPERTY represents the composite of six individual contiguous PROJECTS:

|

| · | Lost Creek Project, |

|

| · | LC East Project, |

|

| · | LC West Project, |

|

| · | LC North Project, |

|

| · | LC South Project, and |

|

| · | EN Project |

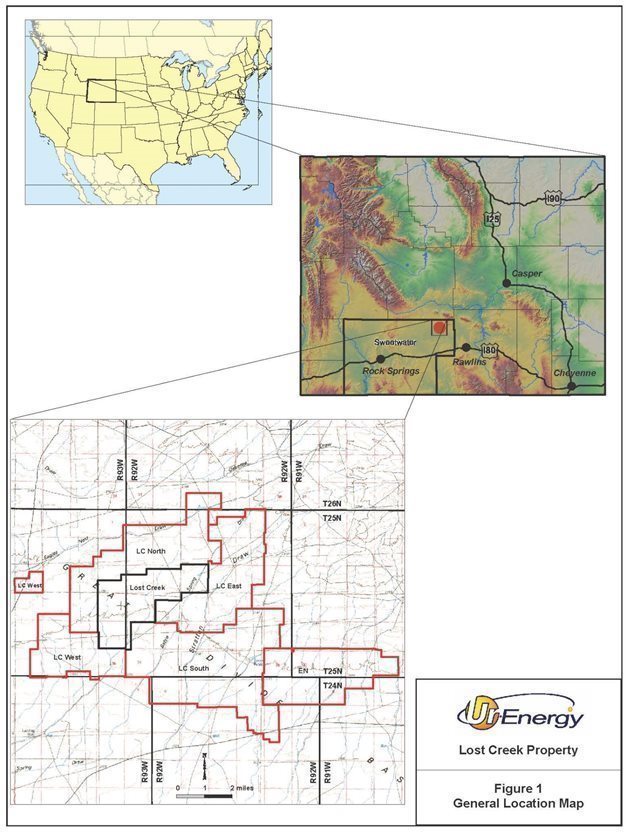

The licensed and operating Lost Creek Project is considered the core project while the others are collectively referred to as the Adjoining Projects. The Adjoining Projects were acquired by URE as exploration targets to provide resources supplemental to those recognized at the Lost Creek Project. Most were initially viewed as stand-alone projects but expanded over time such that collectively they now represent a contiguous land position and mineral property along with the Lost Creek Project. The Lost Creek Property is located in the northeast corner of Sweetwater County, approximately 90 miles southwest of Casper, Wyoming. Current total acreage is approximately 35,400 acres of federal mineral claims and state of Wyoming mineral leases (Figure 1).

