UR-ENERGY INC.

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2012

February 27, 2013

| Page | |

| PRELIMINARY NOTES | 1 |

| THE CORPORATION | 4 |

| GENERAL DEVELOPMENT OF THE BUSINESS | 6 |

| BUSINESS OF UR-ENERGY | 13 |

| RISK FACTORS | 23 |

| DIVIDENDS | 32 |

| CAPITAL STRUCTURE OF THE CORPORATION | 33 |

| MARKET FOR SECURITIES OF THE CORPORATION | 33 |

| DIRECTORS AND EXECUTIVE OFFICERS | 34 |

| AUDIT COMMITTEE | 40 |

| CONFLICTS OF INTEREST | 41 |

| LEGAL PROCEEDINGS | 41 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 42 |

| TRANSFER AGENT AND REGISTRAR | 42 |

| MATERIAL CONTRACTS | 42 |

| INTERESTS OF EXPERTS | 43 |

| ADDITIONAL INFORMATION | 43 |

| SCHEDULE “A” | 45 |

| i |

PRELIMINARY NOTES

Date of Information

Unless otherwise indicated, all information contained in this Annual Information Form (“AIF”) of Ur-Energy Inc. (“Ur-Energy” or the “Corporation”) is as of February 27, 2013.

Financial Information

All financial information in this AIF is prepared in accordance with generally accepted accounting principles in the United States (“US GAAP”).

Currency

All references in this AIF to “dollars” or “$” are to Canadian dollars, unless otherwise indicated.

Forward-Looking Information

This AIF contains "forward-looking statements" within the meaning of applicable United States and Canadian securities laws, and these forward-looking statements can be identified by the use of words such as "expect", "anticipate", "estimate", "believe", "may", "potential", "intends", "plans" and other similar expressions or statements that an action, event or result "may", "could" or "should" be taken, occur or be achieved, or the negative thereof or other similar statements. These statements are only predictions and involve known and unknown risks, uncertainties and other factors which may cause the Corporation’s actual results, performance or achievements, or industry results, to be materially different from any future results, performance, or achievements expressed or implied by these forward-looking statements. Such statements include, but are not limited to: (i) the Corporation’s timeframe for events leading to and culminating in the commencement of production at Lost Creek (including procurement, construction and commissioning); (ii) the timing and outcome of the challenge to the Bureau of Land Management Record of Decision, including petitioner’s motion for preliminary injunction; (iii) ability and timing of the Corporation to secure project financing including the state bond process; (iv) the technical and economic viability of Lost Creek (including the projections contained in the preliminary analysis of economics of the Lost Creek Property); (v) the ability to complete the acquisition of Pathfinder Mines Corporation pursuant to the definitive agreement, and the timing for closing of the transaction; (vi) the ability to complete additional favorable uranium sales agreements and ability to reduce exposure to volatile market; (vii) the production rates and timeline of the Lost Creek Project; (viii) the potential of exploration targets throughout the Lost Creek Property (including the ability to expand resources); (ix) the further exploration, development and permitting of exploration projects including Lost Soldier, the Nebraska properties, Screech Lake and, following a closing, at Pathfinder Mines projects; and (x) the long term effects on the uranium market of events in Japan in 2011 including supply and demand projections. These other factors include, among others, the following: future estimates for production, production start-up and operations (including any difficulties with startup), capital expenditures, operating costs, mineral resources, recovery rates, grades and prices; business strategies and measures to implement such strategies; competitive strengths; estimates of goals for expansion and growth of the business and operations; plans and references to the Corporation’s future successes; the Corporation’s history of operating losses and uncertainty of future profitability; the Corporation’s status as an exploration stage company; the Corporation’s lack of mineral reserves; risks associated with obtaining permits in the United States and Canada; risks associated with current variable economic conditions; the possible impact of future financings; the hazards associated with mining construction and production; compliance with environmental laws and regulations; uncertainty regarding the pricing and collection of accounts; risks associated with dependence on sales in foreign countries; the possibility for adverse results in pending and potential litigation; fluctuations in foreign exchange rates; uncertainties associated with changes in government policy and regulation; uncertainties associated with a Canada Revenue Agency or U.S. Internal Revenue Service audit of any of the Corporation’s cross border transactions; adverse changes in general business conditions in any of the countries in which the Corporation does business; changes in the Corporation’s size and structure; the effectiveness of the Corporation’s management and its strategic relationships; risks associated with the Corporation’s ability to attract and retain key personnel; uncertainties regarding the Corporation’s need for additional capital; uncertainty regarding the fluctuations of the Corporation’s quarterly results; uncertainties relating to the Corporation’s status as a foreign private issuer/non-U.S. corporation; uncertainties related to the volatility of the Corporation’s share price and trading volumes; foreign currency exchange risks; ability to enforce civil liabilities under U.S. securities laws outside the United States; ability to maintain the Corporation’s listing on the NYSE MKT LLC (“NYSE MKT”) and Toronto Stock Exchange (“TSX”); risks associated with the Corporation’s expected classification as a "passive foreign investment company" under the applicable provisions of the U.S. Internal Revenue Code of 1986, as amended; risks associated with the Corporation’s status as a "controlled foreign corporation" under the applicable provisions of the U.S. Internal Revenue Code of 1986, as amended; risks associated with the Corporation’s investments and other risks and uncertainties described under the heading “Risk Factors” of this Annual Information Form.

| -1- |

Cautionary Note to U.S. Investors Concerning Resource Estimates

The terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource,” as used in the Corporation’s disclosure are Canadian mining terms that are defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Best Practice Guidelines for the Estimation of Mineral Resource and Mineral Reserves (“CIM Standards”), adopted by the CIM Council on November 23, 2003, as amended. These Canadian terms are not defined terms under United States Securities and Exchange Commission (“SEC”) Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC by U.S. registered companies. The SEC permits U.S. companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. Accordingly, note that information contained in this disclosure describing the Corporation’s “mineral resources” is not directly comparable to information made public by U.S. companies subject to reporting requirements under U.S. securities laws (wherein “reserves,” and not “resources,” may be disclosed and discussed). Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically minable. U.S. investors are urged to consider closely the disclosure in our disclosure documents which may be secured from us, or online at http://www.sec.gov/edgar.shtml or www.sedar.com.

| -2- |

NI 43-101 Review of Technical Information: John Cooper, Ur-Energy Project Geologist, P.Geo. and SME Registered Member, and Qualified Person as defined by National Instrument 43-101, and Catherine Bull, Ur-Energy Project Engineer, Wyoming P.E. and SME Registered Member, and Qualified Person as defined by National Instrument 43-101, reviewed and approved the technical information contained in this Annual Information Form.

Metric/Imperial Conversion Table

The imperial equivalents of the metric units of measurement used in this AIF are as follows:

| Imperial Measure | Metric Unit | Metric Unit | Imperial Measure | |

| 0.03215 troy ounces | 1 gram | 31.1035 grams | 1 troy ounce | |

| 2.4711 acres | 1 hectare | 0.4047 hectares | 1 acre | |

| 2.2046 pounds | 1 kilogram | 0.4536 kilograms | 1 pound | |

| 0.6214 miles | 1 kilometer | 1.6093 kilometers | 1 mile | |

| 3.2808 feet | 1 meter | 0.3048 meters | 1 foot | |

| 1.1023 short tons | 1 tonne | 0.9072 tonnes | 1 short ton |

Currency Exchange Rates

The following table sets out the exchange rates for currencies expressed in terms of equivalent Canadian dollars for one U.S. dollar:

| Year Ended December 31 | |||||

| Canadian dollar | 2008 | 2009 | 2010 | 2011 | 2012 |

| End of period | $1.22280 | $1.04940 | $1.00020 | $1.01990 | $0.99690 |

| Average for the period | $1.06669 | $1.14235 | $1.03075 | $0.98930 | $1.00019 |

| September | October | November | December | January | February | |

| Canadian dollar | 2012 | 2012 | 2012 | 2012 | 2013 | 1 – 22, 2013 |

| High for the month | $0.9901 | $1.0006 | $1.0025 | $0.9969 | $1.0082 | $1.0184 |

| Low for the month | $0.9677 | $0.9767 | $0.9922 | $0.9843 | $0.9837 | $0.9965 |

Exchange rates are the historical interbank foreign exchange rates for the appropriate period as quoted by OANDA Corporation (“OANDA”) on its website www.oanda.com The rate quoted by OANDA for the conversion of United States dollars into Canadian dollars on February 27, 2013 is CDN$ 1.0261 = US$1.00.

| -3- |

Uranium Prices

Unlike other commodities, uranium does not trade on an open market. Contracts are negotiated privately by buyers and sellers. Uranium prices are published by two of the leading industry-recognized independent market consultants, The Ux Consulting Company, LLC and TradeTech, LLC, who publish on their respective websites. The following information reflects an average of the per pound prices published by these two consulting groups for the timeframe indicated:

|

December 31 of [year] |

2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

| Spot price (US$) | $89.50 | $52.50 | $44.50 | $62.25 | $51.88 | $43.38 |

| LT price (US$) | $95 | $70 | $61 | $66 | $62.00 | $56.50 |

| End of [month] | Aug-12 | Sep-12 | Oct-12 | Nov-12 | Dec-12 | Jan-13 |

Feb-13 (wk of 2.18.13) |

| Spot price (US$) | $48.25 | $46.50 | $41.80 | $42.25 | $43.38 | $43.88 | $42.50 |

| LT price (US$) | $60.50 | $60.50 | $59.50 | $59.50 | $56.50 | $56.50 | [same as 01.31.13] |

THE CORPORATION

Name, Address and Incorporation

Ur-Energy is a corporation continued under the Canada Business Corporations Act on August 8, 2006. The registered office of the Corporation is located at 55 Metcalfe Street, Suite 1300, Ottawa, Ontario K1P 6L5. The Corporation’s United States corporate headquarters is located at 10758 West Centennial Road, Suite 200, Littleton, Colorado, 80127. The Corporation maintains a corporate and operations office at 5880 Enterprise Drive, Suite 200, Casper, Wyoming 82609. The Common Shares are listed on the TSX under the symbol “URE” and on the NYSE MKT under the symbol “URG.”

