UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

20-F

|

|

£

REGISTRATION STATEMENT

PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

Q

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

For

the fiscal year ended December 31,

2008

|

|

|

£

TRANSITION REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

£

SHELL COMPANY REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

Date

of event requiring this shell company

report...................

|

For the transition period from

___________________________ to _______________________

Commission

file number

001-33905

|

UR-ENERGY

INC.

|

|

(Exact

name of Registrant as specified in its charter)

N/A

(Translation

of Registrant’s name into English)

|

|

|

|

Canada

|

|

(Jurisdiction

of incorporation or organization)

|

|

|

|

10758

W. Centennial Road, Suite 200, Littleton, Colorado

80127

|

|

(Address

of principal executive offices)

|

|

|

|

Roger Smith, (720) 981-4588,

roger.smith@ur-energyusa.com, 10758 W. Centennial Road, Suite

200, Littleton, Colorado 80127

|

|

(Name,

Telephone, E-mail and/or Facsimile number and Address of Corporation

Contact Person)

|

|

|

|

Securities

registered or to be registered pursuant to Section 12(b) of the

Act.

|

|

|

|

|

|

Title

of each class

|

|

|

Name

of each exchange on which registered

|

|

|

|

Common

Shares, no par value

|

|

|

NYSE

Amex

|

|

|

|

|

|

|

|

|

Securities

registered or to be registered pursuant to Section 12(g) of the

Act.

|

|

|

|

|

None

|

|

(Title

of Class)

|

Securities

for which there is a reporting obligation pursuant to Section 15(d) of the

Act.

Indicate

the number of outstanding shares of each of the issuer’s classes of capital or

common stock as of the close of the period covered by the annual

report.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

£

Yes

Q

No

If this

report is an annual or transition report, indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934.

£

Yes

Q

No

Note –

Checking the box above will not relieve any registrant required to file reports

pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from

their obligations under those Sections.

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Q

Yes

£

No

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of "accelerated

filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check

One):

Large accelerated filer £

Accelerated filer £

Non-accelerated filer Q

Indicate by check mark which basis of

accounting the registrant has used to prepare the financial statements included

in this filing:

U.S. GAAP £ International

Financial Reporting Standards as issuedOther Q

By the International Accounting Standards Board £

If

“Other” has been checked in response to the previous question, indicate by check

mark which financial statement item the registrant has elected to

follow.

Q

Item

17 £ Item

18

If this

is an annual report, indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

£

Yes

Q

No

(APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE

YEARS)

Indicate

by check mark whether the registrant has filed all documents and reports

required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act

of 1934 subsequent to the distribution of securities under a plan confirmed by a

court.

£

Yes

£

No

TABLE

OF CONTENTS

|

|

|

|

PART

I

|

|

|

Introduction

|

|

|

Forward-Looking

Information

|

|

|

Cautionary

Note to U.S. Investors Concerning Resource Estimates

|

|

|

Metric/Imperial

Conversion Table

|

|

|

Item

1. Identity of Directors, Senior Management and Advisers

|

|

|

Item

2. Offer Statistics and Expected Timetable

|

|

|

Item

3. Key Information

|

|

|

A. Selected

financial data.

|

|

|

Currency

and Exchange Rates

|

|

|

B. Capitalization

and indebtedness.

|

|

|

C. Reasons for

the offer and use of proceeds.

|

|

|

D. Risk

factors.

|

|

|

Item

4. Information on the Corporation.

|

|

|

A. History and Development of

the Corporation.

|

|

|

B. Business

overview.

|

|

|

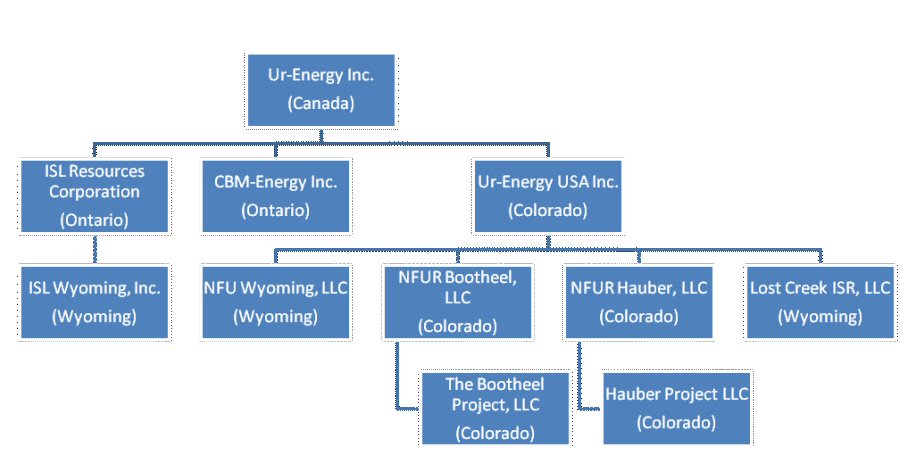

C.

Organizational

Structure.

|

|

|

D. Property, plants and

equipment.

|

|

|

Item

4A. Unresolved Staff Comments.

|

|

|

Item

5. Operating and Financial Review and Prospects.

|

|

|

A. Operating

results.

|

|

|

B. Liquidity

and capital resources.

|

|

|

C. Research

and development, patents and licenses, etc.

|

|

|

D. Trend

information.

|

|

|

E. Off-balance

sheet arrangements.

|

|

|

F. Tabular

disclosure of contractual obligations.

|

|

|

Item

6. Directors, Senior Management and Employees.

|

|

|

|

A.

|

Directors

and senior management.

|

|

|

|

B.

|

Compensation.

|

|

|

|

C.

|

Board

practices.

|

|

|

|

D.

|

Employees.

|

|

|

|

E.

|

Share

ownership.

|

|

|

Item

7. Major Shareholders and Related Party Transactions

|

|

|

|

A.

|

Major

shareholders.

|

|

|

|

B.

|

Related

party transactions.

|

|

|

|

C.

|

Interests

of experts and counsel.

|

|

|

Item

8. Financial Information

|

|

|

|

A.

|

Consolidated

Statements and Other Financial Information.

|

|

|

|

B.

|

Significant

Changes.

|

|

|

Item

9 The Offer and Listing

|

|

|

|

A.

|

Offer

and listing details.

|

|

|

|

B.

|

Plan

of distribution.

|

|

|

|

C.

|

Markets.

|

|

|

|

D.

|

Selling

shareholders.

|

|

|

|

E.

|

Dilution.

|

|

|

|

F.

|

Expenses

of the issue.

|

|

|

Item

10. Additional Information

|

|

|

|

A.

|

Share

capital.

|

|

|

|

B.

|

Memorandum

and articles of association.

|

|

|

|

C.

|

Material

contracts.

|

|

|

|

D.

|

Exchange

controls.

|

|

|

|

E.

|

Taxation.

|

|

|

|

F.

|

Dividends

and paying agents.

|

|

|

|

G.

|

Statement

by experts.

|

|

|

|

H.