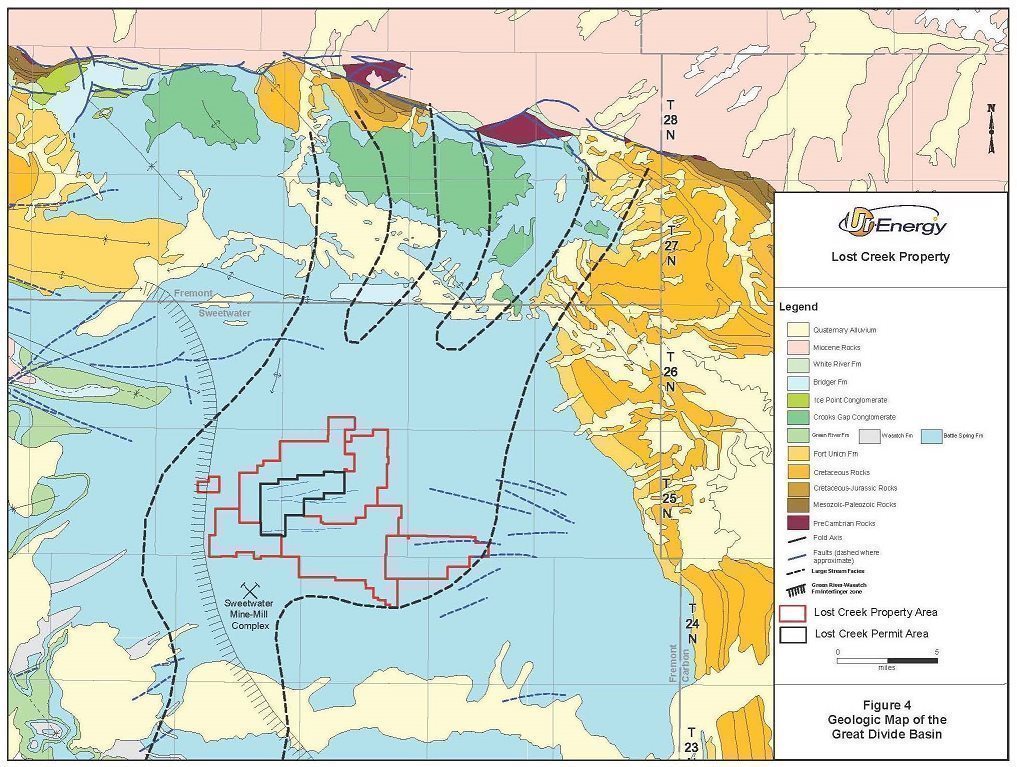

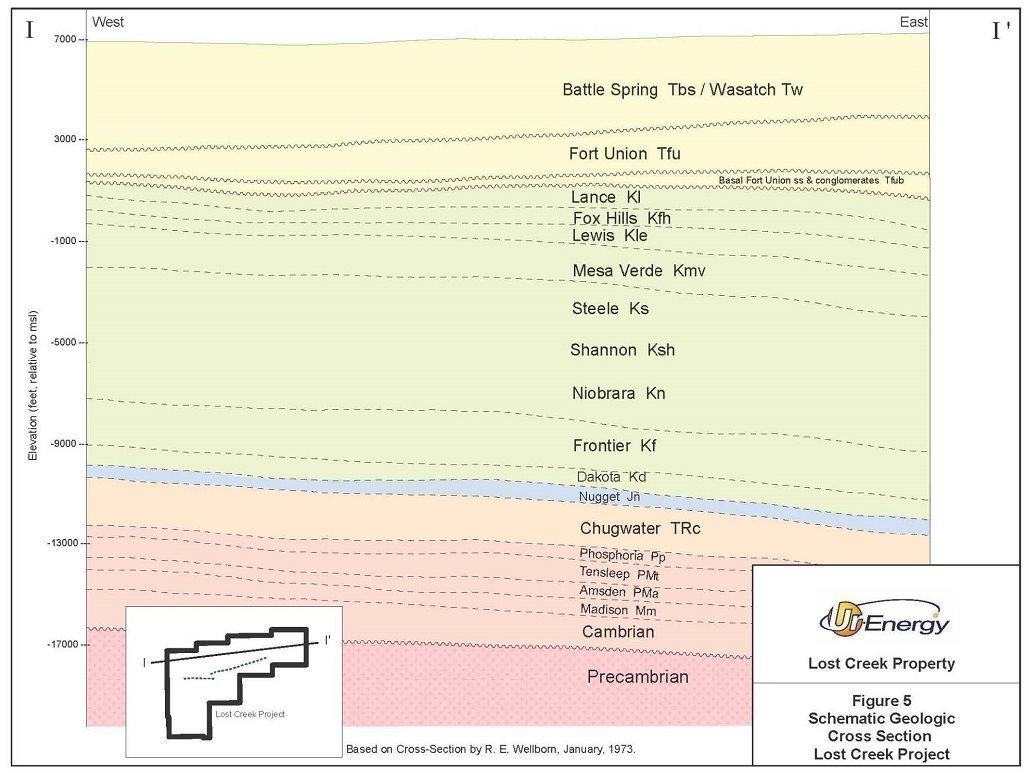

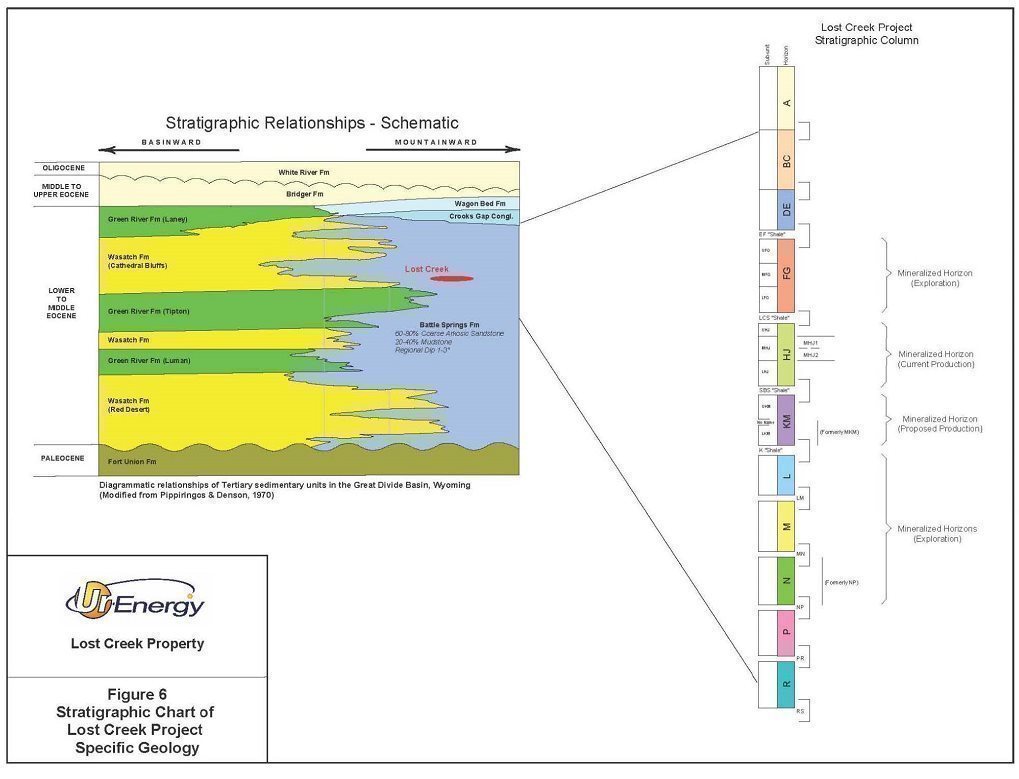

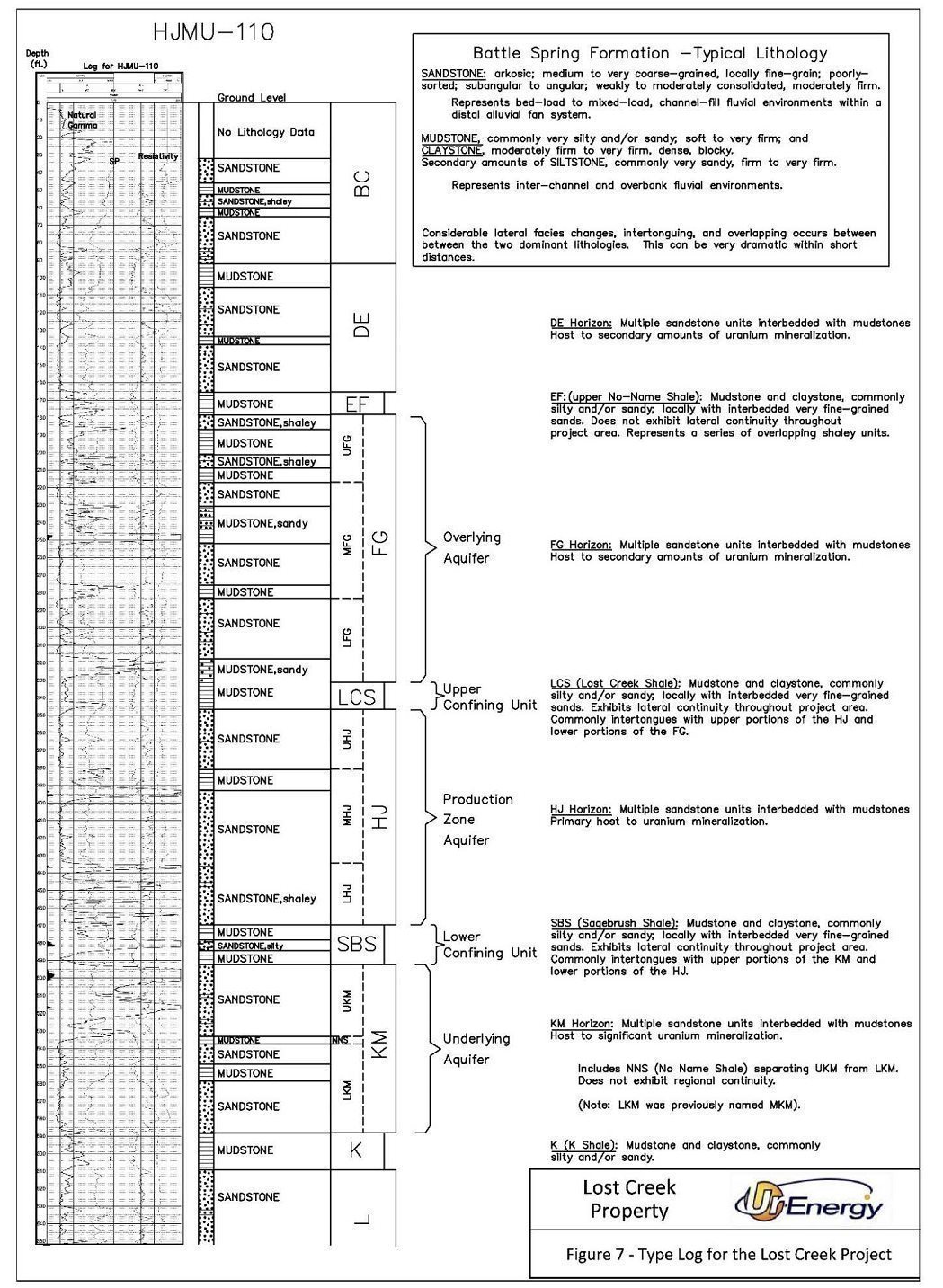

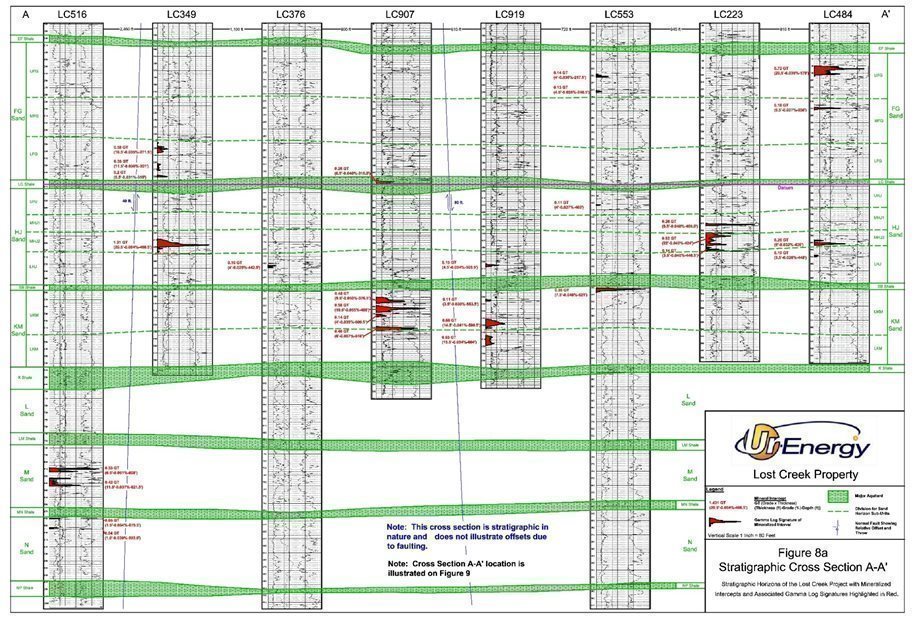

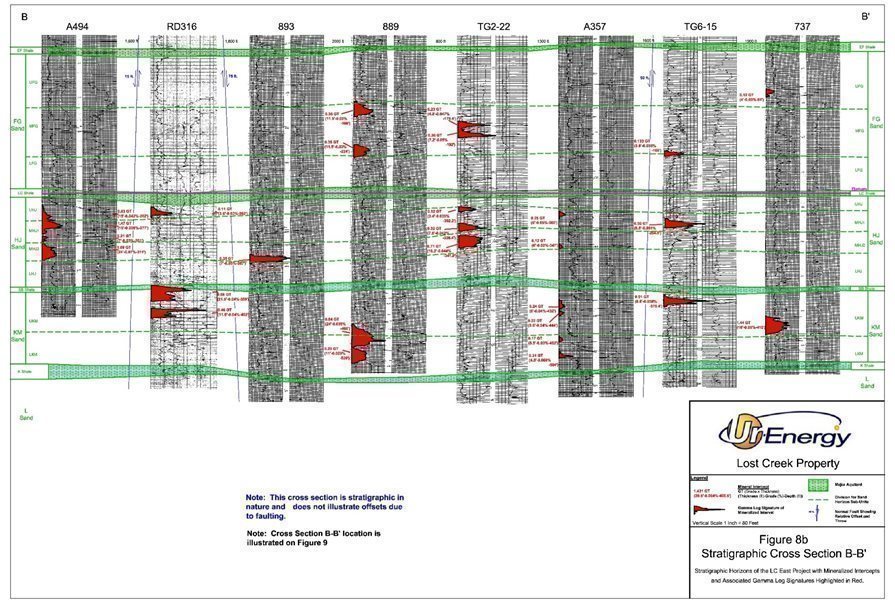

The Property is situated in the northeastern part of the Great Divide Basin (GDB), which is underlain by up to 25,000 ft. of Paleozoic to Quaternary sedimentary units. Rock outcrops in the GDB are dominated by the Battle Spring Formation of Eocene age, which also hosts the uranium mineralization considered in this Report. The dominant lithology in the Battle Spring Formation is coarse arkosic sandstone, interbedded with intermittent mudstone, claystone and siltstone. Deposition occurred as alluvial-fluvial fan deposits within a south-southwest flowing paleo-drainage.

Exploration in the Lost Creek region started in the mid-1960s. Several companies explored portions of the current Property during this early period and continued to advance the uranium discoveries until 1983 when market conditions declined. New Frontiers Uranium, LLC acquired the Lost Creek Project in 2000 and held it until 2005 when Ur-Energy USA Inc. purchased 100 percent ownership of the property through the purchase of a wholly owned company, NFU Wyoming, LLC.