Intercorporate Relationships

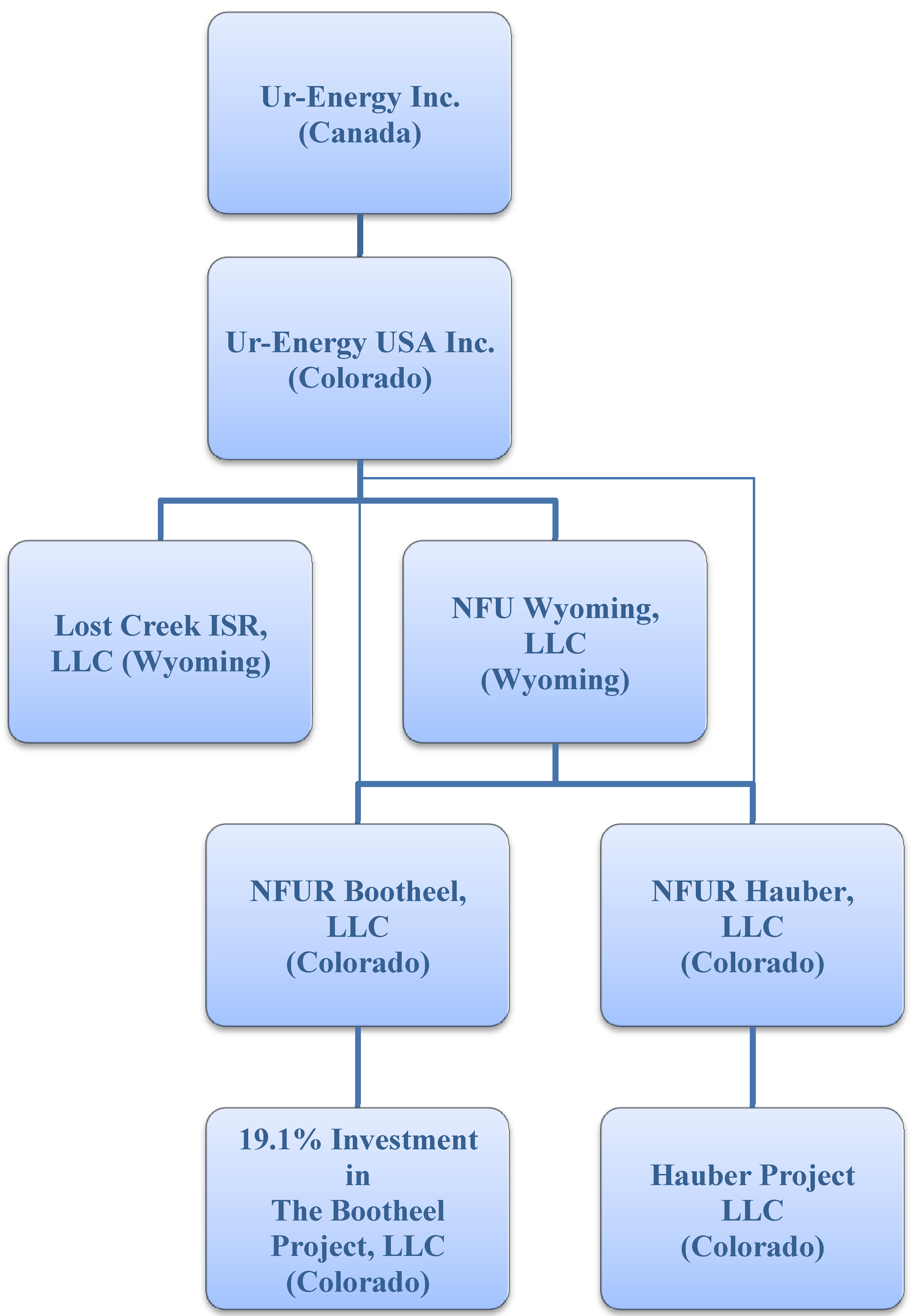

The Corporation has one wholly-owned subsidiary: Ur-Energy USA Inc. (“Ur-Energy USA”), a company incorporated under the laws of the State of Colorado.

Ur-Energy USA has two wholly-owned subsidiaries: NFU Wyoming, LLC (“NFU Wyoming”), a limited liability company formed under the laws of the State of Wyoming to facilitate the Corporation’s acquisition of certain property and assets and, currently, to act as the land holding and exploration entity for the Corporation; and, Lost Creek ISR, LLC, a limited liability company formed under the laws of the State of Wyoming to hold and operate the Corporation’s Lost Creek Project property and assets, and now the LC East Project property and assets.

Ur-Energy USA has two jointly held subsidiaries with NFU Wyoming: NFUR Bootheel, LLC, a limited liability company formed under the laws of the State of Colorado to facilitate the Corporation’s participation in an exploration, mining and development agreement with Crosshair Energy Corporation; and NFUR Hauber, LLC, a limited liability company formed under the laws of the State of Colorado to facilitate the Corporation’s participation in a venture project at its Hauber project, in which NCA Nuclear, Inc., a subsidiary of Bayswater Uranium Corp. was, until July 2012, the earn-in member and manager.

| -4- |

NFUR Hauber has one wholly-owned subsidiary: Hauber Project LLC, a limited liability company formed under the laws of the State of Colorado to hold the Corporation’s Hauber project and facilitate a venture with NCA Nuclear, Inc., a subsidiary of Bayswater Uranium Corp. for exploration of the Hauber project. Following the resignation of NCA Nuclear, Inc., in July 2012, NFUR Hauber, LLC is the sole member and manager of Hauber Project LLC.

NFUR Bootheel has one subsidiary: The Bootheel Project, LLC, a limited liability company formed under the laws of the State of Colorado to hold the Corporation’s interest in the Bootheel Project, a venture formed with Crosshair Energy Corporation, in which Ur-Energy, at December 31, 2012, owns a 19% interest.

ISL Resources Corporation, CBM-Energy Inc. and ISL Wyoming, Inc., each of which was a direct or indirect subsidiary of the Corporation and held no assets or liabilities, were dissolved during 2012.

Currently, and at the end of 2012, the principal direct and indirect subsidiaries of the Corporation and the jurisdictions in which they were incorporated or organized are set out here:

| -5- |

GENERAL DEVELOPMENT OF THE BUSINESS

Incorporated on March 22, 2004, Ur-Energy is an exploration stage junior mining company engaged in the identification, acquisition, evaluation, exploration and development of uranium mineral properties in Canada and the United States. The registered office of the Corporation is in Ottawa, Ontario and the corporate headquarters is located in Littleton, Colorado. Ur-Energy also maintains an operations office in Casper, Wyoming. At December 31, 2012, the Corporation’s U.S. subsidiary, Ur-Energy USA, employed 51 people in its Littleton, Colorado (16) and Casper, Wyoming (35) offices. None of the other subsidiaries had any employees in 2012.