|

Documents

on display.

|

|

|

|

I.

|

Subsidiary

Information.

|

|

|

Item

11. Quantitative and Qualitative Disclosures About Market

Risk

|

|

|

(A)

Quantitative information about market risk.

|

|

|

(B)

Qualitative information about market risk.

|

|

|

Item

12. Description of Securities Other than Equity Securities

|

|

|

PART

II

|

|

|

Item

13. Defaults, Dividend Arrearages and Delinquencies

|

|

|

Item

14. Material Modifications to the Rights of Security Holders and Use of

Proceeds

|

|

|

Item

15. Controls and Procedures

|

|

|

Item

15. Controls and Procedures.

|

|

|

Item

15T. Controls and Procedures.

|

|

|

Item

16. [Reserved]

|

|

|

Item

16A. Audit Committee Financial Expert.

|

|

|

Item

16B. Code of Ethics.

|

|

|

Item

16C. Principal Accountant Fees and Services.

|

|

|

Item

16D. Exemptions from the Listing Standards for Audit

Committees.

|

|

|

Item

16E. Purchases of Equity Securities by the Issuer and Affiliated

Purchasers.

|

|

|

Item

16F. Change in Registrant’s Certifying Accountant.

|

|

|

Item

16G. Corporate Governance.

|

|

|

PART

III

|

|

|

Item

17. Financial Statements.

|

|

|

Item

18. Financial Statements.

|

|

|

Item

19. Exhibits.

|

|

|

EXHIBIT

INDEX

|

|

PART

I

Introduction

Ur-Energy

Inc. is a corporation incorporated under the laws of Canada and is referred to

in this document, together with its subsidiaries, as "Ur-Energy" or the

"Corporation" or the “Company”.

The

Corporation’s consolidated financial statements are prepared in accordance with

accounting principles generally accepted in Canada ("Canadian GAAP") and are

presented in Canadian dollars unless otherwise indicated. All references in this

Annual Report on Form 20-F (Annual Information Form) to financial information

concerning the Corporation refer to such information in accordance with Canadian

GAAP and all dollar amounts in this Annual Report on Form 20-F (Annual

Information Form) are in Canadian dollars unless otherwise

indicated.

In this document, cross-references

relevant to the information being requested may be provided. These

cross-references are provided for ease of reference only and are not meant to be

exclusionary to other relevant information in this document that may relate to

the disclosure in question.

Forward-Looking

Information

This

Annual Report on Form 20-F (Annual Information Form) contains "forward-looking

statements" within the meaning of applicable United States and Canadian

securities laws. Shareholders can identify these forward-looking statements by

the use of words such as "expect", "anticipate", "estimate", "believe", "may",

"potential", "intends", "plans" and other similar expressions or statements that

an action, event or result "may", "could" or "should" be taken, occur or be

achieved, or the negative thereof or other similar statements. These statements

are only predictions and involve known and unknown risks, uncertainties and

other factors which may cause the Corporation’s actual results, performance or

achievements, or industry results, to be materially different from any future

results, performance, or achievements expressed or implied by these

forward-looking statements. Such statements include, but are not limited to: (i)

the Corporation’s belief that it will have sufficient cash to fund its capital

requirements; (ii) receipt of (and related

timing of) a US Nuclear Regulatory Commission Source Material

License, Wyoming Department of Environmental Quality Permit and

License to Mine and other necessary permits related to Lost Creek; (iii) Lost

Creek and Lost Soldier will advance to production and the production timeline at

Lost Creek scheduled for late 2010; (iv) production rates,

timetables and methods at Lost Creek and Lost Soldier; (v) the Corporation’s

procurement plans and construction plans at Lost Creek; (vi) the licensing

process at Lost Soldier which efforts are expected to be streamlined; (vii) the

timing, the mine design planning and the preliminary assessment at Lost Soldier;

(viii) the completion and timing of various exploration programs and (ix) the

regulatory issues with the Thelon Basin Properties and related

exploration. These other factors include, among others, the

following: future estimates for production, production start-up and operations

(including any difficulties with start up), capital expenditures,

operating costs, mineral resources, recovery rates, grades and prices; business

strategies and measures to implement such strategies; competitive strengths;

estimated goals; expansion and growth of the business and operations; plans and

references to the Corporation’s future successes; the Corporation’s history of

operating losses and uncertainty of future profitability; the Corporation’s

status as an exploration and development stage Corporation; the Corporation’s

lack of mineral reserves; the hazards associated with mining construction and

production; compliance with environmental laws and regulations; risks associated

with obtaining permits in Canada and the United States; risks associated with

current variable economic conditions; the possible impact of future financings;

uncertainty regarding the pricing and collection of accounts; risks associated

with dependence on sales in foreign countries; the possibility for adverse

results in potential litigation; fluctuations in foreign exchange rates;

uncertainties associated with changes in government policy and regulation;

uncertainties associated with the Canadian Revenue Agency’s audit of any of the

Corporation’s cross border transactions; adverse changes in general business

conditions in any of the countries in which the Corporation does business;

changes in the Corporation’s size and structure; the effectiveness of the

Corporation’s management and its strategic relationships; risks associated with

the Corporation’s ability to attract and retain key personnel; uncertainties

regarding the Corporation’s need for additional capital; uncertainty regarding

the fluctuations of the Corporation’s quarterly results; uncertainties relating

to the Corporation’s status as a non-U.S. corporation;

uncertainties

related to the volatility of the Corporation’s shares price and trading volumes;

foreign currency exchange risks; ability to enforce civil liabilities under U.S.

securities laws outside the United States; ability to maintain the Corporation’s

listing on the NYSE Amex (the “NYSE Amex”) and Toronto Stock Exchange (the

“TSX”); risks associated with the Corporation’s possible status as a "passive

foreign investment Corporation" or a "controlled foreign corporation" under the

applicable provisions of the U.S. Internal Revenue Code of 1986, as amended;

risks associated with the Corporation’s investments and other risks and

uncertainties described under the heading “Risk Factors” of this Annual Report

on Form 20-F (Annual Information Form).

Cautionary

Note to U.S. Investors - Resource and Reserve Estimates

The terms

“mineral reserve,” “proven mineral reserve” and “probable mineral reserve” used

in the Corporation’s disclosure are Canadian mining terms that are defined in

accordance with National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”) under the guidelines set out in the Canadian Institute of

Mining, Metallurgy and Petroleum (the “CIM”) Best Practice Guidelines for the

Estimation of Mineral Resource and Mineral Reserves (the “CIM Standards”),

adopted by the CIM Council on November 23, 2003. These definitions differ from

the definitions in the United States Securities and Exchange Commission (the

“SEC”) Industry Guide 7 under the Securities Act of 1933, as amended (the

“Securities Act”). Under Industry Guide 7 standards, mineralization may not be

classified as a “reserve” unless the determination has made that the

mineralization could be economically and legally produced or extracted at the

time the reserve determination is made. Under Industry Guide 7

standards, a “final” or “bankable” feasibility study is required to report

reserves, the three-year historical average price is used in any reserve or cash

flow analysis to designate reserves and the primary environmental analysis or

report must be filed with the appropriate governmental authority.