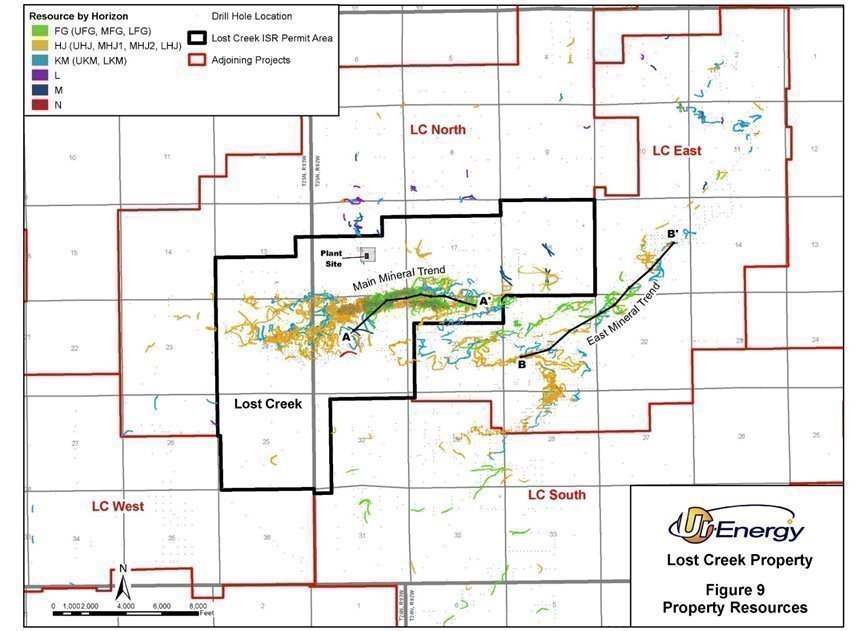

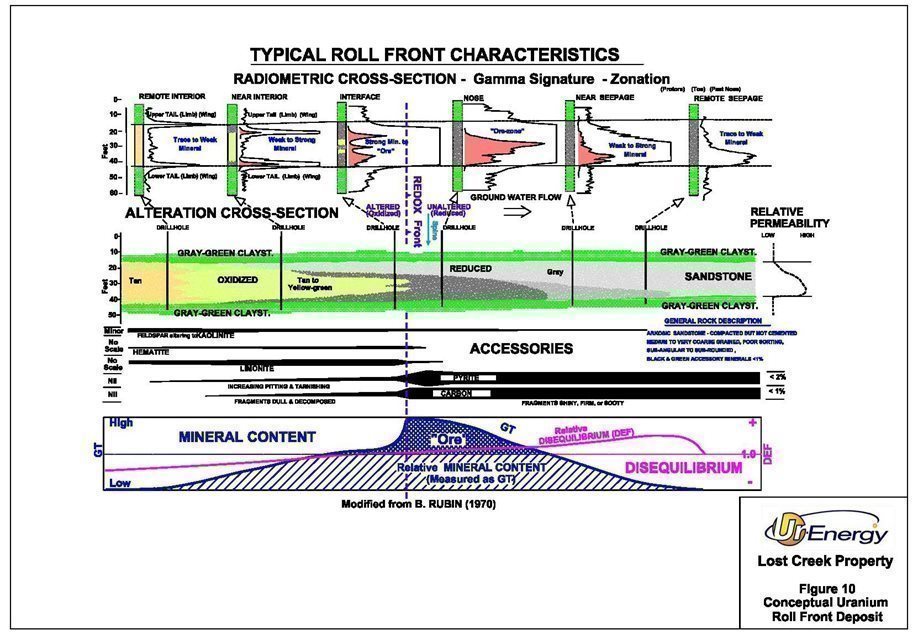

The uranium mineralization occurs as roll front type deposits formed where uranium precipitated from oxidizing groundwater when it contacted reduced host rock. The majority of known, potentially recoverable uranium throughout the Property occurs within two major mineralized trends. The Main Mineral Trend (MMT) lies within the Lost Creek Project and the East

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 1 |

|

|

|

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 2 |

|

|

|

Mineral Trend (EMT) occurs in the LC East Project. The main mineralized stratigraphic intervals are identified by URE as the HJ and KM Horizons of the Battle Spring Formation.

Additional uranium has been identified in the overlying FG and DE Horizons and also in the underlying Deep Horizons.

Construction of the Lost Creek plant and installation of Mine Unit 1 (MU1) was initiated in October 2012. Production operations in MU1 within the HJ Horizon began on August 2, 2013, and, through December 31, 2021, 2.735 million pounds of U3O8 have been produced from the originally planned 13 header houses (HHs) in MU1 and the first three planned HHs in Mine Unit 2 (MU2). For this Report, in order to accurately reflect existing resources, all resources produced through December 31, 2021, have been subtracted from total Measured resources from the HJ Horizon in MU1 and MU2. All the wells to support the originally planned 13 HHs for MU1 have been completed, and surface installations installed, as have the first three HHs in MU2. All monitor ring wells have been installed and pump tested in MU2. The Lost Creek Project is currently operating on a limited basis to maintain operational bleed in the wellfields due to depressed uranium prices. The processing plant and the wellfield remain in operable condition such that production can be quickly ramped up should prices improve.

The existing plant, wellfields, and disposal wells are all fully permitted with the appropriate authorities. Additionally, URE has received approval from the U.S. Bureau of Land Management (BLM) and Wyoming Department of Environmental Quality (WDEQ) Uranium Recovery Program (URP) for production in the HJ and KM Horizons within the LC East Project and to authorize production from additional HJ mine units within the EMT in the Lost Creek Project. Upon approval of an amendment of the Permit to Mine, URE will be able to pursue production in the KM and HJ Horizons at the LC East Project and additional HJ Units at the Lost Creek Project.

The mineral resource estimate for the Property is 11.914 million pounds in the Measured and Indicated categories, and 6.607 million pounds eU3O8 in the Inferred category. Lost Creek has produced 2.735 million pounds U3O8 as of December 31, 2021. The mineral resource reported here has been reduced to account for production to date. The resource estimate is summarized in Table 1.

The QP firm (QP), is of the opinion that the classification of the resources as stated meets the established professional standards and guidelines for reporting mineral resources for the purposes of S-K 1300. The mineral resource estimates in this Report, based on historical and URE drilling, were reviewed and accepted by the QP.

The majority of resources within the Property have been geographically allocated to 12 designated Resource Areas (RAs) which represent the accumulation of resources within a given horizon in a given area. Economic analyses in this Report are performed solely on these designated areas, due to the vertical and lateral continuity of the resources. RAs represent precursors to potential mine units (wellfields).

To date, RAs 1 and 2 have been converted to MU1 and MU2, respectively. At the current time, approximately 85 percent of the total Property resources, as presented in Table 1, are contained within RAs.

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 3 |

|

|

|

Table 1. Lost Creek Property – Resource Summary

|

| Measured | Indicated | Inferred | ||||||

| Project | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) |

| LOST CREEK | 0.048 | 8,572 | 8,173 | 0.048 | 3,412 | 3,295 | 0.046 | 3,261 | 3,013 |

| Production through 12/31/2021 |

0.048 |

-2,849 |

-2,735 |

|

|

|

|

|

|

| LC EAST | 0.052 | 1,392 | 1,449 | 0.041 | 1,891 | 1,567 | 0.042 | 2,954 | 2,484 |

| LC NORTH | — | — | — | — | — | — | 0.045 | 644 | 580 |

| LC SOUTH | — | — | — | 0.037 | 220 | 165 | 0.039 | 637 | 496 |

| LC WEST | — | — | — | — | — | — | 0.109 | 16 | 34 |

| EN | — | — | — | — | — | — | — | — | — |

| GRAND TOTAL | 0.048 | 7115 | 6,887 | 0.046 | 5,523 | 5,027 | 0.044 | 7,512 | 6,607 |

|

|

|

| MEASURED + INDICATED = | 12,638 | 11,914 |

|

|

| |

| 1. | Sum of Measured and Indicated tons and pounds may not add to the reported total due to rounding. |

| 2. | % eU3O8 is a measure of gamma intensity from a decay product of uranium and is not a direct measurement of uranium. Numerous comparisons of eU3O8 and chemical assays of Lost Creek rock samples, as well as PFN logging, indicate that eU3O8 is a reasonable indicator of the chemical concentration of uranium. |

| 3. | Table shows resources based on grade cutoff of 0.02 % eU3O8 and a grade x thickness cutoff of 0.20 GT. |

| 4. | Measured, Indicated, and Inferred Mineral Resources as defined in 17 CFR § 229.1300. |

| 5. | Resources are reported through December 31, 2021. |

| 6. | All reported resources occur below the static water table. |

| 7. | 2.735 million lbs. of U3O8 have been produced from the HJ Horizon in the Lost Creek Project as of December 31, 2021. |

| 8. | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| 9. | The point of reference for resources is in situ at the Property. |

Cautionary statement: This Report is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is increased risk and uncertainty to commencing and conducting production without established mineral reserves that may result in economic and technical failure which may adversely impact future profitability. The estimated mineral recovery used in this Report is based on recovery data from wellfield operations to date, as well as Ur-Energy personnel and industry experience at similar facilities. There can be no assurance that recovery at this level will be achieved.

The QP has assumed that URE’s operations at the Property will be conducted in conformance with applicable laws, regulations and requirements of federal, state and local agencies. It is also assumed that organization and management controls have been and will continue to be established to ensure compliance with applicable regulations and to implement URE’s policy for providing a safe working environment including the philosophy of maintaining radiation exposures As Low As Reasonably Achievable (ALARA).

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 4 |

|

|

|

The resources identified and evaluated have been added to the Lost Creek production plan and continue to support the possible economics of the Property. Using the estimated capital expenses (CAPEX), operating expenses (OPEX) and closure costs presented herein, a cash flow statement has been developed. The statement assumes no escalation, and no debt, interest or capital repayments. It also does not include depreciation. It should be noted that Lost Creek ISR, LLC is the recipient of a State of Wyoming Taxable Industrial Development Revenue Bond, as amended from time to time. Debt interest and repayment of this bond is not included in the economic analysis. This information is summarized in the following Table 2.