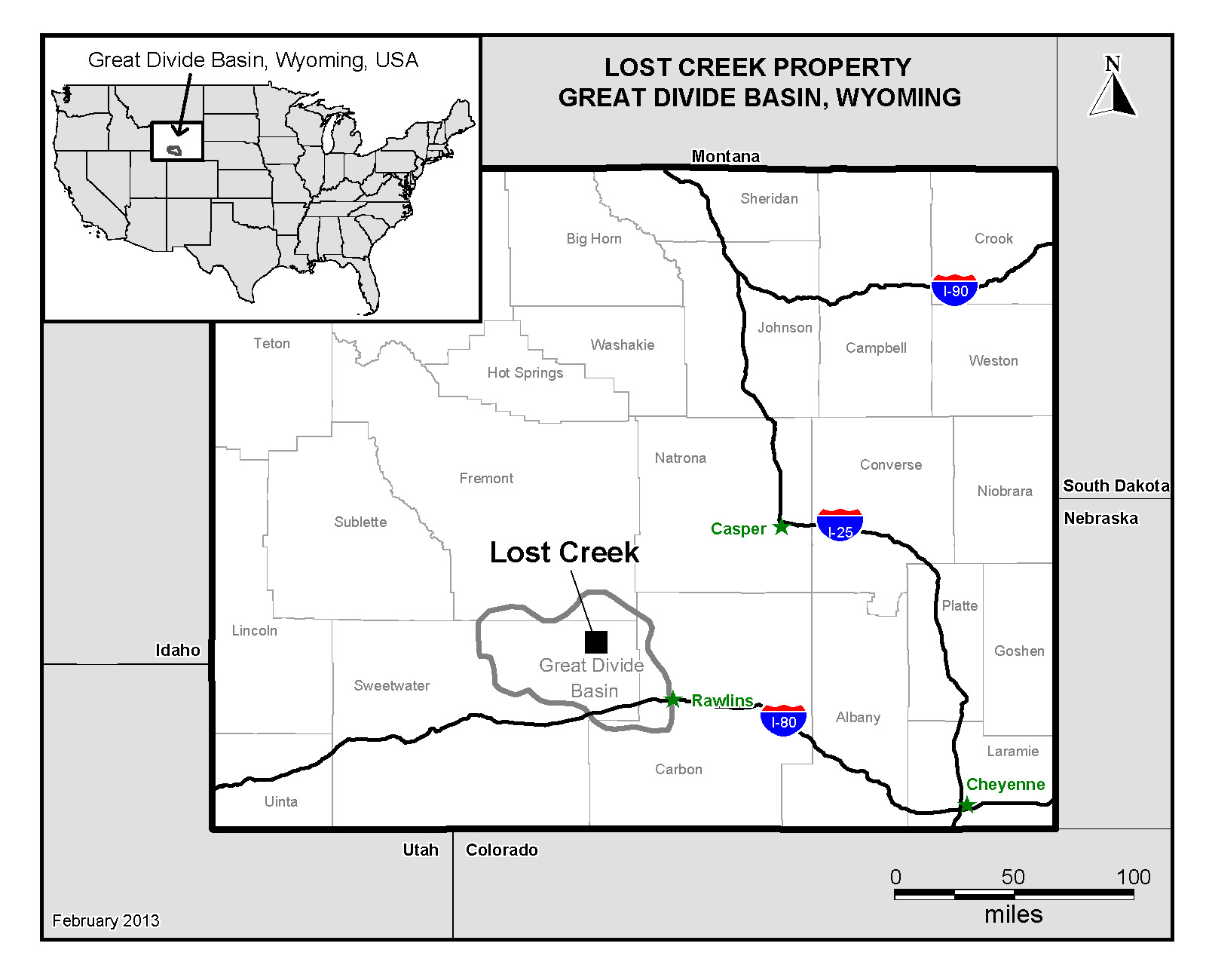

The Corporation’s current land portfolio includes 13 projects in the United States and three exploration projects in Canada. Ten of the U.S. projects are in the Great Divide Basin, Wyoming, of which the Corporation’s flagship project, Lost Creek, is advancing through construction toward an initial production date forecast to be second half 2013. Five of the projects at the Lost Creek Property contain National Instrument 43-101 (“NI 43-101”) compliant mineral resources: Lost Creek, LC East, LC West, LC South and LC North. Ur-Energy’s Lost Soldier project, also located in Wyoming, also contains an NI 43-101 compliant mineral resource.

The Corporation’s Wyoming properties together total more than 63,000 acres (25,495 hectares) and leased lands for exploration prospects in Nebraska represent an additional approximately 35,000 acres (14,164 hectares). The Corporation has two properties in the Northwest Territories, Canada and one property in Nunavut, Canada. Collectively, the Corporation’s landholdings total approximately 98,000 acres (39,659 hectares) in the U.S. and approximately 140,000 acres (56,656 hectares) in Canada.

Lost Creek Property – Great Divide Basin, Wyoming

The Corporation currently controls a total of more than 2,100 unpatented mining claims and four State of Wyoming mineral leases for a total of approximately 42,000 acres (16,997 hectares) in the area of its Lost Creek Property, including the Lost Creek permit area (the “Lost Creek Project” or “Project”) and certain adjoining properties comprising LC East, LC West, LC North, LC South and EN project areas (collectively, with the Lost Creek Project, the “Lost Creek Property”). This land status description represents a net increase in land holdings at the Lost Creek Property of approximately 8,000 acres (3,237 hectares) during 2012, including the location of more than 250 additional unpatented mining claims, and the acquisition of approximately 5,250 acres (2,125 hectares) from the asset exchange agreement announced in February 2012 in which the Corporation exchanged an historic mineral database for the property interests and data related to the property. The projects are described in detail in the Corporation’s April 30, 2012 Preliminary Economic Assessment described below.

The original Lost Creek project area was acquired by the Corporation in 2005, and is located in the Great Divide Basin, Wyoming. The main mineral trend of the Lost Creek uranium deposit (the “MMT”) is located within the Lost Creek Project. The permit area of the Lost Creek Project covers 4,254 acres (1,722 hectares), comprising 201 lode mining claims and one State of Wyoming mineral lease section. A royalty on future production of 1.67% is in place with respect to 20 claims of the Lost Creek Project; a royalty also exists on the State of Wyoming mineral lease as provided by law. Since 2005, the Corporation has advanced the exploration, permitting and development of the Lost Creek Project. In October 2012, construction commenced following receipt of the final regulatory authorization required by the project. First production is currently anticipated second half 2013. The progression of exploration and development of Lost Creek Project is further discussed below under the heading “Business of Ur-Energy – Lost Creek Property.”

| -6- |

Beginning in 2007, the Corporation completed all necessary applications and related processes to obtain the required permitting and licensure for the Project, of which the three most significant are: a Source and Byproduct Materials License from the U.S. Nuclear Regulatory Commission (“NRC”) (received August 2011); a Plan of Operations with the United States Bureau of Land Management (“BLM”) (Record of Decision received October 2012); and a Permit and License to Mine from the Wyoming Department of Environmental Quality (“WDEQ”) (October 2011). Additional authorizations from federal, state and local agencies were also received. These regulatory achievements are further discussed below under the heading “Business of Ur-Energy – Lost Creek Property.”

Through two new NI 43-101 technical reports on the Lost Creek Property during 2012, the Corporation confirmed the possible economics of the Lost Creek Property, while updating to an increased mineral resource estimate. First, the “Preliminary Economic Assessment of the Lost Creek Property, Sweetwater County, Wyoming,” prepared by Ur-Energy and dated February 29, 2012 (the “February 2012 PEA”) reported increased mineral resources and verified the earlier (TREC Inc. 2011) economic analysis in support of the possible economics of the property and continued development to mine production. The February 2012 PEA supports the earlier recommendations to continue development to mine production based upon the earlier reported mineral resources at the “main mineral trend” (“MMT”) of the Lost Creek Project, without further consideration of the additional resource estimate reported. The earlier reported mineral resources, validated by Mr. Cooper, include 5.22 million pounds eU3O8 of Measured and Indicated Mineral Resources contained in 4.73 million tons, at an average grade of 0.055% eU3O8; and 0.78 million pounds eU3O8 of Inferred Mineral Resources, contained in 0.77 million tons, at an average grade of 0.051% eU3O8. The economic analysis is based upon an assumed 80% recovery of the reported total mineral resources in the MMT. See also “Business of Ur-Energy – Lost Creek Property.”

The purpose of the February 2012 PEA was to report new mineral resources following the 2011 drill program and to confirm the possible economics of Lost Creek Project using the scientific and technical information then available.

Subsequently, following the acquisition of the LC East and LC West Projects in February 2012, the Corporation prepared another Preliminary Economic Assessment to provide an updated mineral resource estimate for the Lost Creek Property prompted by the February 2012 acquisition. The April 30, 2012 report, prepared by Ur-Energy, titled Preliminary Economic Assessment of the Lost Creek Property, Sweetwater County, Wyoming, (the “April 2012 PEA”) also updated the economic analysis for the property, and demonstrates the possible economics of the mineral resources at the Property. The economic analysis focuses on the resources within the Lost Creek and LC East Projects (the “MMT” and the newly recognized “EMT” at LC East) due to the preponderance of data available there. The full technical report is filed on the Corporation’s profile on www.sedar.com and on http://www.sec.gov/edgar.shtml. See also the extract of the April 2012 PEA set forth below under the heading “Business of Ur-Energy – Lost Creek Property.”