The terms

“mineral resource,” “measured mineral resource,” “indicated mineral resource”

and “inferred mineral resource” used in the Corporation’s disclosure are

Canadian mining terms that are defined in accordance with NI 43-101 under the

guidelines set out in the CIM Standards; however, these terms are not defined

terms under Industry Guide 7 and are normally not permitted to be used in

reports and registration statements filed with the SEC. Investors are

cautioned not to assume that any part or all of mineral deposits in these

categories will ever be converted into reserves. “Inferred mineral

resources” have a great amount of uncertainty as to their existence, and great

uncertainty as to their economic feasibility. It cannot be assumed

that all or any part of an inferred mineral resource will ever be upgraded to a

higher category. Under Canadian rules, estimates of inferred mineral

resources may not form the basis of feasibility or pre-feasibility studies,

except in rare cases. Investors are cautioned not to assume that all

or any part of an inferred mineral resource exists or is economically

mineable.

Accordingly,

information contained in this report containing descriptions of the

Corporation’s mineral deposits may not be comparable to similar information made

public by U.S. companies subject to the reporting and disclosure requirements

under the United States federal securities laws and the rules and regulations

thereunder.

Metric/Imperial

Conversion Table

The

imperial equivalents of the metric units of measurement used in this Annual

Report on Form 20-F (Annual Information Form) are as follows:

| |

Metric

Unit |

|

Imperial

Equivalent |

|

| |

gram |

|

0.03215 troy

ounces |

|

| |

hectare |

|

2.4711

acres |

|

| |

kilogram |

|

2.2046223

pounds |

|

| |

kilometer |

|

0.62139

miles |

|

| |

meter |

|

3.2808

feet |

|

| |

tonne |

|

1.1023 short

tons |

|

| |

|

|

|

|

Item

1. Identity of Directors, Senior Management and Advisers.

Not

applicable.

Item

2. Offer Statistics and Expected Timetable.

Not

applicable.

Item

3. Key Information.

A. Selected financial

data.

The

following table summarizes certain of the Corporation’s selected financial

information (stated in thousands of Canadian dollars) prepared in accordance

with Canadian GAAP. The information in the table was derived from the more

detailed financial statements for the period ended December 31, 2006 through the

fiscal year ended December 31, 2008, inclusive, and the related notes, and

should be read in conjunction with the financial statements and with the

information appearing under the headings "Item 5 – Operating and Financial

Review and Prospects" and "Item 18 – Financial

Statements". As discussed in Item 5, in December 2008, the Company

changed its policy for accounting for exploration and development

expenditures. In prior years, the Company capitalized all direct

exploration and development expenditures. Under its new policy,

exploration, evaluation and development expenditures, including annual

exploration license and maintenance fees, are charged to earnings as incurred

until the mineral property becomes commercially mineable. Management considers

that a mineral property will become commercially mineable when it can be legally

mined, as indicated by the receipt of key permits. This change has

been applied retroactively and all comparative amounts in Management’s

Discussion and Analysis (“MD&A”) have been restated to give effect to this

change. Certain comparative figures have been reclassified to conform with the

presentation adopted for the current year.

Historical

results are not necessarily indicative of results to be expected for any future

period. No dividends have been paid in any of the fiscal years ended December

31, 2006 through the fiscal year ended December 31, 2008.

| |

|

2008

|

|

|

2007

|

|

|

2006

|

|

|

2005

|

|

|

2004

|

|

| |

|

(In

thousands of Canadian dollars) |

|

|

|

|

|

|

|

(As

restated)

|

|

|

(As

restated)

|

|

|

(As

restated)

|

|

|

(As

restated)

|

|

|

Results from

operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Total

expenses

|

|

|

(25,968 |

) |

|

|

(22,959 |

) |

|

|

(12,396 |

) |

|

|

(6,151 |

) |

|

|

(3,406 |

) |

|

Interest

income

|

|

|

2,494 |

|

|

|

2,816 |

|

|

|

630 |

|

|

|

127 |

|

|

|

11 |

|

|

Foreign

exchange gain (loss)

|

|

|

5,656 |

|

|

|

(806 |

) |

|

|

(177 |

) |

|

|

908 |

|

|

|

(13 |

) |

|

Other

income (loss)

|

|

|

(37 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Loss

before income taxes

|

|

|

(17,854 |

) |

|

|

(20,949 |

) |

|

|

(11,943 |

) |

|

|

(5,116 |

) |

|

|

(3,408 |

) |

|

Recovery

of future income taxes

|

|

|

- |

|

|

|

429 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Net

loss

|

|

|

(17,854 |

) |

|

|

(20,520 |

) |

|

|

(11,943 |

) |

|

|

(5,116 |

) |

|

|

(3,408 |

) |

|

Net

loss per share, basic and diluted

|

|

|

(0.19 |

) |

|

|

(0.24 |

) |

|

|

(0.20 |

) |

|

|

(0.15 |

) |

|

|

(0.36 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial

position

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

assets

|

|

|

101,533 |

|

|

|

110,931 |

|

|

|

59,927 |

|

|

|

38,000 |

|

|

|

5,010 |

|

|

Capital

stock and additional paid-in capital

|

|

|

157,118 |

|

|

|

149,826 |

|

|

|

64,137 |

|

|

|

26,698 |

|

|

|

7,224 |

|

|

Accumulated

deficit and accumulated other comprehensive loss

|

|

|

(58,841 |

) |

|

|

(40,987 |

) |

|

|

(20,467 |

) |

|

|

(8,524 |

) |

|

|

(3,408 |

) |

|

Net

assets

|

|

|

98,277 |

|

|

|

108,839 |

|

|

|

43,670 |

|

|

|

18,175 |

|

|

|

3,816 |

|

|

Outstanding

shares, in thousands

|

|

|

93,244 |

|

|

|

92,172 |

|

|

|

73,475 |

|

|

|

47,204 |

|

|

|

23,644 |

|

Currency

and Exchange Rates

The following table sets out the

exchange rates for currencies expressed in terms of equivalent Canadian dollars

for one U.S. dollar in effect at the end of the following periods, and the

average exchange rates:

|

|

|

Year

Ended December 31

|

|

|

Canadian

dollar

|

|

2008

|

|

|

2007

|

|

|

2006

|

|

|

2005

|

|

|

2004

|

|

|

End

of period

|

|

$ |

1.22280 |

|

|

$ |

0.98200 |

|

|

$ |

1.16640 |

|

|

$ |

1.16600 |

|

|

$ |

1.20480 |

|

|

Average

for the period

|

|

$ |

1.06669 |

|

|

$ |

1.07440 |

|

|

$ |

1.13461 |

|

|

$ |

1.21173 |

|

|

$ |

1.30151 |

|

|

Canadian

dollar

|

|

July

2008

|

|

|

August

2008

|

|

|

September

2008

|

|

|

October

2008

|

|

|

November

2008

|

|

|

December

2008

|

|

|

High

for the month

|

|

$ |

1.02720 |

|

|

$ |

1.07270 |

|

|

$ |

1.08190 |

|

|

$ |

1.30130 |

|

|

$ |

1.2980 |

|

|

$ |

1.30050 |

|

|

Low

for the month

|

|

$ |

0.99730 |

|

|

$ |

1.02130 |

|

|

$ |

1.02960 |

|

|

$ |

1.0416 |

|

|

$ |

1.14600 |

|

|

$ |

1.18160 |

|

Exchange

rates are the historical interbank foreign exchange rates for the appropriate

period as quoted by OANDA Corporation on its website www.oanda.com. The

rate quoted by OANDA for the conversion of United States dollars into Canadian

dollars on March 18, 2009

is CDN$1.27160 = US$1.00.