Table 2. Summary of Economics

| Economic Parameter |

| Units |

| Pre-income Tax |

|

| Post-income Tax |

| ||

| Initial CAPEX 1 |

| US$ 000s |

| $ | - |

|

| $ | - |

|

| Sustaining CAPEX |

| US$ 000s |

| $ | 19,878 |

|

| $ | 19,878 |

|

| LoM OPEX |

| $ / Lb |

| $ | 16.34 |

|

| $ | 16.34 |

|

| Income Taxes |

| $ / Lb |

| $ | - |

|

| $ | 8.72 |

|

| Total Cost per Pound |

| $ / Lb |

| $ | 33.61 |

|

| $ | 42.33 |

|

| Production |

| Lb 000s |

|

| 12,261 |

|

|

| 12,261 |

|

| Net Cash Flow |

| US$ 000s |

| $ | 376,427 |

|

| $ | 267,054 |

|

| NPV 8% |

| US$ 000s |

| $ | 210,894 |

|

| $ | 156,790 |

|

| IRR (adjusted for Undepreciated Initial Capital) 2 |

| % |

|

| 72.2 | % |

|

| 66.8 | % |

| 1. | Initial capital costs of $46.5 million were incurred and expended prior to the starting date of this economic analysis. Because there are no additional cash expenditures required for initial capital, they are therefore excluded from the cash flow and NPV calculations. |

| 2. | As of December 31, 2021, Lost Creek had $27.4 million of undepreciated, initial capital assets that will be charged against operations over time. By including the undepreciated, initial capital assets, an IRR can be calculated. Without these costs, an IRR cannot be calculated. |

The economic analyses presented herein provide the results of the analyses for pre-income tax and post-income tax, which includes U.S. federal and Illinois state income taxes. There is no State of Wyoming income tax, and all sales are assumed to take place in Illinois where the conversion facility is located. The only difference between the two scenarios is the value of the estimated income taxes. All other sales, property, use, severance and conservations taxes as well as royalties are included in both scenarios. Both economic analyses presented herein assume no escalation and no debt, interest or capital repayments. Ur-Energy USA Inc. files consolidated federal tax returns in the United States and had approximately $105.6 million in tax loss carry forwards as of December 31, 2021. URE does not anticipate paying any significant federal income taxes until the existing, and any future, tax loss carry forwards are utilized. In addition, reclamation costs can be deducted in the early years of the Property, thus also pushing out the tax liability.

The sale price for the produced uranium is assumed to vary based on an annual average of the projections prepared by VIII Capital Corp.; Cantor Fitzgerald Canada Corporation; H.C. Wainwright & Co.; and UxC, LLC (See Chapters 16 and 24). The revenue for the cash flow estimate was developed using the GT contour mineral resource estimate for the MMT and EMT, and further assumed that, based on an 80 percent recovery factor, approximately 12.3 million pounds of U3O8 will be recovered from the MMT and EMT at the Property.

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 5 |

|

|

|

Remaining CAPEX costs are for sustaining capital requirements at the mine site and are for the installation of a wastewater treatment building to optimize wastewater reduction. The remaining sustaining capital is for the replacement of equipment that will be used in future operations of the plant and the wellfields. The sustaining capital cost is estimated to be $19.9 million. In addition, costs are included in the wellfield development portion of this analysis for the installation of one additional Underground Injection Control (UIC) Class I deep disposal well (DDW) at an estimated cost of $3.2 million. The sustaining capital estimate is based on the actual previous purchases of the same equipment and/or vendor prices, thus the predicted level of accuracy of the sustaining capital estimate is +/- 10 percent. In cases where price quotes or previous purchases were made more than a year prior to this analysis, costs were escalated against the Consumer Price Index or the gross domestic product: implicit price deflator adjusted to December 2021 (CPI, 2021 & FRED, 2021)

URE purchased and paid for the processing plant and much of the first mine unit prior to the commencement of operations in 2013 and prior to this economic analysis. Those initial capital costs totaled approximately $46.5 million and are not included in this economic analysis because they were previously incurred.

OPEX cost estimates were developed by evaluating each process unit operation and associated operating services (power, water, air, waste disposal), infrastructure (offices, shops), salary plus burden, and environmental control (heat, air conditioning, monitoring). The OPEX estimate is based on URE’s current operating costs, budgets, development plan, deliverables, process flow sheets, process design, materials balance and project manpower schedule. The annual OPEX is provided in Chapter 18.0.

Construction of the plant and MU1 began in October 2012. Plant construction was completed in the third quarter of 2013. Wellfield drilling and construction activities have been completed to various levels with the majority of the work occurring in the MU1 and the areas of the first three HHs in MU2.

Subsequent to initial capital purchases, all other installation costs have been expensed. These include additional construction in MU1, installation of the monitor well ring in MU2 and drilling and construction of the third DDW. The Net Present Value (NPV) calculations assume that cash flows occur in the middle of the accounting periods. The NPV is calculated from the discounted cash flow model and is based on the CAPEX, OPEX and closure cost estimates, a variable future uranium price and the anticipated production schedule. Excluding sunk costs which occurred prior to December 31, 2021, the Property is estimated to generate net cash flow over its life, before income tax, of $376.4 million and $267.1 million after income tax. Payback of the initial capital investments, including $23.7 Million in sunk costs which occurred prior to the beginning of this analysis, is estimated during the second quarter of 2024. The Property has a calculated before tax Internal Rate of Return (IRR) of 72.2 percent and a before tax NPV of $210.9 million applying an eight percent discount rate. When income taxes are included in the calculation, the after-tax IRR is 66.8 percent and the after tax NPV is $156.8 million applying an eight percent discount rate. Life of Mine (LoM) operating costs are approximately $33.61 per pound of U3O8 produced including royalties and local taxes. Federal and State income taxes are estimated to be $8.72 per pound. A summary of the current project economics is presented below in Table 3 and is discussed in more detail in Chapter 19.

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 6 |

|

|

|

Approximately 27.4 percent of the resources in the economic analysis were inferred resources. Inferred resources are resources that are considered too speculative geologically to have modifying factors applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that this economic assessment will be realized. To account for the chance that the inferred resources are not upgraded as mining progresses and URE collects additional drilling data, a second economic analysis was prepared which excluded the inferred resources. The estimated recovery excluding the inferred resources was 8.6 million pounds. Without the inferred resources the Property is estimated to generate net cash flow over its life, before income tax, of $234.8 million and $175.3 million after income tax. Without the inferred resources the calculated before tax IRR is 71.7 percent and a before tax NPV of $153.4 million applying an eight percent discount rate. When income taxes are included in the calculation without inferred resources, the after-tax IRR is 67.0 percent and the after tax NPV is $120.0 million applying an eight percent discount rate. Without the inferred resources LoM operating costs are estimated at approximately $36.23 per pound of U3O8 produced including royalties and local taxes. Income taxes are estimated to be $6.69 per pound.

Table 3. Cash Flow Summary

| Cash Flow Line Items |

| Units |

| Total |

|

| US$ per Pound |

| ||

| Pounds produced |

| Lbs |

|

| 12,261,347 |

|

|

|

| |

| Pounds sold |

| Lbs |

|

| 12,546,207 |

|

|

|

| |

| Sales |

| US$ 000s |

| $ | 798,601 |

|

| $ | 63.65 |

|

| Royalties |

| US$ 000s |

| $ | (440 | ) |

| $ | (0.04 | ) |

| Net sales |

| US$ 000s |

| $ | 798,161 |

|

| $ | 63.62 |

|

| Wyoming severance tax |

| US$ 000s |

| $ | (16,321 | ) |

| $ | (1.30 | ) |

| Sweetwater ad valorem tax |

| US$ 000s |

| $ | (27,598 | ) |

| $ | (2.20 | ) |

| Operating costs (see Table 9) |

| US$ 000s |

| $ | (205,055 | ) |

| $ | (16.34 | ) |

| Wellfield development |

| US$ 000s |

| $ | (151,733 | ) |

| $ | (12.09 | ) |

| Exploration cost |

| US$ 000s |

| $ | - |

|

| $ | - |

|

| Sweetwater property tax |

| US$ 000s |

| $ | (1,148 | ) |

| $ | (0.09 | ) |

| Working capital changes |

| US$ 000s |

| $ | - |

|

| $ | - |

|

| Project cash flow |

| US$ 000s |

| $ | 396,305 |

|

| $ | 31.59 |

|

| Initial capital |

| US$ 000s |

| $ | - |

|

| $ | - |

|

| Sustaining capital |

| US$ 000s |

| $ | (19,878 | ) |

| $ | (1.58 | ) |

| Net cash flow before tax |

| US$ 000s |

| $ | 376,427 |

|

| $ | 30.00 |

|

| Federal income tax |

| US$ 000s |

| $ | (77,108 | ) |

| $ | (6.15 | ) |

| State income tax |

| US$ 000s |

| $ | (32,265 | ) |

| $ | (2.57 | ) |

| Net cash flow after tax |

| US$ 000s |

| $ | 267,054 |

|

| $ | 21.29 |

|

| 1. | Production is based on an 80% recovery of the total of Measured, Indicated and Inferred resources in the 12 RAs of the MMT and EMT. |

| 2. | Uranium price is based on the average of the projections of VIII Capital Corp., November 4, 2021; Cantor Fitzgerald Canada Corporation, October 18, 2021; H.C. Wainwright & Co., September 29, 2021; and UxC, LLC, December 6, 2021, as discussed in Chapter 16.0. |

| 3. | Wellfield development includes wellfield drilling and wellfield construction costs. |

| 4. | Working capital changes are primarily related to annual cash flow timing differences in accounts receivable and accounts payable and totals to zero. |

| 5. | Pounds sold exceeds pounds produced due to existing inventories. |

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 7 |

|

|

|

The QP finds the Property is potentially viable based on the assumptions contained herein. There is no certainty that the mineral recovery or the economic analyses presented in this Report will be realized. In order to realize the full potential benefits described in this Report, the following activities, as discussed in Chapter 23.0 (Recommendations), are required:

|

| · | Further development of wellfields including MU2 and the resources not previously put under pattern in MU1, |

|

| · | Completion of the permit amendment process for the required permits and approvals for additional HJ production at Lost Creek and production from the HJ and KM Horizons at LC East production, |

|

| · | Continue to advance other adjoining projects as necessary to mine uranium at the Property, and |

|

| · | URE should continue with its pre-construction design and engineering work related to wastewater management processes and procedures with the goal of concentrating and minimizing RO brine production and maximizing permeate output. Further costs for this continued design and engineering work are estimated to be $0.2 million. |

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 8 |

|

|

|

2.0 INTRODUCTION

2.1 Registrant

WWC has been retained by URE to prepare this Report for the Property, which includes the Lost Creek Project and the Adjoining Projects located in northeastern Sweetwater County in south-central Wyoming, USA. This Report has been prepared in accordance with the guidelines set forth under S-K 1300 for the submission of technical reports on mineral properties. This Report also presents a validation of the estimate of Measured, Indicated and Inferred Mineral Resources as defined in S-K 1300 (17 CFR §229.1300). Estimates of Mineral Reserves were not prepared. Property economics and related analyses were also updated from earlier such analyses.