| -7- |

The April 2012 PEA reported an updated mineral resource estimate for the Lost Creek Property:

| MEASURED | INDICATED | INFERRED | |||||||||

| PROJECT | AVG GRADE | SHORT TONS | POUNDS | AVG GRADE | SHORT TONS | POUNDS | AVG GRADE | SHORT TONS | POUNDS | ||

| % eU3O8 | (X 1000) | (X 1000) | % eU3O8 | (X 1000) | (X 1000) | % eU3O8 | (X 1000) | (X 1000) | |||

| LOST CREEK | 0.055 | 2,692.1 | 2,942.9 | 0.058 | 2,413.8 | 2,822.4 | 0.054 | 937.5 | 1,015.7 | ||

| LC EAST | 0.054 | 1,158.3 | 1,255.9 | 0.043 | 1,551.3 | 1,327.0 | 0.045 | 910.8 | 815.3 | ||

| LC NORTH | ----- | ----- | ----- | ----- | ----- | ----- | 0.048 | 413.8 | 398.2 | ||

| LC SOUTH | ----- | ----- | ----- | ----- | ----- | ----- | 0.042 | 710.0 | 602.6 | ||

| LC WEST | ----- | ----- | ----- | ----- | ----- | ----- | 0.109 | 17.2 | 37.4 | ||

| EN | ----- | ----- | ----- | ----- | ----- | ----- | ----- | ----- | ----- | ||

| GRAND TOTAL | 0.055 | 3,850.4 | 4,198.8 | 0.053 | 3,965.1 | 4,149.4 | 0.049 | 2,989.2 | 2,869.1 | ||

| MEASURED + INDICATED = | 7,815.5 | 8,348.2 | |||||||||

Notes:

| 1. | Sum of Measured and Indicated tons and pounds may not add to the reported total due to rounding. |

| 2. | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| 3. | Based on grade cutoff of 0.02 percent eU3O8 and a grade x thickness cutoff of 0.3 GT. |

| 4. | Typical ISR-industry practice is to apply a GT cutoff in the range of 0.3 which has generally been determined to be an economical cutoff value. A 0.3 GT cutoff was used in this report without direct relation to an associated price. |

| 5. | Measured, Indicated, and Inferred Mineral Resources as defined in NI 43-101, Section 1.2 (CIM Definition Standards). |

A majority of the resources for the LC East Project reported in the April 2012 PEA are located in close proximity to the Lost Creek plant site and are contained within the HJ and KM Horizons. Additionally, resources were also identified in the FG, L and M Horizons. Numerous identified roll fronts with ore grade mineralization have relatively low drilling densities associated with them and merit additional exploration. Also, most of the historic drilling in this region targeted shallow uranium mineral trends with the intention to conduct open pit mining. The deeper L, M and N Horizons at Lost Creek Project and LC East have sparse drilling and are presently inadequately tested for their potential as in situ recovery (ISR) candidates. The Lost Creek Property resources are classic roll-front type deposits in which the uranium is introduced via groundwater flow and precipitated at chemical oxidation/reduction (redox) boundaries after the host rock deposition.

Based upon the updated mineral resource and economic analyses (of the MMT and EMT only), the Lost Creek Property is estimated to generate net earnings over the life of the mine, before income tax, of US$283.0 million. Payback is estimated during the third quarter of the third year of operations (two years from start of construction). It is estimated that Lost Creek has an IRR of 87% and a NPV of US$181.0 million applying an eight percent discount rate. The estimated cost of uranium produced is US$36.52 per pound including all costs, with an estimated operation cost of US$16.12 per pound.

| -8- |

The April 2012 PEA includes recommendations for the Lost Creek Property in three general categories: production, delineation and exploration. In addition to advancing Lost Creek to production following completion of the permitting process, it is then recommended that revenues generated from production should be used to fund additional delineation and exploration drilling including further delineation of the resources within the MMT and EMT to bring them into the Measured and Indicated Categories (greater detail provided in the April 2012 PEA).

Other U.S. Projects:

Lost Soldier Project – Great Divide Basin, Wyoming

Also acquired in 2005, the Lost Soldier project is located approximately 14 miles (22.5 kilometers) to the northeast of the Lost Creek Project. Lost Soldier has over 3,700 historic drill holes defining 14 mineralized sandstone units. NI 43-101 compliant resources for Lost Soldier (Technical Report – Lost Soldier July 2006, by C. Stewart Wallis) are 5.0 million pounds of U3O8 at 0.064% as a Measured Mineral Resource, 7.2 million pounds of U3O8 at 0.065% as an Indicated Mineral Resource and 1.8 million pounds of U3O8 at 0.055% as an Inferred Mineral Resource. The NI 43-101 report is filed on the Corporation’s profile on www.sedar.com and on http://www.sec.gov/edgar.shtml. The Corporation maintains 143 lode mining claims at Lost Soldier, totaling approximately 2,710 mineral acres. A royalty of one percent, arising from a data purchase, is in place with respect to future production on certain claims within the project. While no longer deemed to be a material property by the Corporation, Ur-Energy continues to anticipate that further technical work and regulatory applications for Lost Soldier will be completed as corporate priorities are determined for the exploration and development of the Lost Creek Property, and funding may be allocated to the Lost Soldier project.

Wyoming Ventures: The Bootheel Project, LLC and Hauber Project LLC

The Corporation has ventured two of its Wyoming properties: the Bootheel and Hauber projects.

Hauber Project - Black Hills Uplift, Wyoming

The Corporation’s wholly-owned Hauber Project maintains properties within the Black Hills Uplift in Crook County, Wyoming, comprising 205 unpatented lode mining claims and one State of Wyoming uranium lease totaling approximately 4,570 mineral acres (1,849 hectares). During 2012, the venture agreement completed in 2009 with NCA Nuclear Inc., a subsidiary of Bayswater Uranium Corp. (TSX.V:BYU)(“Bayswater”), was effectively terminated when Bayswater resigned as the earn-in member and manager. Since the resignation, the Corporation is responsible for all obligations at the project. The Corporation conducted no work at Hauber project during 2012 and no field work is planned in 2013.

The Bootheel Project – Shirley Basin, Wyoming

Crosshair Energy Corporation (TSX:CXX; NYSE MKT:CXZ) (formerly Crosshair Exploration & Mining Corp., “Crosshair”) has been the Manager of the Bootheel Project venture since 2007. Following a decision by Ur-Energy to not fund its portion of the budget for the venture’s budget year ending March 31, 2012, the Corporation’s ownership interest was reduced from 25% to approximately 19% at the conclusion of that budget year. The Project’s 2012-2013 program was approved and the Corporation has participated financially in the year’s nominal program. In February 2013, the private mineral lease and use agreements for the Bootheel property of the Project expired. To date, efforts to renegotiate an additional term have been unsuccessful. Certain portions of the minerals included in the technical report issued by Crosshair, dated February 27, 2012, are located on the leased lands at the Bootheel property. There remain land holdings at Bootheel and Buck Point properties comprising 274 federal lode mining claims and two State of Wyoming mineral leases. The Corporation’s determination of impairment, if any, will be reflected in subsequent financial statements.

| -9- |

Western Nebraska Exploration

The Corporation has leased approximately 35,000 acres (14,164 hectares)(not contiguous) in western Nebraska for initial exploration to test new concepts in a geologic environment that is favorable for the discovery of uranium deposits. An in-house team of geologists conducted a detailed study mapping the subsurface geology and host formations, leading to the land leasing program. The study area covers eleven counties and is based on data obtained primarily from the records of several thousand oil and gas well logs. The objective of the study was to identify potential uranium bearing paleo-channels in sandstone formations; these may contain deposits similar in nature to Cameco Resources (TSX:COO) Crow Butte deposit in Dawes County, Nebraska. Ur-Energy’s land position was chosen in areas with similar geologic characteristics to the Crow Butte deposit, which is presently being mined by in-situ recovery method. Although no work was conducted during 2012, the Corporation plans for continued exploration of the leased lands in the future.

Corporation Databases

Evaluation continues of the Corporation’s historic exploration databases, in an effort to realize additional value from the databases. Following earlier sales of databases, the asset exchange completed in February 2012 for property interests adjacent to the Lost Creek Project realized substantial value for another of the Corporation’s historic databases. During 2011, an additional mineral database was acquired by the Corporation. The exploration databases owned by the Corporation contain data on lands controlled by the Corporation, as well as data related to lands controlled by third parties.

Canadian Exploration Properties

The Corporation has three properties in northern Canada: Screech Lake and Gravel Hill (together, approximately 96,100 acres (38,900 hectares)) in the Thelon Basin, Northwest Territories, and Bugs (approximately 45,000 acres (18,200 hectares)) in the Baker Lake Basin, Nunavut. The Corporation’s landholdings at Screech Lake total more than 60,600 acres (24,500 hectares). Various exploration and field programs have been conducted on the property since 2005. Highly anomalous radon concentrations and trends were identified. The coincidence of consistent high to extremely high radon with deep structure and conductivity combine to make the North Screech radon trend the primary focus for further exploration on the project. No work was conducted at the Canadian projects during 2012 and no work is planned in 2013.

| -10- |

Technical Developments

The Corporation filed the two NI 43-101 technical reports on Lost Creek, “Preliminary Economic Assessment of the Lost Creek Property, Sweetwater County, Wyoming,” dated February 29, 2012 and April 12, 2012, which are described above.

Board of Directors and Management Changes

There were no changes to the Board of Directors during 2012. All officers of the Corporation remained unchanged in 2012. In September 2012, the Corporation hired the Mine Manager, Mike Lueders, for its Lost Creek Project. Mr. Lueders is a mining professional with thirty-one years of in situ uranium recovery experience, including start-up operations, mine planning, wellfield construction & operation, safety compliance, staffing, supervision, and training.