B. Capitalization and

indebtedness.

Not

applicable.

C. Reasons for the offer and use of

proceeds.

Not

applicable.

D. Risk factors.

The

Corporation operates in a dynamic and rapidly changing environment that involves

numerous risks and uncertainties. The risks described below should be considered

carefully when assessing an investment in the Corporation’s common

shares. The occurrence of any of the following events could harm the

Corporation. If these events occur, the trading price of the Corporation’s

common shares could decline, and shareholders may lose part or even all of their

investment.

The

Corporation faces numerous risks as an exploration and development stage

company.

The

Corporation is engaged in the business of acquiring and exploring mineral

properties in the hope of locating economic deposits of minerals. The

Corporation’s property interests are in the exploration and development stage

only. Accordingly, there is little likelihood that the Corporation will realize

profits in the short term. Any profitability in the future from the

Corporation’s business will be dependent upon development of an economic deposit

of minerals and further exploration and development of other economic deposits

of minerals, each of which is subject to numerous risk factors. Further, there

can be no assurance, even when an economic deposit of minerals is located, that

any of the Corporation's property interests can be commercially mined. The

exploration and development of mineral deposits involve a high degree of

financial risk over a significant period of time which a combination of careful

evaluation, experience and knowledge of

management

may not eliminate. While discovery of additional ore-bearing structures may

result in substantial rewards, few properties which are explored are ultimately

developed into producing mines. It is impossible to ensure that the

current exploration programs of the Corporation will result in profitable

commercial mining operations. The profitability of the Corporation's operations

will be, in part, directly related to the cost and success of its exploration

and development programs which may be affected by a number of factors.

Substantial expenditures are required to establish resources and reserves which

are sufficient to commercially mine some of the Corporation's properties and to

construct, complete and install mining and processing facilities in those

properties that are actually mined and developed.

The

price of uranium is affected by demand.

The price

of uranium fluctuates. The future direction of the price of uranium will depend

on numerous factors beyond the Corporation’s control including international,

economic and political trends, governmental regulations, expectations of

inflation, currency exchange fluctuations, interest rates, global or regional

consumption patterns, speculative activities and increased production due to new

extraction developments and improved extraction and production methods. The

effect of these factors on the price of uranium, and therefore on the economic

viability of the Corporation’s properties, cannot accurately be predicted. As

the Corporation is only at the exploration and development stage, it is not yet

possible for it to adopt specific strategies for controlling the impact of

fluctuations in the price of uranium.

The

only market for uranium is nuclear power plants world wide, and there are a

limited number of customers.

The

marketability of uranium and acceptance of uranium mining is subject to numerous

factors beyond the control of the Corporation. The price of uranium may

experience volatile and significant price movements over short periods of time.

Factors affecting the market and price include demand for nuclear power,

political and economic conditions in uranium mining, producing and consuming

countries, reprocessing of spent fuel and the re-enrichment of depleted uranium

tails or waste, sales of excess civilian and military inventories (including

from the dismantling of nuclear weapons) by governments and industry

participants, and production levels and costs of production in geographical

areas such as Russia, Africa and Australia.

Deregulation

of the electrical utility industry and acceptance of nuclear energy affects the

demand for uranium.

The

Corporation’s future prospects are tied directly to the electrical utility

industry worldwide. Deregulation of the utility industry, particularly in the

United States and Europe, is expected to affect the market for nuclear and other

fuels for years to come, and may result in a wide range of outcomes including

the expansion or the premature shutdown of nuclear

reactors. Maintaining the demand for uranium at current levels and

future growth in demand will depend upon acceptance of the nuclear technology as

a means of generating electricity. Lack of public acceptance of

nuclear technology would adversely affect the demand for nuclear power and

potentially increase the regulation of the nuclear power industry.

The

Corporation’s share price is subject to significant fluctuations.

The value

of the Corporation’s common shares could be subject to significant fluctuations

in response to variations in quarterly and yearly operating results, the success

of the Corporation's business strategy, competition, financial markets,

commodity prices or applicable regulations which may affect the business of the

Corporation and other factors.

While the

Corporation has mineral resources, it currently does not have any mineral

reserves. Calculations of

mineral resources and recovery are only estimates, and there can be no assurance

about the quantity and grade of minerals until reserves or resources are

actually mined.

Until

reserves or resources are actually mined and processed, the quantity of reserves

or resources and grades must be considered as estimates only. In addition, the

quantity of reserves or resources may vary depending on

commodity

prices. Any material change in the quantity of resources, grade, or production

costs may affect the economic viability of the Corporation’s

properties.

The

Corporation is dependent on key personnel, contractors and service providers,

the loss of whom could harm the Corporation’s business.

Shareholders

will be relying on the good faith, experience and judgment of the Corporation’s

management and advisors in supervising and providing for the effective

management of the business and the operations of the Corporation and in

selecting and developing new investment and expansion opportunities. The

Corporation may need to recruit additional qualified employees, contractors and

service providers to supplement existing management, the availability of which

cannot be assured. The Corporation will be dependent on a relatively small

number of key persons including specifically W. William Boberg, President and

Chief Executive Officer, Harold Backer, Executive Vice President, Geology &

Exploration and Wayne Heili, Vice President, Mining & Engineering, the loss

of any one of whom could have an adverse effect on the Corporation’s business

and operations. The Corporation does not hold key man insurance in

respect of any of its executive officers.

Mining

operations involve a high degree of risk and the results of exploration and

ultimate productions are highly uncertain.

The

exploration for, and development of, mineral deposits involves significant risks

which a combination of careful evaluation, experience and knowledge may not

eliminate. While the discovery of an ore body may result in substantial rewards,

few properties which are explored are ultimately developed into producing mines.

Major expenses may be required to establish ore reserves, to develop

metallurgical processes and to construct mining and processing facilities at a

particular site. It is impossible to ensure that the current exploration and

development programs planned by the Corporation will result in a profitable

commercial operation.

Whether a

mineral deposit will be commercially viable depends on a number of factors, some

of which are the particular attributes of the deposit, such as size, grade and

proximity to infrastructure, as well as uranium prices which are highly cyclical

and government regulations, including regulations relating to prices, taxes,

royalties, land tenure, land use, importing and exporting of uranium and

environmental protection. The exact effect of these factors cannot be accurately

predicted, but the combination of these factors may result in the Corporation

not receiving an adequate return on invested capital.