URE was incorporated on March 22, 2004 and is an exploration stage mining company engaged in the identification, acquisition, evaluation, exploration, development and operation of uranium properties in the United States. URE is incorporated in Canada with principal executive offices located at 10758 West Centennial Road, Suite 200, Littleton, CO 80127. URE’s uranium mineral property portfolio includes properties in the Great Divide Basin, the Shirley Basin, and the Gas Hills mining districts of Wyoming.

2.2 Terms of Reference

This Report was prepared to disclose the updated results of mineral resource estimations for the Property prompted by development activities through December 31, 2021. Property economics and related analyses were also updated from earlier such analyses. This is the first S-K 1300 technical report for the Property. However, reports meeting Canadian National Instrument 43-101 (NI 43-101) standards have been previously prepared and are referenced in this report. The last NI 43-101 compliant report prepared for the Property had a February 8, 2016, effective date (TREC, 2016).

2.3 Information Sources and References

The information and data presented in this Report was gathered from various sources listed in Chapters 24 and 25. Technical information was provided to WWC by URE and includes data from other professional consultants and follows generally accepted uranium ISR practices. Mineral resource estimates are based on exploration, delineation and production drilling, and associated data, provided by URE and reviewed by WWC.

The wellfield design was provided by URE with associated numbers and locations of wells and HHs. It includes the as-built design in MU1 and MU2 as well as anticipated wellfield layout for future development. The cost estimates presented here are based on wellfield layouts, process flow diagrams, tank and process equipment and buildings currently installed at the Property, personnel and capital equipment requirements provided by URE.

Units of measurement, unless otherwise indicated, are feet (ft.), miles, acres, pounds avoirdupois (lbs.), and short tons (2,000 lbs.). Uranium is expressed as pounds U3O8, the standard market unit. All references to dollars ($) are in U.S. dollars. Grades reported for historical resources and the mineral resources reported and used herein are percent eU3O8 (equivalent U3O8 by calibrated gamma geophysical logging unit). ISR refers to in situ recovery, sometimes also termed ISL or in situ leach. A complete list of abbreviations is provided on pages vii-viii.

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 9 |

|

|

|

2.4 Inspection of the Property by Each Qualified Person

WWC professionals have most recently visited the site on January 28, 2022, and on February 1, 2022. The purpose of these site visits was to observe the geography and geology of the Project site, verify work done at the site by URE, observe the potential locations of Project components, confirmation drilling and other site activities, and confirm existing site infrastructure including installed wellfields, plant facilities and equipment at the site.

2.4.1 QP Qualifications

Completion of this Report was under the direction and supervision of WWC. WWC is a third-party QP as defined by Regulation S-K 1300. Additionally, WWC has approved the technical disclosure contained in this Report.

2.5 Previous Technical Report Summaries

URE has not previously filed a Technical Report Summary under S-K 1300 regulations. Additional reports meeting Canadian National Instrument 43-101 (NI 43-101) standards have been previously prepared and are referenced in this report.

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 10 |

|

|

|

3.0 PROPERTY DESCRIPTION AND LOCATION

3.1 Location and Size

The Property is located in the northeastern corner of Sweetwater County in south-central Wyoming. As shown on Figure 1, the Property is in an unpopulated area located approximately 15 miles southwest of Bairoil, Wyoming, about 38 miles northwest of Rawlins, Wyoming and about 90 miles southwest of Casper, Wyoming. It is centered at approximately 42 degrees, 8.06 minutes North latitude and 107 degrees, 51.7 minutes West longitude. All references herein to Township and Range occur within the 6th Prime Meridian.

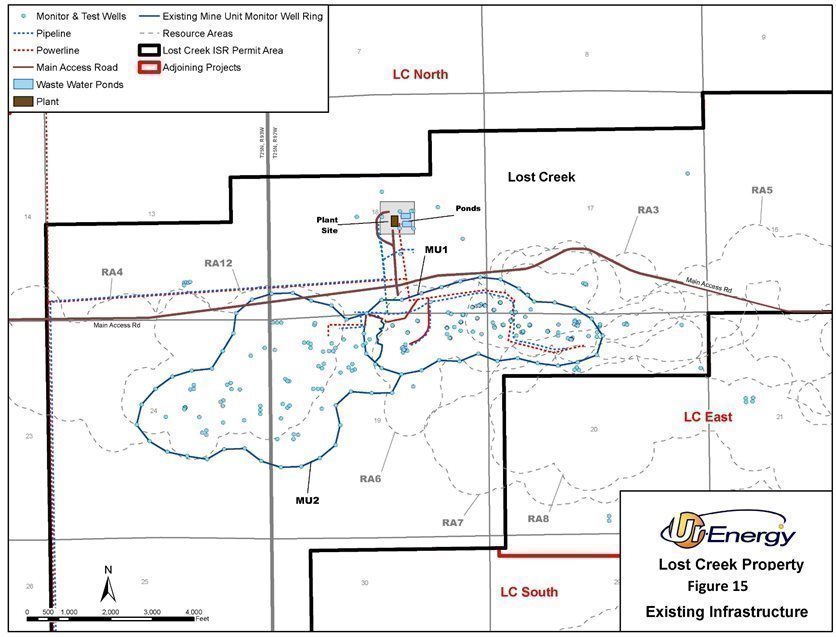

The Lost Creek plant is constructed and operating. Production well installation for the originally designed 13 HHs in MU1 is complete and production operations have occurred in all 13. Additionally, the first three HHs of MU2 have been constructed and are operational. Additional HHs will be developed in both mine units and additional recovery areas, as production requirements warrant. Three DDWs were drilled and operated; subsequently, one deep well was plugged and abandoned. Shallow UIC Class V wells for water recycling were permitted, drilled and have been in operation since 2017. Associated access roads have been constructed. URE has also installed numerous monitoring and other wells in support of its permit and license applications and to further mine planning. Various other infrastructure, including wells, water tanks, ponds, a meteorological station, and other equipment, has been placed on the Property by URE in support of its mining, development, exploration, and permit/license activities.