Corporate Transactions and Financing Developments

Pathfinder Mines Corporation Share Purchase Agreement (July 2012)

On July 24, 2012, the Company executed a Share Purchase Agreement (“SPA”) to acquire Pathfinder Mines Corporation (“Pathfinder”). The transaction calls for the purchase of all issued and outstanding shares of Pathfinder from COGEMA Resources, Inc., an AREVA Mining affiliate, for US$13,250,000. The initial payment of US$1,325,000 was made upon execution of the SPA and will be held in escrow pending closing, which is anticipated six to twelve months from the time of signature. The closing may proceed following receipt of various regulatory and governmental approvals, including approval by the Nuclear Regulatory Commission (“NRC”) for the change of control of an NRC License for the Shirley Basin mine site owned by Pathfinder. The closing is also contingent upon other customary closing conditions.

Pathfinder owns the Shirley Basin and Lucky Mc mine sites in the Shirley Basin and Gas Hills mining districts of Wyoming, respectively, for which internal historic reports prepared by Pathfinder estimate the presence of mineral resources at the two projects totalling approximately 15 million pounds U3O8. These historic reports estimate that the Shirley Basin project holds over 10 million pounds U3O8 at a GT (grade-thickness) cut off of 0.25% U3O8. The average grade reported for the property is 0.21% U3O8. Lucky Mc is estimated to have an additional 4.7 million pounds U3O8. These historic resource calculations were reviewed by Ur-Energy during due diligence, but a qualified person has not completed sufficient work to classify the historical estimates as current mineral resources under NI 43-101 and Ur-Energy is not treating the historic estimate as current mineral resources or mineral reserves.

The tailings facility at the Shirley Basin site is one of the few remaining facilities in the United States that is licensed by the NRC to receive and dispose of byproduct waste material from other in situ uranium mines.

Together with property holdings totalling more than 5,100 acres (2,064 hectares), the Corporation would acquire all historic geologic, engineering and operational data related to the two projects held by Pathfinder. Additionally, Ur-Energy would acquire all historic Pathfinder U.S. exploration and development data in a database estimated to comprise hundreds of project descriptions in more than twenty states, including thousands of drill logs and geologic reports.

| -11- |

Both Lucky Mc and Shirley Basin conventional mine operations were suspended in the 1990s due to low uranium pricing and facility reclamation was substantially completed. If the transaction closes, the Corporation would assume remaining reclamation responsibilities including financial surety for reclamation, at Shirley Basin and the Lucky Mc mine site. The Lucky Mc tailings site was fully reclaimed and has been transferred to the U.S. Department of Energy. Ur-Energy will therefore assume no obligations with respect to the NRC License at the Lucky Mc tailings site, which will either be terminated or will be assumed by COGEMA Resources, Inc. or an affiliate prior to the closing of the transaction.

Private Placement, February 2012

On February 23, 2012, the Corporation announced it closed a private placement for gross proceeds of $17,250,000. BlackRock, Inc., then an insider of the Corporation, through one of its investment advisory subsidiaries, subscribed for 2,000,000 Common Shares issued under the private placement. The agents were paid a four and one half percent (4.5%) commission.

Off Take Sales Agreements (2011 – 2012)

In January and February 2012, the Corporation announced it had entered into additional uranium sales arrangements relating to production from the Lost Creek Project. An arrangement concluded in January 2012 calls for delivery of 200,000 pounds uranium concentrates per year to a North American utility company in a multi-year schedule commencing in 2013. The average delivery price under the arrangement is consistent with the Long-Term U3O8 Price Indicator at that time as published by Trade Tech. In February 2012, the Corporation announced a uranium sales agreement under which it will deliver 100,000 pounds of uranium concentrates per year in another multi-year schedule. The agreement specifies firm delivery prices in the low US$60 per pound range over its term.

These announcements followed the March 2011 announcement that the Corporation had entered into its first such uranium sales agreement. That long-term contract calls for deliveries over a three-year period at a defined price for the term of the agreement.

The 2012 sales agreements were completed as a part of the Corporation’s strategic marketing and development plan, in conjunction with an agreement, announced in October 2011, with NuCore Energy, LLC (“NuCore”). Under the arrangement, renewed during 2012, Mr. Cornell, President of NuCore, is representing Ur-Energy exclusively in negotiation of uranium off-take purchase agreements for future production, as well as providing additional professional advisory services.

Earlier Financing and Share Developments (2010 – 2011)

The Corporation announced on February 7, 2011 that it had entered into a bought deal offering with a syndicate of underwriters. Closing of the offering was delayed while the Corporation updated its continuous disclosure filings, including the preparation of an updated NI 43-101 Technical Report. Due to the delay, the prospectus for the Offering was withdrawn by the Corporation on March 11, 2011.

| -12- |

The Corporation completed a brokered private placement financing May 31, 2010, under which the Corporation issued 5,000,000 Common Shares at a price of $1.00 per share for gross proceeds of $5,000,000. BlackRock, Inc., then an insider of the Corporation, through one of its investment advisory subsidiaries, subscribed for all of the 5,000,000 Common Shares issued under the private placement.

On June 24, 2010, the shareholders of the Corporation approved the Ur-Energy Inc. Restricted Share Unit Plan, (“RSU Plan”) which had been adopted by the Board of Directors (the “Board”) of the Corporation on May 7, 2010. The Corporation adopted the RSU Plan as part of the Corporation’s overall stock-based compensation plan. The RSU Plan allows participants to receive restricted share units (“RSUs”) and earn actual Common Shares of the Corporation over time, rather than options that give participants the right to purchase stock at a set price. The Corporation continues to have the Ur-Energy Inc. Amended and Restated Stock Option Plan 2005 (“Option Plan”), which was approved by the shareholders most recently in 2011.

The Company maintains a shareholder rights plan (the “Rights Plan”) designed to encourage the fair and equal treatment of shareholders in connection with any take-over bid for the Company's outstanding securities. The Rights Plan is intended to provide the Company’s board of directors with adequate time to assess a take-over bid, to consider alternatives to a take-over bid as a means of maximizing shareholder value, to allow competing bids to emerge, and to provide the Company’s shareholders with adequate time to properly assess a take-over bid without undue pressure. The Rights Plan was reconfirmed by shareholders at the Company’s annual and special meeting of shareholders on May 10, 2012.

BUSINESS OF UR-ENERGY

The Corporation is a uranium exploration and development company currently constructing its first in situ uranium mine at its Lost Creek Project, Wyoming. Ur-Energy engages in the identification, acquisition, evaluation, exploration and development of uranium properties in the United States and in Canada.

The Corporation continues to actively pursue future growth opportunities by evaluating the acquisition of exploration, development or production assets as well as considering joint venture or similar projects for existing Corporation properties. At any given time, discussions and activities can be in process on a number of initiatives, each at different stages of development. Although the Corporation may from time to time be a party to letters of intent in respect of certain joint ventures opportunities and other acquisitions, the Corporation currently does not have any binding agreements or binding commitments to enter into any such transactions, other than as disclosed in the Corporation’s continuous disclosure filings. There is no assurance that any potential transaction will be successfully completed.

| -13- |

Lost Creek Property

Ur-Energy’s priority is to advance its Lost Creek Project (located in the Great Divide Basin, Wyoming) into production, which is currently anticipated in second half 2013.

Lost Creek Project Development and Construction

In addition to the historic drill data it owns with regard to the Lost Creek Project, the Corporation has drilled 1,181 exploration and delineation drill holes totalling approximately 789,141 feet (240,530 meters). Subsequent to the receipt of the ROD authorizing construction and wellfield development, the Corporation commenced installing wells in Mine Unit 1, and has conducted further delineation drilling in Mine Unit 2. Initial review of the drill results in the ongoing drill program reveals the character of the uranium roll front to be consistent with historic mapping and analyses, including those from which the April 2012 PEA was generated. As the Corporation continues its analyses of the construction drilling results, it will continue to review its mineral resource estimates at Lost Creek and update as appropriate.

| -14- |

Construction activities also commenced after receipt of the ROD in October 2012, with Wyoming-based Groathouse Construction, Inc. acting as the general construction contractor for both road construction and construction of the plant facilities. Since construction began, the Corporation has spent approximately $20 million on construction and capital assets. The access roads to the Lost Creek plant have been constructed; powerlines are installed with power in to the plant site and to the first mine unit; an additional deep disposal well was drilled and subsurface engineering work on it nears completion while the initial deep well (drilled in 2008) has been completed. The foundation work is complete and erection of the building commenced in mid-February 2013. Lost Creek has taken delivery on additional large equipment for the plant, and all of the larger equipment has been set in place on the plant floor. Based upon a generalized review, there has been no material variance to date with the costs contemplated by the economic analysis of the April 2012 PEA; realized costs remain within the sensitivities and contingencies of the Project.

Hiring for Lost Creek has begun and, as set forth above, includes Lost Creek Mine Manager, Mike Lueders. As of mid-February, approximately 30 employees of the Corporation are working at Lost Creek.