Mining

operations generally involve a high degree of risk. The Corporation's operations

will be subject to all the hazards and risks normally encountered in the

exploration and development of uranium, including unusual and unexpected geology

formations, flooding and other conditions involved in the drilling and removal

of material, any of which could result in damage to, or destruction of, mines

and other producing facilities, damage to life or property, environmental damage

and possible legal liability.

Permitting,

licensing and approval processes are required for the Corporation’s operations

and obtaining and maintaining these permits and licenses is subject to many

conditions which the Corporation may be unable to achieve.

Many of

the operations of the Corporation require licenses and permits from various

governmental authorities. The Corporation believes it holds or is in the process

of obtaining all necessary licenses and permits to carry on the activities which

it is currently conducting under applicable laws and regulations. Such licenses

and permits are subject to changes in regulations and changes in various

operating circumstances. There can be no guarantee that the Corporation will be

able to obtain all necessary licenses and permits that may be required to

maintain its exploration and mining activities including constructing mines or

milling facilities and commencing operations of any of its exploration

properties. In addition, if the Corporation proceeds to production on any

exploration property, it must obtain and comply with permits and licenses which

may contain specific conditions concerning operating procedures, water use, the

discharge of various materials into or on land, air or water, waste disposal,

spills, environmental studies, abandonment and restoration plans and financial

assurances. There can be no assurance that the Corporation will be able to

obtain such permits and licenses or that it will be able to comply with any such

conditions.

The

Corporation’s operations are subject to many regulatory

requirements.

The

Corporation's business is subject to various federal, state, provincial and

local laws governing prospecting and development, taxes, labor standards and

occupational health, mine and radiation safety, toxic substances, environmental

protection and other matters. Exploration and development are also subject to

various federal, state, provincial and local laws and regulations relating to

the protection of the environment. These laws impose high standards on the

mining industry to monitor the discharge of waste water and report the results

of such monitoring to regulatory authorities, to reduce or eliminate certain

effects on or into land, water or air, to progressively restore mine properties,

to manage hazardous wastes and materials and to reduce the risk of worker

accidents. A violation of these laws may result in the imposition of substantial

fines and other penalties and potentially expose the Corporation to

litigation. There can be no assurance that the Corporation will be

able to meet all the regulatory requirements in a timely manner or without

significant expense or that the regulatory requirements will not change to delay

or prohibit the Corporation from proceeding with certain exploration and

development.

Possible

Amendment to Mining law of 1872 may significantly impact the Corporation’s

ability to develop certain unpatented mining claims.

Members

of the United States Congress have repeatedly introduced bills which would

supplant or alter the provisions of the United States Mining Law of 1872, as

amended. If enacted, such legislation could change the cost of holding

unpatented mining claims and could significantly impact the Corporation’s

ability to develop mineralized material on unpatented mining claims. Such bills

have proposed, among other things, to either eliminate or greatly limit the

right to a mineral patent and to impose a federal royalty on production from

unpatented mining claims. Although it is impossible to predict at this point

what any legislated royalties might be, enactment could adversely affect the

potential for development of such mining claims and the economics of existing

operating mines on federal unpatented mining claims. Passage of such legislation

could adversely affect the financial performance of the

Corporation.

Competition

from larger or better capitalized companies may affect the Corporation’s share

prices and the Corporation’s ability to acquire properties.

The

international uranium industry is highly competitive. The Corporation's

activities are directed toward the search, evaluation, acquisition and

development of uranium deposits. There is no certainty that the expenditures to

be made by the Corporation will result in discoveries of commercial quantities

of uranium deposits. There is aggressive competition within the mining industry

for the discovery and acquisition of properties considered to have commercial

potential. The Corporation will compete with other interests, many of which have

greater financial resources than it will have, for the opportunity to

participate in promising projects. Significant capital investment is required to

achieve commercial production from successful exploration and development

efforts.

Nuclear

energy competes with other sources of energy, including oil, natural gas, coal

and hydro-electricity. These other energy sources are to some extent

interchangeable with nuclear energy, particularly over the longer term. Lower

prices of oil, natural gas, coal and hydro-electricity may result in lower

demand for uranium concentrate and uranium conversion services. Furthermore, the

growth of the uranium and nuclear power industry beyond its current level will

depend upon continued and increased acceptance of nuclear technology as a means

of generating electricity. Because of unique political, technological and

environmental factors that affect the nuclear industry, the industry is subject

to public opinion risks which could have an adverse impact on the demand for

nuclear power and increase the regulation of the nuclear power

industry.

Uncertain

global economic conditions will affect the Corporation and its common share

price.

Current

conditions in the domestic and global economies are uncertain. There continues

to be a high level of market instability and market volatility with

unpredictable and uncertain financial market projections. The impacts of a

global recession or depression, commodity price fluctuations, the availability

of capital and the acceptance of nuclear energy may have consequences on the

Corporation and its share price. In addition, it could have

consequences on the nuclear industry’s ability to finance future construction of

nuclear generating facilities. Global financial problems and lack of

confidence in the strength of global financial institutions have

created

many economic and political uncertainties that have impacted the global economy.

As a result, it is difficult to estimate the level of growth for the world

economy as a whole. It is even more difficult to estimate growth in various

parts of the world economy, including the markets in which the Corporation

participates. All components of the Corporation's budgeting and forecasting are

dependent on commodity prices and their fluctuations as well as political

acceptance and policy. The prevailing economic uncertainties render estimates of

future expenditures difficult.

The

Corporation will need to obtain additional funding in the medium to long term in

order to implement the Corporation’s business plan, and the inability to obtain

it could cause the Corporation’s business plan to fail.

Additional

funds will be required for future exploration and development. The source of

future funds available to the Corporation is through the sale of additional

equity capital, proceeds from the exercise of convertible equity instruments

outstanding or borrowing of funds. There is no assurance that such funding will

be available to the Corporation. Furthermore, even if such financing is

successfully completed, there can be no assurance that it will be obtained on

terms favorable to the Corporation or will provide the Corporation with

sufficient funds to meet its objectives, which may adversely affect the

Corporation's business and financial position. In addition, any future equity

financings by the Corporation may result in substantial dilution for existing

shareholders of the Corporation.

The

Corporation lacks a history of earnings and dividend record.

The

Corporation has no earnings or dividend record. It has not paid dividends on its

common shares since incorporation and does not anticipate doing so in the

foreseeable future. Payments of any dividends will be at the discretion of the

board of directors of the Corporation after taking into account many factors,

including the Corporation’s financial condition and current and anticipated cash

needs.

The

impact of hedging activities may affect the Corporation’s

profitability.