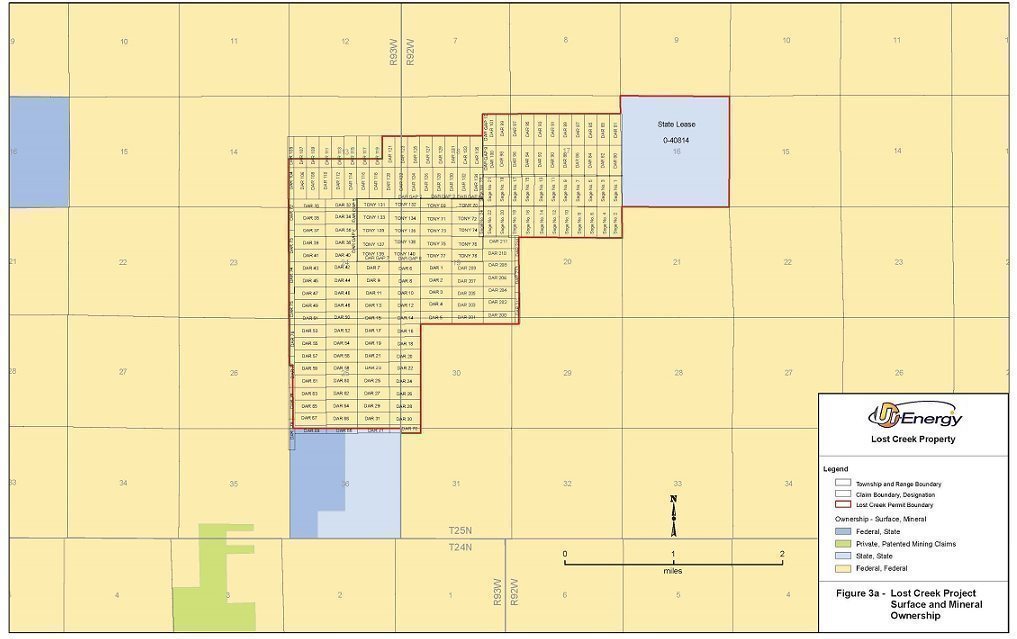

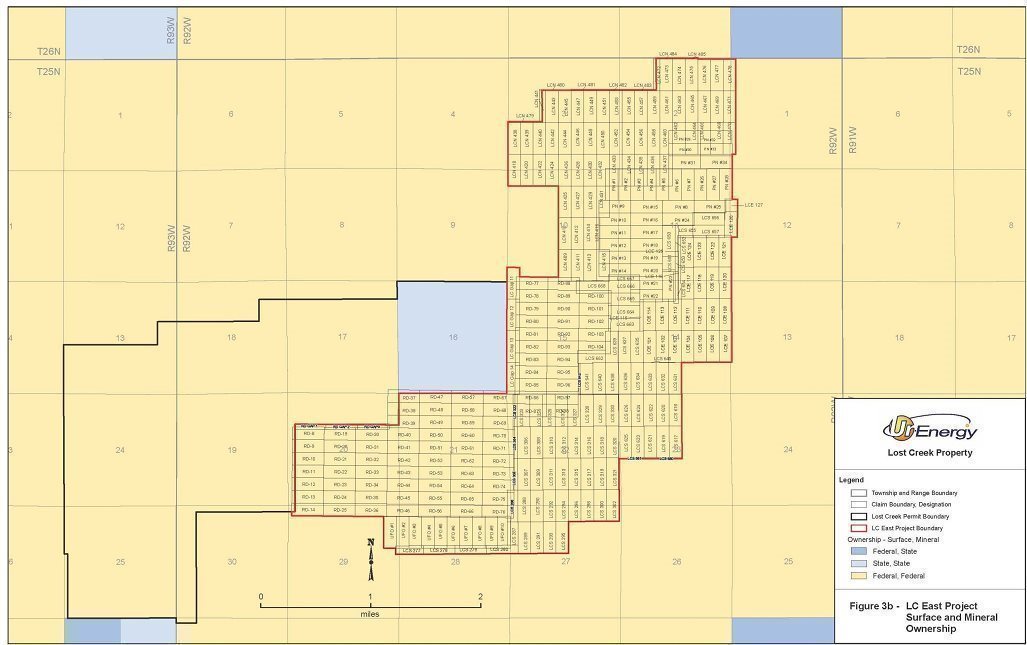

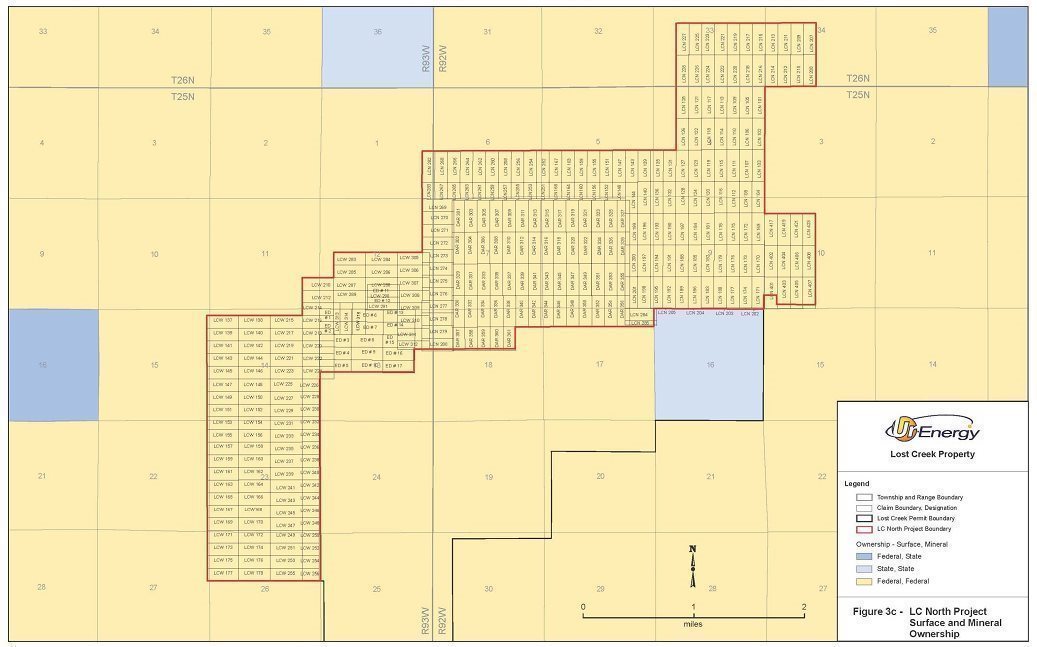

The Property currently comprises six individual Projects named the Lost Creek, LC East, LC North, LC South, LC West, and EN Projects (Figure 2) located over approximately 35,400 acres. The Lost Creek Project is considered the core project, with current production occurring in MU1 and MU2. The other five Projects, collectively referred to as the Adjoining Projects, are extension and exploration properties targeted as possible sources of additional feed to the Lost Creek Project production facilities. All Projects within the Property consist mostly or entirely of federal unpatented lode mining claims. Three of the Projects also have state mineral leases. URE does not hold any private (fee) mineral leases within the Property. Land holdings within the six Projects of the Property are summarized below. With the exception of the Lost Creek Project, acreage estimates are rounded to the nearest 10s.

Lost Creek Project: is located in Sections 13, 24 and 25 of T25N, R93W, and Sections 16 through 20 and 29 through 31 of T25N, R92W (Figure 3a). The Project is approximately 4,194 acres in size, including 3,554 acres in 201 federal unpatented lode mining claims and 640 acres in one state of Wyoming mineral lease.

Adjoining Company Projects:

LC East Project: is a block of 324 federal mineral claims (Figure 3b) which are adjoining to the east and northeast of the Lost Creek Project, within Sections 1 through 3, 10 through 15, 20 through 23, 27 through 29 of T25N, R92W. The LC East Project encompasses approximately 5,750 acres.

LC North Project: is adjoining to the north and west of the Lost Creek Project in Sections 4 through 10, 17, and 18 of T25N, R92W, Sections 1, 11 through 15, 22, 23, 26, and 27 of T25N, R93W and Sections 33 through 34 of T26N, R92W (Figure 3c). The LC North Project includes 338 federal unpatented lode mining claims totaling approximately 6,260 acres.

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 11 |

|

|

|

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 12 |

|

|

|

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 13 |

|

|

|

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 14 |

|

|

|

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 15 |

|

|

|

LC South Project: is an adjoining project to the south and east of the Lost Creek Project in Sections 22 through 35 of T25N, R92W, Sections 3 through 6, and 8 through 11, 14, and 15 of T24N, R92W, and Section 1 of T24N, R93W (Figure 3d). The LC South Project encompasses 546 federal unpatented lode mining claims totaling approximately 10,200 acres.

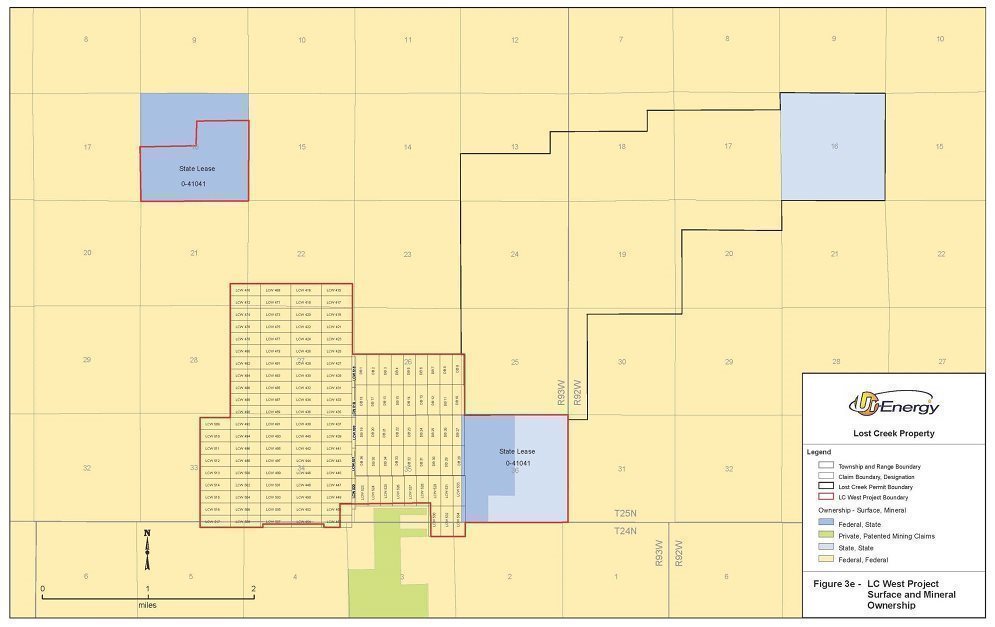

LC West Project: consists of a block of mining claims plus one state lease in two parcels (Figure 3e). Most of LC West adjoins the Lost Creek, LC North and LC South Projects within Sections 16, 21, 22, 25 through 28, 33 through 36 of T25N, R93W, and Sections 2 through 5 of T24N, R93W. One of the state mineral lease parcels lies as a disconnected parcel approximately a mile north from the LC West mining claims. LC West Project encompasses a total of approximately 3,840 acres, including 2,800 acres in 142 federal unpatented lode mining claims and 1,040 acres in the state of Wyoming mineral lease.

EN Project: is the adjoining project to the east of the LC South Project in Sections 31 through 34 of T25N, R91W, Sections 5 through 7 of T24N, R91W, Sections 35 and 36 of T25N, R92W, and Sections 1 through 3 and 10 through 12 of T24N, R92W (Figure 3f). The current EN Project encompasses approximately 5,160 acres, including approximately 4,520 acres in 234 federal unpatented lode mining claims and 640 acres in the state of Wyoming mineral lease.

3.2 Mining Claims, Mineral Leases and Surface Use Agreements

Collectively the Property currently consists of a total of 1,785 federal unpatented lode mining claims and three state of Wyoming leases for uranium and associated minerals. The land status of each project is illustrated in Figures 3a-f and described below:

The surface of all the mining claims is controlled by the BLM, with URE possessing the right to use as much of the surface as is necessary for exploration and mining of the claims, subject to compliance with all federal, state and local laws and regulations. Surface use on BLM lands is administered under federal regulations.