Through its wholly-owned subsidiary Lost Creek ISR, LLC, the Corporation submitted a bond-financing application in June 2012 to the Wyoming Business Council (“WBC”) for up to US$34 million to be funded through the State of Wyoming’s Industrial Development Bond financing program. Under the proposal, the bond financing program would fund 75% of qualified capital expenditures including plant capital, disposal well and wellfield development expenditures. The application included a letter of support from Sweetwater County, the issuing authority. In September 2012, the WBC approved the application, subject to certain conditions and covenants, and issued a letter of recommendation to the Governor, Treasurer and Attorney General. The Governor provided his letter of recommendation to the Treasurer and Attorney General in January 2013, following the completion of the WBC’s due diligence. Final approval of the bond financing is subject to the satisfaction of these other approvals and various transactional matters.

Lost Creek Regulatory and Legal Proceedings

At this time, all of the licenses and permits necessary for construction and operations have been issued for the Lost Creek Project. In October 2012, the BLM issued a ROD for the Project. The BLM selected the Drying Yellowcake On-Site Alternative as the preferred alternative within its final environmental impact statement. In November 2012, a Wyoming-based group filed a petition in the U.S. District Court for Wyoming for the review of the BLM ROD. There is a second, separate, request for administrative review of the BLM ROD which was made to the State Director of the BLM in November 2012. See also “Legal Proceedings.”

Earlier Licenses, Permits and Authorizations

The NRC issued the Source and Byproduct Materials License (“NRC License”) for the Lost Creek Project in 2011. The Corporation received the NRC site-specific Supplemental Environmental Impact Statement for the project in June 2011. The NRC License includes the Safety Evaluation Report for the project. The Corporation subsequently submitted its application for an amendment to the NRC License to include the yellowcake drying and packaging circuit of the Lost Creek plant, for which approval is expected during first half of 2013. In that same timeframe, the Corporation also expects to submit its application for an amendment to the NRC License to allow for mineral recovery from the KM horizon which is immediately below the approved HJ horizon.

| -15- |

The Wyoming Department of Environmental Quality (“WDEQ”) Permit to Mine for Lost Creek (“WDEQ Permit”) also was issued in 2011, following a determination by the Wyoming Environmental Quality Council (“WEQC”) with respect to a third-party objection. As a part of its ruling in favor of the project, the WEQC directed that the WDEQ Permit be approved by the WDEQ. The WDEQ Permit includes the approval of the first mine unit, as well as the Wildlife Management Plan, including a positive determination of the protective measures at the project for the greater sage grouse species.

In March 2010, the U.S. Fish and Wildlife Service (“USFWS”) submitted a finding of “warranted for listing but precluded by higher priorities” with regard to the greater sage grouse, whose habitat includes Wyoming. A finding that listing is “warranted but precluded” results in recognition of the greater sage grouse as a candidate for listing. This finding is reconsidered annually, taking into account changes in the status of the species. When higher priority listing actions have been addressed by the USFWS for other species, a proposed listing rule is prepared and issued for public comment. This means that until the USFWS finalizes a listing determination, the greater sage grouse will remain under state management.

As a part of its WDEQ Application, the Corporation submitted a Wildlife Protection Plan regarding, among other issues, the sage grouse. The Wyoming Game and Fish Department (“WGFD”) reviewed and recommended the Wildlife Management Plan to the WDEQ, including findings that the Wildlife Management Plan meets all of the protection measures for the greater sage grouse species, and is consistent with the Wyoming Governor’s Executive Order on the sage grouse. Following WGFD’s recommendation, the Lost Creek Wildlife Management Plan was incorporated into the WDEQ Permit.

The Environmental Protection Agency (“EPA”) issued an aquifer exemption for the Lost Creek project. The WDEQ’s separate approval of the aquifer reclassification is a part of the WDEQ Permit. The Corporation received approval from the EPA and the Wyoming State Engineer’s Office for the construction and operation of two holding ponds at Lost Creek.

Other permits and authorizations previously received for the Lost Creek ISR project include: WDEQ-Air Quality Division Air Quality Permit (January 2010; renewed in 2012) and WDEQ-Water Quality Division Class I Underground Injection Control Permit (May 2010). The latter permit allows Lost Creek operate up to five Class I injection wells to meet the anticipated disposal requirements for the life of the Lost Creek Project.

The Corporation’s Five Projects Adjoining Lost Creek Form the Lost Creek Property

The LC East and LC West Projects (approximately 4,780 acres (1,934 hectares) and 3,840 acres (1,554 hectares), respectively) are new to the Lost Creek Property in 2012. The two projects were formed through location of new unpatented lode mining claims and the asset exchange completed in February 2012. The April 2012 PEA identified mineral resources at both new projects, based upon historic data owned by the Corporation. See also “General Development of the Business – Lost Creek Property – Great Divide Basin, Wyoming.”

| -16- |

As previously reported, the Corporation completed an exploration drill program at its LC East Project in the second half of 2012. Through a recently-completed analysis of those drill results, the Corporation estimates a total current mineral resource at its LC East Project as follows:

| MEASURED | INDICATED | INFERRED | ||||||

| AVG GRADE | SHORT TONS | POUNDS | AVG GRADE | SHORT TONS | POUNDS | AVG GRADE | SHORT TONS | POUNDS |

| % eU3O8 | (X 1,000) | (X 1,000) | % eU3O8 | (X 1,000) | (X 1,000) | % eU3O8 | (X 1,000) | (X 1,000) |

| 0.054 | 1,158.3 | 1,255.9 | 0.043 | 1,538.4 | 1,327.0 | 0.045 | 1,255.1 | 1,121.4 |

Notes:

| 1. | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| 2. | Based on grade cutoff of 0.02 percent eU3O8 and a grade x thickness cutoff of 0.3 GT. |

| 3. | Typical ISR-industry practice is to apply a GT cutoff in the range of 0.3 which has generally been determined to be an economical cutoff value. A 0.3 GT cutoff was used in this report without direct relation to an associated price. |

| 4. | Measured, Indicated, and Inferred Mineral Resources as defined in NI 43-101, Section 1.2 (CIM Definition Standards). |

These figures represent an approximate nine percent increase in the Inferred Mineral Resource for the LC East Project. Reported mineral resources in the Measured and Indicated categories for LC East did not change from the April 2012 PEA figures. Additionally, in 2012, the Corporation initiated all baseline studies at LC East, and anticipates concluding the studies by third quarter 2013. The Corporation anticipates filing applications for amendments of its licenses and permits, to include development of LC East, during fourth quarter 2013.

The LC North Project (approximately 7,489 acres (3,031 hectares)) is located to the north and to the west of the Lost Creek Project. Historical wide-spaced exploration drilling on this project consisted of 161 drill holes. In 2007, Ur-Energy drilled 30 exploration holes in two areas immediately north of the Lost Creek Project. In 2011, additional drilling was conducted on the LC North Project; in total, 105 holes and one well were drilled (total, 101,919 feet 31,065 meters)). The February 2012 PEA reports a mineral resource at the LC North Project for the first time: 398,200 pounds eU3O8 (as an Inferred Mineral Resource), contained in 413,800 tons at a grade of 0.048% eU3O8. The April 2012 PEA recommends additional exploration drilling at the project to pursue the potential of an extension of the MMT in the HJ and KM Horizons.

The LC South Project (approximately 11,467 acres (4,641 hectares)) is located to the south and southeast of the Lost Creek Project. Historical drilling on the LC South Project consisted of 482 drill holes. In 2010, Ur-Energy drilled 159 exploration holes (total, 101,270 feet (30,876 meters)) which confirmed numerous individual roll front systems occurring within several stratigraphic horizons correlative to mineralized horizons in the Lost Creek Project. Also, a series of wide-spaced drill holes were part of this exploration program which identified deep oxidation (alteration) that represents the potential for several additional roll front horizons. The February 2012 PEA reports an Inferred Mineral Resource of 602,600 pounds eU3O8 contained in 710,000 tons, at a grade of 0.042% eU3O8 at the project. Additional drilling is recommended at the LC South Project, including to further evaluate the potential of deeper mineralization, and to test the FG trend.

| -17- |

The EN Project (approximately 10,122 acres (4,096 hectares)) is adjacent to and east of LC South. Ur-Energy has over 50 historical drill logs from the EN project. In 2007, three deep holes were drilled to test mineralization below 2,000 feet (610 meters) as identified from historical data, which indicated the presence of mineralized redox fronts persisting at depth. Results of the three test wells substantiated mineralization and the presence of redox interfaces at that depth. In 2008, approximately two miles to the south, 11 wide-spaced exploration drill holes were drilled. Nine drill holes showed evidence of multiple mineralized horizons. Although no mineral resource is yet reported due to the limited nature of the data, the April 2012 PEA recommends that the EN project should be explored further.