Although

the Corporation has no present intention to do so, it may hedge a portion of its

future uranium production to protect it against low uranium prices and/or to

satisfy covenants required to obtain project financings. Hedging activities are

intended to protect the Corporation from the fluctuations of the price of

uranium and to minimize the effect of declines in uranium prices on results of

operations for a period of time. Although hedging activities may protect a

company against low uranium prices, they may also limit the price that can be

realized on uranium that is subject to forward sales and call options where the

market price of uranium exceeds the uranium price in a forward sale or call

option contract.

The

Corporation’s operations are subject to environmental risks and compliance with

environmental regulations which are increasing and costly.

Environmental

legislation and regulation is evolving in a manner which will require stricter

standards and enforcement, increased fines and penalties for non-compliance,

more stringent environmental assessments of proposed projects and a heightened

degree of responsibility for companies and their officers, directors and

employees. Compliance with environmental quality requirements and reclamation

laws imposed by federal, state, provincial, and local governmental authorities

may require significant capital outlays, materially affect the economics of a

given property, cause material changes or delays in intended activities, and

potentially expose the Corporation to litigation. These authorities may require

the Corporation to prepare and present data pertaining to the effect or impact

that any proposed exploration for or production of minerals may have upon the

environment. The requirements imposed by any such authorities may be costly,

time consuming, and may delay operations. Future legislation and regulations

designed to protect the environment, as well as future interpretations of

existing laws and regulations, may require substantial increases in costs for

equipment and operating costs and delays, interruptions, or a termination of

operations. The Corporation cannot accurately predict or estimate the impact of

any such future laws or regulations, or future interpretations of existing laws

and regulations, on the Corporation’s operations. Historic mining

activities have occurred on and around certain of the Corporation’s properties.

If such historic activities have resulted in releases or threatened

releases

of

regulated substances to the environment, potential for liability may exist under

federal or state remediation statutes.

The

Corporation’s title to certain properties may be uncertain.

Although

the Corporation has obtained title opinions with respect to certain of its

properties and has taken reasonable measures to ensure proper title to its

properties, there is no guarantee that title to any of its properties will not

be challenged or impugned. Third parties may have valid claims

underlying portions of the Corporation's interests. The Corporation’s

mineral properties in the United States consist of leases to private mineral

rights, leases covering state lands and unpatented mining claims. Many of the

Corporation’s mining properties in the United States are unpatented mining

claims to which the Corporation has only possessory title. Because title to

unpatented mining claims is subject to inherent uncertainties, it is difficult

to determine conclusively ownership of such claims. These

uncertainties relate to such things as sufficiency of mineral discovery, proper

posting and marking of boundaries and possible conflicts with other claims not

determinable from descriptions of record. The present status of the

Corporation’s unpatented mining claims located on public lands allows the

Corporation the exclusive right to mine and remove valuable minerals. The

Corporation is allowed to use the surface of the public lands solely for

purposes related to mining and processing the mineral-bearing ores. However,

legal ownership of the land remains with the United States. The Corporation

remains at risk that the mining claims may be forfeited either to the United

States or to rival private claimants due to failure to comply with statutory

requirements. The Corporation has taken or will take all curative measures to

ensure proper title to its properties where necessary and where

possible.

The

Corporation may be subject to aboriginal land claims.

Certain

properties in which the Corporation has an interest may be the subject of

aboriginal land claims. As a result of these claims, the Corporation

may be significantly delayed on unable to pursue exploration and production

activities in respect of these properties or may have to expend considerable

management resources and funds to adequately meet the regulatory requirements to

pursue activities in respect of these properties.

Some

hazards which the Corporation may face are uninsurable.

The

Corporation currently carries insurance coverage for general liability,

directors’ and officers’ liability and other matters. The Corporation intends to

carry insurance to protect against certain risks in such amounts as it considers

adequate. The nature of the risks the Corporation faces in the conduct of its

operations is such that liabilities could exceed policy limits in any insurance

policy or could be excluded from coverage under an insurance policy. The

potential costs that could be associated with any liabilities not covered by

insurance or in excess of insurance coverage or compliance with applicable laws

and regulations may cause substantial delays and require significant capital

outlays, adversely affecting the Corporation’s business and financial

position.

The

Corporation’s board of directors may face the possibility of conflicts of

interest with other resource companies with which they are

involved.

Certain

directors of the Corporation also serve as directors and officers of other

companies involved in natural resource exploration, development and production.

Consequently, there exists the possibility that such directors will be in a

position of conflict of interest. Any decision made by such directors involving

the Corporation will be made in accordance with their duties and obligations to

deal fairly and in good faith with the Corporation and such other companies. In

addition, such directors will declare, and refrain from voting on, any matter in

which such directors may have a material interest.

The

Corporation may have potential adverse U.S. Federal Income Tax

consequences.

consequences

could apply, including a material increase in the amount of tax that the U.S.

holder would owe, an imposition of tax earlier than would otherwise be imposed,

interest charges and additional tax form filing requirements.

The

determination of whether a corporation is a PFIC involves the application of

complex tax rules. The Corporation has not made a conclusive

determination as to whether it has been in prior tax years or is currently a

PFIC. The Corporation could have qualified as a PFIC for past tax

years and may qualify as a PFIC currently or in future tax

years. However, no assurance can be given as to such status for prior

tax years, for the current tax year or future tax years. U.S. holders

of Corporation’s shares are urged to consult their own tax advisors regarding

the application of U.S. income tax rules.

The

Corporation may lose its status as a foreign private issuer.

Ur-Energy

is a “foreign private issuer,” as such term is defined in Rule 405 under the

Securities Act, and, therefore, it is not required to comply with all the

periodic disclosure and current reporting requirements of the Exchange Act, and

related rules and regulations. In order for the Corporation to

maintain its current status as a foreign private issuer, a majority of its

common shares must be either directly or indirectly owned of record by

non-residents of the U.S., as it does not currently satisfy any of the

additional requirements necessary to preserve this status.

The

Corporation may in the future lose its foreign private issuer status if a

majority of its shares are owned of record by residents of the U.S. and it

continues to fail to meet the additional requirements necessary to avoid loss of

foreign private issuer status. The regulatory and compliance costs to

the Corporation under U.S. securities laws as a U.S. domestic issuer may be

significantly more than the costs it incurs as a Canadian foreign private issuer

eligible to use the Multi-Jurisdictional Disclosure System

(“MJDS”). If it is not a foreign private issuer, it would not be

eligible to use the MJDS or other foreign issuer forms and would be required to

file periodic and current reports and registration statements on U.S. domestic

issuer forms with the SEC, which are more detailed and extensive than the forms

required of a foreign private issuer. The Corporation may also be

required to prepare its financial statements in accordance with U.S. generally

accepted accounting principles (“GAAP”). In addition, the Corporation may lose

the ability to rely upon exemptions from certain corporate governance

requirements on U.S. stock exchanges that are available to foreign private

issuers. Further, if the Corporation engages in capital raising

activities through private placements after losing its foreign private issuer

status, there is a higher likelihood that investors may require the Corporation

to file resale registration statements with the SEC as a condition to any such

financing.

Item 4. Information on the

Corporation.

A. History and Development of the

Corporation.