The Lost Creek and other projects currently held by LC are subject to a mortgage securing a bond loan with Sweetwater County, Wyoming, through the State of Wyoming Taxable Industrial Development Revenue Bond program, and the related State bond which was issued for this loan in October 2013. The mortgage, as amended, is recorded in Sweetwater County, Wyoming (October 23, 2013, Rec. 1630230 Bk. 1202, pg. 5867; December 28, 2015, Rec. 1646033 Bk. 1212, pg. 4611); October 1, 2019, Rec. 1669974, Bk. 1228, pg. 5759; and October 7, 2020, Rec. 1677345, Bk. 1235, Pg. 976).

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 16 |

|

|

|

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 17 |

|

|

|

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 18 |

|

|

|

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 19 |

|

|

|

Similarly, access to state-controlled land is largely inherent within the state of Wyoming mineral leases. The state lease within the Lost Creek Project requires a nominal surface impact fee to be paid as may the other state mineral leases from time to time. Various Temporary Use Permits are in place at the Property, including one which allows for the use and maintenance of an improved road on the leased state section within the Lost Creek Project.

3.3 Title to Property

URE, through its wholly owned subsidiaries Lost Creek ISR, LLC and NFU Wyoming, LLC controls the federal unpatented lode mining claims and state of Wyoming mineral leases which comprise the Property. Currently, NFU Wyoming, LLC controls the mining claims and state lease at the EN Project. Lost Creek ISR, LLC controls the lands at the other five projects within the Property, including Lost Creek Project. Title to the mining claims is subject to rights of pedis possessio against all third-party claimants as long as the claims are maintained. The mining claims do not have an expiration date. Affidavits have been timely filed with the BLM and recorded with the Sweetwater County Recorder attesting to the payment of annual maintenance fees to the BLM as established by law. The state leases have a ten-year term, subject to renewal for successive ten-year terms. From time to time, formal mineral title reports are prepared for URE by mineral title attorneys.

3.3.1 Property Boundaries

A professional legal survey of the permit area boundary of the Lost Creek Project was completed in advance of the submission of applications for permits and licenses on the Project. Similarly, a professional legal survey was conducted for the permit area for the LC East Project permit amendments. Legal surveys of individual mining claims are not required, and otherwise have not been completed. The area covered by the state leases is based on the legal subdivision descriptions as set forth by the U.S. Cadastral Survey and has not been verified by legal surveys.

3.4 Royalties, Taxes and Fees

URE is required to pay various state and local taxes related to production and the ownership of property. These taxes are in the form of severance, ad valorem, gross products, personal, and real property taxes. There is no state income tax in Wyoming. Royalties based on sales of uranium will be paid to the state under the state mineral lease at the Project. The state mineral leases carry the standard five percent royalty required by law. There are no royalties owed on the mining claims held at the Lost Creek Project. Various royalties exist on portions of the Adjoining Projects, including on a portion of LC East Project. Those royalties, as they pertain to currently anticipated production, have been included in the analysis but are relatively insignificant affecting only three future HHs at a rate of one percent of production sales. Additionally, maintenance fees will be paid to the BLM, and payments made to the state for the state mineral leases. Currently, annual maintenance fees to the BLM are $165/claim with a nominal recording fee paid to Sweetwater County (i.e., <$200, annually). Annual payments of the three state mineral leases in the Property are currently $3.00/acre (Lost Creek lease, $1,920; EN lease, $1,920; LC West lease, $3,120).

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 20 |

|

|

|

The Property economic analysis includes tax estimates for state severance taxes, county ad valorem taxes and property taxes, all of which are directly attributable to the Property. The economic analyses presented herein also provide the results of the analyses for pre-income tax and post-income tax, which includes U.S. federal and Illinois state income taxes. There is no State of Wyoming income tax, and all sales are assumed to take place in Illinois where the conversion facility is located. The only difference between the two scenarios is the value of the estimated income taxes. All other sales, property, use, severance and conservations taxes as well as royalties are included in both scenarios. Both economic analyses presented herein assume no escalation and no debt, interest or capital repayments. Ur-Energy USA Inc. files consolidated federal tax returns in the United States and had approximately $105.6 million in tax loss carry forwards as of December 31, 2021. URE does not anticipate paying any significant federal income taxes until the existing, and any future, tax loss carry forwards are utilized. In addition, reclamation costs can be deducted in the early years of the project, thus also pushing out the tax liability.

3.5 Significant Encumbrances or Risks to Perform Work on the Property

3.5.1 Environmental Liabilities

There were no pre-existing mineral processing facilities or related tailings ponds or waste deposits within the Property prior to the initiation of the construction of Lost Creek’s ISR facilities and wellfields. Surface disturbance included in the economic analysis is associated with drilling, well installation, wellfield construction, plant construction and installation of the three deep waste disposal wells. Likewise, subsurface disturbance is associated with the injection and production operations in MU1 and MU2. Other than the foregoing, there are no known environmental liabilities on the Property. The total bond held by the WDEQ to reclaim property disturbances for which LC is liable is $16.844 million as of December 31, 2021.

3.5.2 Existing and Required Permits

All permits and authorizations required to operate the Lost Creek Mine, as currently operating, are in place and include the following:

|

| · | The BLM issued a Record of Decision on the Lost Creek Plan of Operations in October 2012. |

|

|

|

|

|

| · | The BLM issued a Record of Decision on the LC East and KM Amendment in March 2019. |

|

|

|

|

|

| · | The U.S. Nuclear Regulatory Commission (NRC) issued a Source and Byproduct Material License SUA-1598 in August 2011. The NRC subsequently performed pre-operational inspections and granted permission to begin mining on August 2, 2013, and permission to operate the yellowcake dryer on October 3, 2013. |

|

|

|

|

|

| · | The URP issued Source and Byproduct Material License WYSUA-1598 Amendment No. 8 in August 2021. |

|

|

|

|

|

| · | In addition to the URP license for LC East, WDEQ has issued several permits including: |

|

| o | Permit 788, which includes an aquifer exemption for the three Lost Creek HJ mine units and approval to begin injection in MU1, was granted in October 2011. A hydrologic package must be submitted for review and approval for each subsequent Mine Unit. Approval of the MU2 hydrologic package was granted in 2017. |

|

|

|

|

|

| o | Permit 788 was granted after consultation with the Wyoming Game and Fish Department (WGFD) and the U.S. Fish and Wildlife Service (USFWS). Special consideration was given to greater sage grouse protection. |

|

|

|

|

|

| o | Air Quality Permit CGT-13201 was issued in May 2012. In March 2021, the WDEQ-Air Quality Division (AQD) issued a determination that a further permit for LC East was not required. |

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 21 |

|

|

|

|

| o | Storm Water Discharge Permit WYR103695 was approved in June 2011 and includes the LC East and Lost Creek Projects. |

|

|

|

|

|

| o | Class I UIC Permit 09-586, granting permission to install up to five DDWs, was granted in May 2010. An aquifer exemption for LC DW #4 was subsequently granted in December 2013. The U.S. Environmental Protection Agency (EPA) granted an aquifer exemption for LC DW#3 in October 2014. Additional aquifer exemptions may be required if other deep wells are drilled and encounter water quality less than 10,000 mg/l total dissolved solids. An aquifer exemption was not required for LC DW #1 since the water contains greater than 10,000 mg/l total dissolved solids. |

|

|

|

|

|

| o | Class V UIC Permit 15-081, granting permission to operate two injection wells was issued in June 2016. |

|

| · | The two facility holding ponds were approved by EPA Permit 8P-AR in December 2011 and by State Engineer Permit 13595R in May 2010. |

|

|

|

|

|

| · | Sweetwater County rezoned the land per Resolution 08-03-ZO-07 in March 2008. The county later approved the Development Plan in December 2009. Septic Permit 11‑082 was issued in April 2011. The county has also signed a Road Maintenance Agreement allowing the company to remove snow from local county roads as needed. |

|

|

|

|

|

| · | Sweetwater County rezoned the land for LC East per Resolution 21-05-ZO-01 in May 2021. No further approval is required with respect to a development plan. |

|

|

|

|

|

| · | Numerous well installation permits have been applied for and received through the State Engineer’s Office. Additional permits will be sought as needed. |

|

|

|

|

|

| · | Exploration activities on the Adjoining Projects are carried out under Drill Notices issued by the WDEQ and Notices of Operations issued by the BLM. These permits are obtained and managed as necessary to continue exploration work. |

The following permits will be required before beginning recovery at LC East and within the additional HJ Horizon Mine Units at Lost Creek.

|

| · | Approval from WDEQ LQD for the major modification to Permit 788 to allow mining in the KM and HJ Horizons at LC East. The approval will include an aquifer exemption for both horizons. |

|

|

|

|

|

| · | Approval from WDEQ-LQD for the major modification to Permit 788 to allow mining in additional HJ Mine Units at Lost Creek. The approval will include an aquifer exemption for additional HJ Horizons. |

|

|

|

|

|

| · | Block permits for UIC Class III wells will be submitted to the State Engineer’s Office closer to the time of production operations. |

3.5.3 Significant Risks that May affect Access, Title, or Right to Perform Work

The Lost Creek plant has been constructed and is operational. Production well installation in MU1 is complete for all 13 originally designed HHs and the first three planned HHs in MU2. HHs 1-1 through 1-13 and HHs 2-1 through 2-3 were operational prior to the reduction in operations. The plant is currently operating at a limited capacity to maintain required wellfield bleed. The reduction in operations is due to depressed uranium prices. The plant remains fully operational to take advantage of improving prices in the future. Three DDWs were drilled at the Property, of which one has been plugged and abandoned; the other two deep wells remain operational. Two UIC Class V wells were installed and are operational. The plant and associated access roads have been constructed. URE has also installed numerous monitoring and other wells in support of its permit and license applications and to further its mine planning. Various other infrastructure, including wells, water tanks, a meteorological station, and other equipment, has been placed on the Property by URE in support of its mining, development, exploration, and permit/license activities.