Technical Report Summaries

The following is the executive summary excerpted in substantive form from the April 30, 2012 Preliminary Economic Assessment of the Lost Creek Property, Sweetwater County, Wyoming, authored by John K. Cooper, P.G. and SME Registered Member and Catherine L. Bull, P.E. and SME Registered Member, both of Ur-Energy. The April 2012 PEA was the second such report prepared during 2012, and was prepared to provide an updated mineral resource estimate for the Lost Creek Property prompted by acquisition of adjacent mineral properties, and based upon historic data on those properties. The April 2012 PEA also updated the economic analysis for the property, and demonstrates the possible economics of the mineral resources at the Property. The economic analysis focuses on the resources within the Lost Creek and LC East Projects due to the preponderance of data available there. The full technical report, including all figures and tables referenced here, is filed on the Corporation’s profile on www.sedar.com and on http://www.sec.gov/edgar.shtml.

Summary from Preliminary Economic Assessment of the Lost Creek Property,

Sweetwater County, Wyoming

Ur-Energy Inc. (URE) generated this Preliminary Economic Assessment (PEA) in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) to disclose an updated mineral resource estimate for the Lost Creek Property prompted by recent acquisition of adjacent mineral properties. The Preliminary Economic Assessment for the Lost Creek Property has been revised to evaluate the impact of the additional identified resources. This report therefore serves to replace the most recent PEA for the Lost Creek Property dated February 29, 2012.

Effective February 27, 2012, URE entered into an Asset Exchange Agreement (AEA) with Uranium One Americas, Inc. to acquire two State of Wyoming Mineral Leases and 175 federal mineral claims in the immediate vicinity of the Lost Creek Property. The total acquired land package (herein referred to as “the AEA”) consists of approximately 5,250 acres. The main portion of this acreage is within a large block of claims which are contiguous to the east with the Lost Creek Project. The remainder of the AEA consists of disconnected blocks of claims and state mineral leases generally to the west of the Lost Creek Project. Additionally, as of April 30, 2012, URE has staked 256 mineral lode claims (herein collectively referred to as the “New Claims”) in several areas deemed geologically prospective covering approximately 4,662 acres of BLM land within the Lost Creek Property.

| -18- |

The Lost Creek Property consists of several Projects, including the lands recently acquired with the AEA and the New Claims. The majority of the AEA and portions of the New Claims have been assigned to two newly designated Projects named LC East and LC West. Small parcels of the new acquisitions have also been assigned to the EN, the LC North and the LC South Projects where appropriate to redefine Project boundaries. For clarity, the Lost Creek Property now includes six contiguous Project areas named: Lost Creek, LC East, LC North, LC South, LC West, and EN (Figures 1 and 2). Note also that the previous Toby Project is no longer a stand-alone project, but has been incorporated into the LC South Project.

The Lost Creek Property is located in the northeast corner of Sweetwater County, approximately 90 miles southwest of Casper, Wyoming. With the recent addition of the AEA and the New Claims its land position has increased to a total of 43,503 acres of federal mineral claims and State of Wyoming Leases (Figures 3a – 3f). The Property was extensively drilled in the late 1960s to mid-1980s by several companies, mainly Texasgulf Inc. and Conoco. New drill data obtained with the AEA, together with URE’s historic drill data within the AEA and the New Claims, have increased the total drilling inventory for the Lost Creek Property to 3,924 holes with a total footage of 2,338,444 ft.

The Lost Creek Property is situated in the northeastern part of the Great Divide Basin (GDB) which is underlain by up to 25,000 ft. of Paleozoic to Quaternary sedimentary units (Figures 4, 5 and 6). Rock outcrops in the GDB are dominated by the Battle Spring Formation of Eocene age which also hosts the uranium mineralization considered in this report. The dominant lithology in the Battle Spring Formation is coarse arkosic sandstone, interbedded with intermittent mudstone, claystone and siltstone. Deposition occurred as alluvial-fluvial fan deposits within a south-southwest flowing paleodrainage. The uranium mineralization occurs as roll front type deposits (Figure 7) formed where uranium precipitated from solution when it contacted reduced rock. The majority of uranium mineralization throughout the Lost Creek Property occurs within the HJ and KM Horizons of the Battle Spring Formation, with some occurrences in the overlying FG and underlying Deep Horizons (Figures 6 and 8).

URE possesses drill data from approximately 1,132 drill holes located within the newly acquired lands. Based on this data, URE has completed a detailed geologic review and herein presents a new Preliminary Economic Assessment for the Lost Creek Property.

The new acquisitions and subsequent geological evaluation have increased the resources for the Lost Creek Property by 2,582,900 pounds eU3O8 in the Measured and Indicated categories plus 852,700 pounds U3O8 in the Inferred category; 45% and 42% increases respectively when compared to the most recent Preliminary Economic Assessment dated February 29, 2012. Virtually all of the added resources are the result of the AEA acquisition and lie mainly within the new LC East Project; the exception being resources acquired through New Claims which account for 37,400 pounds eU3O8 located in the LC West Project.

| -19- |

Resource estimation is based on geologic cutoffs requiring a minimum grade of 0.020% eU3O8 and a grade thickness (GT) equal to or greater than 0.30. The current resources at the Lost Creek Property are reported in Table 1 (Figure 9). The majority of the resources are hosted by the HJ and KM Horizons within two separate mineral trends 1) the Main Mineral Trend (MMT) at the Lost Creek Project, as defined in Section 4.5 and 2) a newly reported East Mineral Trend (EMT) which lies within the LC East Project acquired through the AEA (Figures 9, 10a and 10b).

Mr. Cooper is of the opinion that the classification of the resources as stated meets the CIM definitions as adopted by the CIM Council on November 27, 2010 as required (CIM Council, 2010). The mineral resource estimates in this report, based on historic and recent drilling, were completed by Mr. Cooper or completed under his supervision and reviewed and accepted.

Table 1: Lost Creek Property Resource Summary, April 30, 2012

| PROJECT | MEASURED | INDICATED | INFERRED | ||||||

|

AVG GRADE % eU3O8 |

SHORT TONS (X 1000) |

POUNDS (X 1000) |

AVG GRADE % eU3O8 |

SHORT TONS (X 1000) |

POUNDS (X 1000) |

AVG GRADE % eU3O8 |

SHORT TONS (X 1000) |

POUNDS (X 1000) | |

| LOST CREEK | 0.055 | 2,692.1 | 2,942.9 | 0.058 | 2,413.8 | 2,822.4 | 0.054 | 937.5 | 1,015.7 |

| LC EAST | 0.054 | 1,158.3 | 1,255.9 | 0.043 | 1,551.3 | 1,327.0 | 0.045 | 910.8 | 815.3 |

| LC NORTH | ----- | ----- | ----- | ----- | ----- | ----- | 0.048 | 413.8 | 398.2 |

| LC SOUTH | ----- | ----- | ----- | ----- | ----- | ----- | 0.042 | 710.0 | 602.6 |

| LC WEST | ----- | ----- | ----- | ----- | ----- | ----- | 0.109 | 17.2 | 37.4 |

| EN | ----- | ----- | ----- | ----- | ----- | ----- | ----- | ----- | ----- |

| GRAND TOTAL | 0.055 | 3,850.4 | 4,198.8 | 0.053 | 3,965.1 | 4,149.4 | 0.049 | 2,989.2 | 2,869.1 |

| MEASURED+INDICATED = | 7,815.5 | 8,348.2 | |||||||

Notes:

| 1. | Sum of Measured and Indicated tons and pounds may not add to the reported total due to rounding. |

| 2. | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| 3. | Based on grade cutoff of 0.02 percent eU3O8 and a grade x thickness cutoff of 0.30 GT. |

| 4. | Typical ISR industry practice is to apply a GT cutoff in the range of 0.30 which has generally been determined to be an economical cutoff value. This 0.30 GT cutoff was used in this evaluation without direct relation to an associated price. |

| 5. | Measured, Indicated, and Inferred Mineral Resources as defined in Section 1.2 of NI 43-101 the CIM Definition Standards (CIM Council, 2010). |

Although resources occur mainly in the HJ and KM Horizons, mineralization above and below those horizons has also been identified in both the MMT and EMT. The FG Horizon and to a lesser extent the DE Horizon (Figure 6 for a stratigraphic column) contain numerous occurrences of significant mineralization. In the MMT, these horizons have not been specifically targeted by drilling. Rather, knowledge of these occurrences was derived from drilling which targeted deeper horizons. The FG Horizon was, however, the specific target of some of the drilling within LC East (historically) and LC South (both historically and by the Company). Mineralization within the FG is included within the current resource estimate. However, mineralization within the DE remains insufficient to warrant inclusion in this resource estimate. Furthermore, most of the DE Horizon lies above the water table and thus is not amenable to in situ recovery.

| -20- |

Mineralization within the EMT is similar in most respects to that occurring in the MMT. It is found in the same stratigraphic horizons within the Battle Spring Formation and likewise is separated by virtually the same aquitards (Figures 6, 8, 10 and 10b)). Mineralization has been identified from near surface to depths greater than 500 feet with potential for deeper mineralization. No leach testing has been conducted to date on mineralization within the EMT, however leach tests in the MMT have indicated that the mineralization is amenable to leaching with an oxidizing bicarbonate solution.

***** The EMT resources are also anticipated to provide production feed to the Lost Creek facility following further delineation and successful permitting.