Ur-Energy

is a corporation continued under the Canada Business Corporations Act

on August 8, 2006. The registered office of the Corporation is located at

40 Elgin Street, Suite 1400, Ottawa, Ontario, K1P 5K6. The Corporation’s head

office and United States headquarters is located at 10758 West Centennial Road,

Suite 200, Littleton, Colorado, 80127. The Corporation also has offices at 5880

Enterprise Drive, Suite 200, Casper, Wyoming 82609 and 341 Main Street North,

Suite 206, Brampton, Ontario L6X 3C7. The Corporation’s Littleton telephone

number is (720) 981-4588 and its facsimile number is (720) 981-5643. The

Corporation’s common shares are listed on the TSX under the symbol "URE" and on

the NYSE Amex under the symbol "URG".

Incorporated

on March 22, 2004, Ur-Energy is a development stage junior mining company

engaged in the identification, acquisition, evaluation, exploration and

development of uranium mineral properties in Canada and the United States. The

Corporation’s current land portfolio includes 14 properties in Wyoming, USA: 10

are in the Great Divide Basin, two of which (the Lost Creek property and the

Lost Soldier property) contain defined resources that the Corporation expects to

advance to production. The Corporation’s other Wyoming projects include two

properties in the Shirley Basin, one of which is the Bootheel property. The

final Wyoming

property,

the Kaycee property, is located in the Powder River Basin. The Corporation also

has a property in Yuma County, Arizona, USA.

The

Corporation has three properties in the Northwest Territories, Canada, known as

Screech Lake, Eyeberry and Gravel Hill. The Corporation also has the Bugs

property in the Kivalliq region of the Baker Lake Basin in Nunavut, Canada and

has a royalty interest in two properties known as Dismal Lake West and Mountain

Lake in the western Kitikmeot region, Nunavut, Canada.

Background

The

Corporation, through its wholly-owned subsidiary, Ur-Energy USA, acquired

certain of the Wyoming properties comprising the Great Divide Basin and the

Shirley Basin projects, effective June 30, 2005, when Ur-Energy USA entered into

the Membership Interest Purchase Agreement (“MIPA”) with New Frontiers Uranium,

LLC (“New Frontiers”). Under the terms of the MIPA, the Corporation

purchased from New Frontiers all of the issued and outstanding membership

interests (the “Membership Interests”) in the project. Assets

acquired from New Frontiers include the extensively explored and drilled Lost

Creek and Lost Soldier Projects and development database including more than

10,000 electric well logs, over 100 geologic reports and over 1,000 geologic and

uranium maps covering large areas of Wyoming, Montana and South

Dakota.

Under the

MIPA, Ur-Energy USA agreed to purchase and New Frontiers agreed to sell the

Membership Interests for an aggregate consideration of

US$20,000,000. The total amount payable on closing was

US$5,000,000. The balance of the acquisition cost was financed by way

of a promissory note payable to New Frontiers. The first US$5,000,000 payment

under the promissory note was made in June 2006 and on June 7, 2007, the

Corporation pre-paid the balance of the promissory note due to New Frontiers in

the amount of US$11,250,000 which allowed the Corporation to save approximately

US$3,750,000 in future interest charges.

Since

2005, the exploration and development of Lost Creek has progressed, with the

Corporation commissioning an NI 43-101 Preliminary Assessment in 2008, which

establishes the economics of the Lost Creek Project. Beginning in

2007, the Corporation has also proceeded with its applications for a Source

Material License from the US Nuclear Regulatory Commission (“NRC”) and a Permit

and License to Mine from the Wyoming Department of Environmental Quality

(“WDEQ”); the applications have been deemed complete by both agencies and the

technical review process is ongoing with both. See also

“Item 4.B - Business Overview: Lost Creek Project.”

Recent

Developments

Corporate

On

January 7, 2008, the Corporation filed a registration statement with the SEC on

Form 40-F to register its common shares under Section 12(b) of the Exchange

Act.

On March

26, 2008, Ur-Energy completed a non-brokered private placement flow-through

financing of 1,000,000 common shares of the Corporation at a price of $2.75 for

aggregate gross proceeds of $2,750,000. The financing enabled a 2008

summer exploration program for Ur-Energy’s Bugs Project in Nunavut, Canada

including further prospecting, radon surveys and a drilling program which was

completed in September 2008.

On July

24, 2008, the Corporation’s common shares were listed on NYSE Amex (formerly

American Stock Exchange) under the symbol “URG”.

On

November 7, 2008, the board of directors of the Corporation approved the

adoption of a Shareholder Rights Plan designed to encourage the fair and equal

treatment of shareholders in connection with any takeover bid for the

Corporation’s outstanding securities. The Rights Plan was not adopted

by the Corporation’s board of directors in response to any specific proposal or

intention to acquire control of the Corporation. Rights were issued

pursuant to the Rights Plan effective on November 7, 2008. In

accordance with the TSX requirements,

the

Corporation will seek approval and ratification of the Rights Plan at its next

annual and special meeting of shareholders scheduled for April 28,

2009.

Regulatory

On

February 29, 2008, the Corporation voluntarily requested that its application to

the NRC for its Lost Creek Project be withdrawn to enable the Corporation to

include upgrades to its application. The license application to the

NRC had been submitted on October 30, 2007. Subsequent upgrades to

the project’s operational plan and other advances in the health physics

information and analysis prompted the Corporation to update its NRC license

application. The Corporation submitted its upgraded license application to the

NRC on March 24, 2008.

On May

22, 2008, Ur-Energy received notice from the WDEQ that the agency had found the

Lost Creek Permit to Mine Application to be complete. The Corporation

was authorized to proceed with formal public notice of the application, which

was completed in a timely manner. The WDEQ also initiated its technical review

of the Corporation’s application and the Corporation is in the process of

providing additional information requested by the WDEQ.

On June

17, 2008, the Corporation announced that the NRC deemed the Corporation’s

application to construct and operate the Lost Creek ISR Project

acceptable. The NRC indicated that it would commence a detailed

technical and environmental review of the Corporation’s application, for which

the Corporation continues in the process of providing additional information

requested as to both reviews.

On

September 10, 2008, the Corporation provided an update to the Lost Creek Project

timeline based on recently released licensing guidance from the

NRC. As a result of meetings between Ur-Energy and other Wyoming

near-term producers and NRC officials in early September, Ur-Energy revised its

expectation for the issuance of the Lost Creek Project’s NRC license from the

second quarter 2009 to the fourth quarter 2009. First production from

the Lost Creek Project is now anticipated in the second half of

2010.

Technical

On April

2, 2008, the Corporation released the results of a Preliminary Assessment for

the Lost Creek Project. The Preliminary Assessment was prepared by

Lyntek Incorporated in accordance with National Instrument 43-101 (“NI

43-101”). The purpose of the report was to provide an independent

analysis of the potential economic viability of the mineral resources of the

Lost Creek Project.