The QP is aware of no significant factors that contribute to operational risks for the Property.

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 22 |

|

|

|

4.0 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY

4.1 Physiography

The Property is located near the northeastern part of the Great Divide Basin (GDB) and occurs at an elevation of approximately 7,000 ft. above mean sea level. The GDB is an oval-shaped structural depression encompassing some 3,500 square miles in south-central Wyoming. The GDB is bounded on the north by the Wind River Range and Granite Mountains, on the east by the Rawlins Uplift, on the south by the Wamsutter Arch, and on the west by the Rock Springs Uplift.

Most of the Property consists of flat upland areas and gentle south facing slopes that are dissected by southerly-flowing ephemeral washes. There are no perennial streams on the Property. The vegetation on the Property is dominated by sagebrush (Artemisia tridentata) which occurs throughout both upland and lowland environmental settings. Sagebrush is well adapted to the cold winter temperatures and limited precipitation that characterize the Property. Other vegetation identified at the Property includes native cool season perennial grasses, perennial forbs, cushion plants, semi-shrubs, cacti, shrubs and lichens.

4.2 Means of Access

Regional access to the Property relies almost exclusively on existing public roads and highways. The local and regional transportation network relevant to the Property consists of primary, secondary, local and unimproved roads (Figures 1 and 2). Direct access to the Property relies mainly on two crown-and-ditched gravel paved access roads to the processing plant. One enters from the west off Sweetwater County Road 23N (Wamsutter-Crooks Gap Road). The other enters from the east off of BLM Sooner Road. In addition to the designated routes, there are a number of four-wheel-drive “two-track” roads that traverse the area for recreation and grazing access, as well as various other uses, including uranium exploration. On a wider basis, from population centers, the Property area is served by an Interstate Highway (Interstate 80), a U.S. Highway (US 287), Wyoming state routes (SR 220 and 73 to Bairoil), local county roads, and BLM roads.

4.3 Proximity to Population Centers

The Property is located in a remote area of south-central Wyoming. The nearest town, Bairoil, with a population of less than 100, is about 17 miles northeast of the Lost Creek plant. The Wyoming towns of Rawlins, Rock Springs and Casper are approximately 36, 82 and 90 miles from the Property, respectively. Figures 1 and 2 show the locations of population centers with respect to the Property.

Sweetwater County, in which the Property is located, had a population of 42,272 in 2020. This represents a 3.5 percent decrease in Sweetwater County’s population since the 2010 census (U.S. Census Bureau 2020 Report on Sweetwater County, WY). Sweetwater County has a population density of 4.2 people per square mile. Carbon County, which is south of the Property, had a population of 14,537 in 2020 which was primarily located in the town of Rawlins. This represents an 8.5 percent decrease in Carbon County’s population since the 2010 census (U.S. Census Bureau 2020 Report on Carbon County, WY).

Personnel required for management, construction, development, and operation of the Property are drawn from Rawlins, Bairoil, Jeffrey City, Lander, Riverton, Rock Springs and Casper, Wyoming.

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 23 |

|

|

|

4.4 Climate and Operating Season

The Property is located in the intermountain semi-desert eco-region (Curtis and Grimes, 2004), which has cold winters and short, hot summers (Bailey, 1995). The average annual temperatures range from 40 to 52 degrees Fahrenheit. The average annual precipitation ranges from five to 14 inches (Bailey, 1995). Winter weather may limit the time periods for certain portions of wellfield drilling and construction at the Property but to date has not significantly affected operation of the ISR facility. ISR operations at the Property are conducted year-round.

The state of Wyoming has developed a Core Area Strategy to help protect the greater sage-grouse species within certain core areas of Wyoming. Exploration areas of the Property are all within the Greater South Pass core area and are thus subject to work activity restrictions from March 1 to July 15 of each year. The timing restriction precludes exploration drilling and other non-operational based activities that may disturb the greater sage-grouse. Drilling activity is not restricted outside this period.

The greater sage-grouse timing restrictions relevant to ISR production activities at the Lost Creek Project are somewhat different because the state of Wyoming has recognized that mines within core areas must be allowed to operate year-round. Therefore, since construction at the Lost Creek Project began, there have been no timing restrictions on drilling, construction, or operational activities within pre-approved disturbed areas as shown in the Permit to Mine. These disturbed areas include the processing plant, holding ponds, roads, power lines, wellfields, and DDWs. Any exploration drilling within the Property but outside the pre-defined disturbed area of the Permit to Mine will continue to be subject to greater sage-grouse timing restrictions.

The Core Area Strategy also places limitations on the amount of disturbance within an area. Planned disturbance is limited and therefore is unlikely to result in limitations on exploration drilling. For the Property, there is a five percent cap on anthropogenic disturbance in the area. Analyses of the planned disturbance on the Property, including those areas which are permitted, or for which permits will be sought, will be conducted to be consistent with the Wyoming regulatory scheme, and also will be reviewed on a time-to-time basis by WGFD. The WGFD has also approved the Lost Creek Sage Grouse Protection Plan for the Lost Creek Project.

4.5 Property Infrastructure

The Property currently contains an operational ISR processing plant, wellfields, water disposal infrastructure, and necessary equipment to support ISR operations. The basic infrastructure (power, water, and transportation) necessary to support an ISR mining operation is located within reasonable proximity of the Property. Generally, the proximity of the Property to paved roads is beneficial with respect to transportation of equipment, supplies, personnel and product to and from the Property. Improved gravel surfaced access roads have been constructed to the Property from adjacent county roads. Existing regional overhead electrical service is aligned in a north-to-south direction along the western boundary of the Lost Creek Project. An overhead raptor resistant power line, approximately two miles in length, was constructed in 2012 to bring power from the existing Pacific Power line to the Lost Creek plant. Power drops have been made to the Project and distributed to the plant, offices, wellfields, and other facilities.

| Ur-Energy – Lost Creek ISR Uranium Property Amended Technical Report Summary – September 19, 2022 | Page 24 |

|

|

|

Previous infrastructure near the Property is predominantly related to oil and gas development, past and present uranium exploration and beneficiation, and recreation. There have been several historical conventional uranium mills and mines and one historical ISR project (Bison Basin Project) in the vicinity of the Property (Figure 2). The closest mining facility to the Property is the Sweetwater Mine and Mill, a conventional uranium mine and mill that is not currently operational. The facility lies about three and one-half miles south of the southwestern-most boundary of URE’s Lost Creek Project, with less than one mile separating the respective property boundaries.

Lost Creek operations require disposal into DDWs of limited quantities of fluids that cannot be returned to the production aquifers. Five DDWs are permitted for the Lost Creek Project, of which three have been drilled to date, and two remain operational after one DDW was plugged and abandoned. Three additional deep wells are proposed for LC East. Two UIC Class V injection wells have been completed and have been in operation since 2017 as a part of the water recycling systems. Two storage ponds, permitted by state and federal regulators, are located adjacent to the plant and are used to temporarily store the water that will ultimately be disposed of in the DDWs.

The first DDW (LC DW #1) was installed in 2008 and is located in the extreme southwest corner of the Lost Creek Project. The second DDW (LC DW #4) was drilled in 2012 immediately south of the plant building. A third DDW (LC DW #3) was drilled and installed in the SW quarter of Section 13, T25N, R92W in 2014. The location of the other planned DDW for Lost Creek is the SE quarter of Section 17, T25N, R92W. An additional permitted option is in the SE quarter of Section 19, T25N, R92W.

Three additional DDWs proposed by the amendments for LC East would be located in T25N, R92W in the SW quarter of Section 22, NW quarter of Section 23 and the SE quarter of Section 10. For a further discussion of the wastewater disposal and related infrastructure, see Chapter 14.3 (Liquid Disposal). Ponds, outdoor tank storage, and the Class V disposal wells are located proximate to the plant and office building location (see Figures 2 and 12).

Tailings storage areas, solid waste disposal areas, and heap leach pad(s) will not be a part of the infrastructure for the Property as ISR operations do not require these types of facilities.

4.5.1 Water Supply

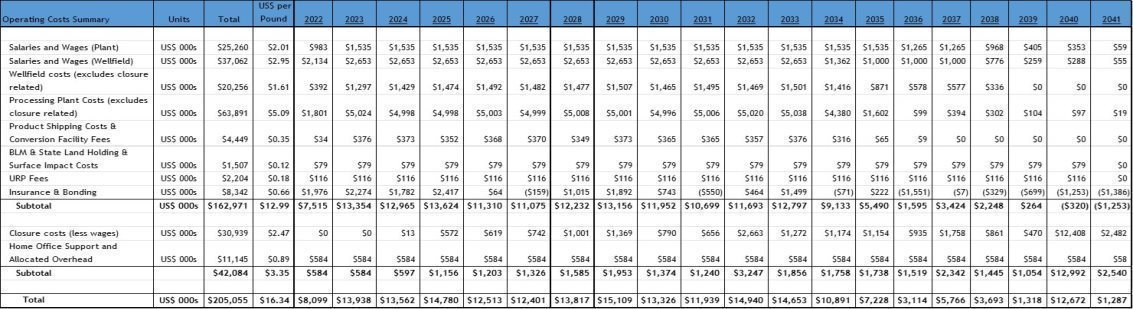

Most of the non-potable water for ISR operations is obtained from the mining operation, i.e., from extracted groundwater. With the exception of a 0.5 percent to 1.5 percent bleed, the groundwater extracted by the production wells will continue to be recycled through the system.