The new resources identified throughout the AEA have been added to the Lost Creek production plan and provide a positive impact on the economics of the property. Using the estimated CAPEX, OPEX and closure costs presented herein, a cash flow statement has been developed and is provided in Table 13. The statement assumes no escalation, no debt, no debt interest or capital repayment and no depreciation or income tax costs. The sale price for the produced uranium is assumed to vary based on a combination of the projections of RBC Dominion Securities, Uranium Market Outlook, First Quarter 2012 (RBC, 2012) and the actual commitments URE has in place. The revenue for the cash flow estimate was developed using the GT contour mineral resource estimate for the MMT and EMT, and further assumes that, based on an 80% recovery factor, approximately 7.38 million pounds of U3O8 will be recovered from the MMT and the EMT at the Lost Creek Property.

CAPEX costs were developed based on the current designs, quantities and unit costs obtained from various sources. Mrs. Bull predicts the level of accuracy of the CAPEX estimate for the plant is +/- 10% and the level of accuracy for the wellfield CAPEX is +/- 15%, due to the timing of purchases. The estimated costs for the major items identified in this study have been sourced in the United States.

OPEX cost estimates were developed by evaluating each process unit operation and associated operating services (power, water, air, waste disposal), infrastructure (offices, change rooms, shop), salary plus burden, and environmental control (heat, air conditioning, monitoring). The OPEX estimate is based on URE’s development plan, deliverables, process flow sheets, process design, materials balance and project manpower schedule. The annual OPEX and Closure cost summary is provided in Table 10. Mrs. Bull estimates the level of accuracy of the OPEX calculation is +/- 10%.

The Net Present Value (NPV) calculations make the simplifying assumption that cash flows occur in the middle of the periods. The NPV is calculated from the discounted cash flow model and is based on the CAPEX, OPEX and closure cost estimates, a variable future uranium price and the anticipated production schedule.

The Lost Creek Project has initial capital costs of $31.6 million including: plant cost of $20.5 million, initial Resource Area construction cost of $4.7 million, and deep disposal well (DDW) cost of $6.4 million. As described, URE has purchased, or has purchased and partially paid for some plant equipment prior to the date of the economic calculations (April 2012). Costs for that equipment (approximately $1.6 million) are included in the cash flow model in Year 1 under the heading “Plant Sunk Costs”.

| -21- |

*****The Project is estimated to generate net earnings over its life, before income tax, of $283.0 million. Payback is estimated during the third quarter of Year 3. The Project has a calculated IRR of 87% and a NPV of $181.0 million applying an eight percent discount rate. The estimated cost of uranium produced is $36.52 per pound including all costs, with an estimated operation cost of $16.12 per pound.

In conclusion, acquisition of the AEA and the New Claims has yielded a total increase of 2,582,900 pounds of new resources in the Measured and Indicated categories, as well as 852,700 pounds in the Inferred category. These new resources can be summarized as:

Measured: 1,255,900 lbs., avg. grade of 0.054%, in 1,158,300 tons

Indicated: 1,327,000 lbs., avg. grade of 0.043%, in 1,551,300 tons

Inferred: 852,700 lbs., avg. grade of 0.048%, in 927,900 tons

By Project, the new mineral resources can be sub-divided as:

LC East Project:

Measured and Indicated: 2,582,900 lbs., avg. grade of 0.048% in 2,709,600 tons

Inferred: 815,300 lbs., avg. grade of 0.045% in 910,800 tons

LC West Project

Inferred: 37,400 lbs., avg. grade of 0.109% in 17,200 tons

With the addition of the resources stated above, the total mineral resource for the Lost Creek Property currently stands at 8,348,200 lbs. in the Measured and Indicated categories with an additional 2,869,100 lbs. as Inferred.

Recommendations for the Property can be divided into three general categories: production, delineation and exploration. Upon completion of the permitting process the primary goal should be to construct the facility and initiate production. Revenues generated from production should then be used to fund additional delineation and exploration drilling (detailed below).

Resources within the MMT and the EMT that currently fall within the Inferred Category should be delineated in order to bring them into the Measured or Indicated Categories. These delineation efforts should focus on the eastern and western edges of the MMT since these areas contain significant resources and would be the logical choice for recovery during the early years of mining. Likewise, the central and northern portions of the EMT require the greatest delineation effort.

In addition to delineation, resources within LC East should be investigated further by means of limited confirmation drilling to solidify confidence in the historic mineral intercept database. Coring should be conducted to provide samples for leach testing and host rock characterization. Systematic PFN logging should be done to fully investigate equilibrium conditions (Section 7.5). Finally, baseline studies, including the installation of baseline sampling wells, should be initiated in anticipation of permitting the EMT for production.

| -22- |

Exploration is recommended for several areas of the Property with a priority placed on the northeastern portion of the Lost Creek Project, the western portion of the LC North Project, and extension of resources identified within LC East. The first two areas appear to be extensions of the MMT and contain redox fronts in the KM, HJ and Deep Horizons that warrant further exploration. An additional 300 drill holes at an estimated cost of $2.7 million dollars is believed to be sufficient to bring mineralization in these areas into the Inferred category. Similarly, exploration in LC East will require approximately 300 drill holes at an approximate cost of $1.05 million.

Additional exploration at the LC South Project is also recommended with the goal of further defining mineralization within the FG, HJ, KM and Deep Horizons. A program consisting of an additional 400 holes at an approximate cost of $3.6 million dollars is recommended.

Finally, wide spaced framework drilling at the EN Project is recommended in order to locate regional alteration fronts. A total of 150 holes at an estimated cost of $1.5 million dollars are recommended. These exploration and drilling costs are explained further in Section 26.

All delineation and exploration drilling should be performed under the management of geologists with uranium-roll front experience. The recommended drill programs are preliminary and will be adjusted routinely as more holes are drilled, reflecting an up-to-date geologic interpretation.

Cautionary statement: this Preliminary Economic Assessment is preliminary in nature, and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. The estimated mineral recovery used in this Preliminary Economic Assessment is based on site-specific laboratory recovery data as well as URE personnel and industry experience at similar facilities. There can be no assurance that recovery at this level will be achieved.

RISK FACTORS

The Corporation operates in a dynamic and rapidly changing environment that involves numerous risks and uncertainties. The risks described below should be considered carefully when assessing an investment in the Common Shares of the Corporation. The occurrence of any of the following events could harm the Corporation. If these events occur, the trading price of the Corporation’s Common Shares could decline, and shareholders may lose part or even all of their investment.

Exploration Stage Corporation

The Corporation is engaged in the business of acquiring, exploring and developing mineral properties in the hope of locating economic deposits of minerals. The Corporation’s property interests are in the exploration stage as characterized by applicable securities laws. Accordingly, there is little likelihood that the Corporation will realize profits in the short term. Any profitability in the future from the Corporation’s business will be dependent upon development of an economic deposit of minerals and further exploration and development of other economic deposits of minerals, each of which is subject to numerous risk factors. Further, there can be no assurance, even when an economic deposit of minerals is located, that any of the Corporation’s property interests can be commercially mined. The exploration and development of mineral deposits involve a high degree of financial risk over a significant period of time which a combination of careful evaluation, experience and knowledge of management may not eliminate. While discovery of additional ore-bearing structures may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. It is impossible to ensure that the current exploration programs of the Corporation will result in profitable commercial mining operations. The profitability of the Corporation’s operations will be, in part, directly related to the cost and success of its exploration and development programs which may be affected by a number of factors. Substantial expenditures are required to establish resources and reserves which are sufficient to commercially mine some of the Corporation’s properties and to construct, complete and install mining and processing facilities in those properties that are actually mined and developed.

| -23- |

Mining operations involve a high degree of risk and the results of exploration and ultimate productions are highly uncertain

The exploration for, and development of, mineral deposits involves significant risks which a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenses may be required to establish mineral resources or reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the current exploration and development programs planned by the Corporation will result in a profitable commercial operation.

Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are the particular attributes of the deposit, such as size, grade and proximity to infrastructure, as well as uranium prices which are highly cyclical and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of uranium and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Corporation not receiving an adequate return on invested capital.

Mining operations generally involve a high degree of risk. The Corporation’s operations will be subject to all the hazards and risks normally encountered in the exploration, development and production of uranium, including unusual and unexpected geology formations, unanticipated metallurgical difficulties, equipment malfunctions, other conditions involved in the drilling and removal of material, and industrial accidents, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability.

| -24- |

Uranium prices may affect the economic viability of projects

The price of uranium fluctuates. The future direction of the price of uranium will depend on numerous factors beyond the Corporation’s control including international, economic and political trends; changes in public acceptance of nuclear power generation as a result of any future accidents or terrorism at nuclear facilities, including the longer-term effects on the market due to the events following the earthquake and tsunami in Japan; governmental regulations; expectations of inflation; currency exchange fluctuations; interest rates; global or regional consumption patterns; speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of uranium, and therefore on the economic viability of the Corporation’s properties, cannot accurately be predicted. Because the Corporation remains in exploration and development of its projects, it is not yet possible for the Corporation to control the impact of fluctuations in the price of uranium; however, the Corporation employs pricing strategies through its off-take sales arrangements in an effort to mitigate this risk.

Environmental regulations are increasing and costly