On June

19, 2008, the Corporation announced the commencement of the 2008 drilling

program at the Bootheel property in southern Wyoming. The Bootheel

property, together with the Buck Point property, make up The Bootheel Project,

LLC, a venture in which Ur-Energy and Target Exploration and Mining Corporation

are members. Target is the operator and is currently earning a 75%

interest in the project.

On August

18, 2008, the Corporation announced the continued expansion of its technical

expertise by adding necessary personnel for the build up toward construction and

production.

On

November 12, 2008, the Corporation announced that it had completed the 2008

drilling program which had commenced in May 2008 at its Lost Creek

Project. Activities included the drilling of 459 drill holes which

included delineation drill holes, monitoring wells and exploration drill

holes. In addition, the Corporation’s engineering staff continued its

evaluation of the Lost Soldier Project.

Principal

Capital Expenditures and Divestitures

During

the year ended December 31, 2006, the Corporation invested cash of $1.0 million

in mineral properties, bonding deposits and capital assets. The

majority of these expenditures went toward mineral properties. The

capital asset purchases were primarily for field equipment purchased to

facilitate the exploration and development work programs in

Wyoming.

During

the year ended December 31, 2007, the Corporation invested cash of $3.5 million

in mineral properties, bonding deposits and capital assets. The

majority of these expenditures went toward mineral properties and bonding

deposits. The capital asset purchases were primarily for field

vehicles and field equipment purchased to facilitate the exploration and

development work programs in Wyoming.

During

the year ended December 31, 2008, the Corporation invested cash of $3.5 million

in mineral properties, bonding deposits, capital assets and design work on the

Lost Creek plant. The majority of these expenditures went toward

bonding deposits and the purchase of capital assets. The capital

asset purchases were primarily for field vehicles and field equipment purchased

to facilitate the exploration and development work programs in

Wyoming.

No

significant capital expenditures are currently in progress. Pursuant

to the Corporation’s revised policy, the Corporation is continuing to develop

the Lost Creek property and is incurring costs which are presently being charged

to expense as incurred.

B. Business

overview.

Lost Creek

Project

The Lost

Creek uranium deposit is located in the Great Divide Basin, Wyoming. The deposit

is approximately three miles (4.8 kilometers) long and the mineralization occurs

in four main sandstone horizons between 315 feet (96 meters) and 700 feet (213

meters) in depth.

As

identified in the June 2006 Technical Report on Lost Creek, NI 43-101

compliant resources are 9.8 million pounds of U3O8 at

0.058 percent as an indicated resource and an additional 1.1 million pounds

of U3O8 at

0.076 percent as an inferred resource. During 2006, 17 cased

monitoring and pump test wells were completed on the property, and initial

testing was completed.

The 2007

drilling program included 58 additional monitor and pump test wells,

two water wells and a total of 195 delineation drill holes. This program

enabled the Corporation to obtain additional baseline and hydrogeologic data

within the first mine unit area for engineering assessments; for the WDEQ Permit

to Mine application; for the NRC Source Material License application; and, for

the WDEQ Mine Unit #1 Permit application. In addition, six condemnation holes

were drilled to make certain the potential target plant location was not over

any part of the ore body.

In

October 2007, the Corporation submitted its Application to the NRC for a Source

Material License for the Lost Creek project. This license is the first stage of

obtaining all necessary licenses and permits to enable the Corporation to

recover uranium via in situ recovery method at the Lost Creek project. The

collection and compilation of the extensive environmental background data for

the application was a two-year process. In February 2008, the Corporation

requested that the NRC application for its Lost Creek project be withdrawn to

enable the Corporation to include upgrades to its application with respect to

the project's operational plan and other advances in the health physics

information and analyses. In March 2008, the Corporation re-submitted

the Source Material License application to the NRC. In June 2008, the

NRC notified the Corporation it deemed the Lost Creek

application complete. The NRC thereafter commenced its detailed technical and

environmental review of the Corporation’s application.

In 2007,

the Corporation also submitted the Lost Creek Mine Permit Application to the

WDEQ. Individual mine unit applications for each well field will be submitted to

cover each mine unit or well field that will be produced on the Lost Creek

project. In May 2008, the Corporation received notice from the

WDEQ that the agency found the application to be complete, and authorized the

Corporation to proceed with formal Public Notice of the application, which was

subsequently timely completed by the Corporation. The Lost Creek

Project Permit Area, as submitted to the WDEQ, comprises 4,220 acres

(1,708 hectares) and consists of 201

mining claims and one state mining lease.

Throughout

the latter part of 2008 and, to date, in 2009, the Corporation has been

responding to requests from both agencies for additional information, which is

part of the routine process toward completion of the technical and environmental

reviews of the applications.

In

February 2008, an in-house economic analysis on the Lost Creek project was

completed by the Corporation’s engineering team. An independent technical report

under NI 43-101 was subsequently prepared by Lyntek Incorporated

(“Lyntek”). The purpose of the report was to provide an independent

analysis and preliminary assessment of the potential economic viability of the

mineral resource of the Lost Creek project. The resulting base case

in the preliminary assessment prepared by Lyntek returned a pre-tax internal

rate of return of 43.6% at a price of US$80 per pound U3O8, and

demonstrated that the project would be economic at prices above US$40 per pound

U3O8.

In

September 2008, the Corporation announced an update to the Lost Creek permitting

and production timeline based on further licensing guidance from the

NRC. Based upon an NRC release of updated guidance on its expected

publication of a final Generic Environmental Impact Statement for In-Situ Leach

Uranium Milling Facilities ("GEIS") in a July 28, 2008 Federal Register notice

(Vol.73, No. 145), the NRC revised its expected publication date from January

2009 to June 2009.

In early

September 2008, the Corporation conducted meetings with senior officials of the

NRC to confirm how the revised GEIS completion date would affect the timing of

the issuance of licenses to presently pending applicants, including Lost

Creek. As a result of the meetings, Ur-Energy revised its expectation

for the issuance of the Lost Creek's NRC license from second quarter 2009 to

fourth quarter 2009. First production from the Lost Creek project is now

anticipated to occur in the second half of 2010.

The

exploration and development program for 2008 at Lost Creek was designed to

further delineate known resources, explore the permit area for additional

resources outside of the known areas, and to install the monitoring wells

required for the first mine unit. The program included the following

activities:

|

|

o

|

300

delineation holes within the proposed mine unit area to provide detailed

definition of the extent of minable uranium

resources.

|

|

|

o

|

99

exploration holes were drilled to test for potential extensions of mineral

trends. Drill hole depths ranged from 600 to 1,000 feet (183 to

305 meters).

|

|

|

o

|

48

cased monitor and pump test wells were installed within and surrounding

the first proposed mine unit. These wells will be utilized for

production monitoring.

|

|

|

o

|

Ten

regional baseline wells were also installed at the request of the

WDEQ. The average well depth is approximately 450 feet (137

meters).

|

|

|

o

|

Two

water supply wells were drilled, cased and

completed.

|

|

|

·

|

The

program employed seven contract drill rigs throughout much of the

six-month drilling program. Geophysical logging units were also