UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Amendment No. 1)

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD OF _________ TO _________. |

Commission File Number:

(Exact name of registrant as specified in its charter) |

| Not Applicable | |

State or other jurisdiction of incorporation or organization |

| (I.R.S. Employer Identification No.) |

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol |

| Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Smaller reporting company | |

Accelerated filer | ☐ | Emerging growth company | |

☒ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of March 3, 2022, there were

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required for Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K is incorporated by reference to the registrant’s definitive proxy statement for the 2022 Annual Meeting of Shareholders.

UR-ENERGY INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

|

| Page |

|

| |

|

|

|

4 | ||

|

|

|

|

| |

|

|

|

27 | ||

|

|

|

| 30 |

| 2 |

| Table of Contents |

Explanatory Note

This Amendment No. 1 on Form 10-K/A (“Amendment No. 1”) amends Ur-Energy Inc.’s (“Ur-Energy” or the “Company”) Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed with the Securities and Exchange Commission (the “SEC”) on March 9, 2022 (the “Original Filing”). The Original Filing is amended by this Amendment No. 1 solely to (i) revise Part 1, Items 1 and 2 to include a revised map to more clearly show the location of the Lost Creek Property and a map showing the location of the properties held at Shirley Basin; and (ii) file an amended version of the Technical Report Summary on the Lost Creek ISR Uranium Property, Sweetwater County, Wyoming, USA (which is filed herewith as Exhibit 96.1) and Technical Report Summary on the Shirley Basin ISR Uranium Property, Carbon County, Wyoming, USA (which is filed herewith as Exhibit 96.2), both of which supersede their respective previously filed reports (and to make conforming edits in Items 1 and 2 to reflect the changes in the amended reports).

Both Exhibits 96.1 and 96.2 are amended to add clarifying edits, primarily in Chapter 16 of each report, with respect to the annual average pricing projections which are utilized in the cashflow and economic analysis for each report. Exhibit 96.2 (the Shirley Basin Report) is also amended to include a post-tax analysis consistent with the approach taken on the Lost Creek Report; specifically, to include annual and project-total post-tax data (state and federal income taxes) and the effects of taxes on annual cash flow, net present values, internal rates of return and related sensitivities.

Except as otherwise expressly noted above, this Amendment No. 1 does not amend, update or change any other disclosures in the Original Filing. In addition, the information in this Amendment No. 1 does not modify or update in any way (i) the consolidated financial position, the results of operations or cash flows of the Company, or (ii) the disclosures in or exhibits to the Original Filing (other than those exhibits filed hereby); nor does it reflect events occurring after the filing of the Original Filing, including without limitation, forward-looking statements made in the Original Filing have not been revised to reflect events that occurred or facts that became known to us after the filing of the Original Filing, and such forward-looking statements should be read in their historical context. This Amendment No. 1 should be read in conjunction with the Original Filing and any subsequent filings with the SEC.

When we use the terms “Ur-Energy,” “we,” “us,” “our,” or the “Company,” we are referring to Ur-Energy Inc. and its subsidiaries, unless the context otherwise requires.

| 3 |

| Table of Contents |

PART I

Items 1 and 2. BUSINESS AND PROPERTIES

Overview and Corporate Structure

Incorporated on March 22, 2004, we are engaged in uranium mining, recovery and processing activities, including the acquisition, exploration, development and operation of uranium mineral properties in the U.S. Through our Wyoming operating subsidiary, Lost Creek ISR, LLC, we began operation of our first in situ recovery uranium mine at our Lost Creek Project in 2013. Ur-Energy is a corporation continued under the Canada Business Corporations Act on August 8, 2006. Our Common Shares are listed on the NYSE American under the symbol “URG” and on the TSX under the symbol “URE.”

Due to persistent low uranium prices, we have limited our production operations since the third quarter of 2020. During 2021, we captured 251 pounds of U3O8 at our Lost Creek plant. Our last sale of produced inventory was made in 2019 Q2. All of our sales made in 2020 were of purchased inventory. We made no sales of U3O8 in 2021.

We are an “exploration stage issuer,” as that term is defined under S-K 1300, because we have not established proven or probable mineral reserves through the completion of a pre-feasibility or feasibility study for any of our uranium projects. As a result, and even though we commenced recovery of uranium at our Lost Creek Project in 2013, we remain classified as an exploration stage issuer, as defined in S-K 1300, and will continue to remain an exploration stage issuer until such time as proven or probable mineral reserves have been established.

We are engaged in uranium recovery and processing operations, in addition to the exploration for and development of uranium mineral properties. Uranium fuels carbon-free, emission-free nuclear power which is a clean, cost-effective, and reliable form of electrical power. Nuclear power is estimated to provide more than 50 percent of the carbon-free electricity in the U.S. and approximately one-third of carbon-free electricity worldwide. As a uranium producer, we are advancing the interests of clean energy, thereby contributing in positive ways to address the challenges of global climate change.

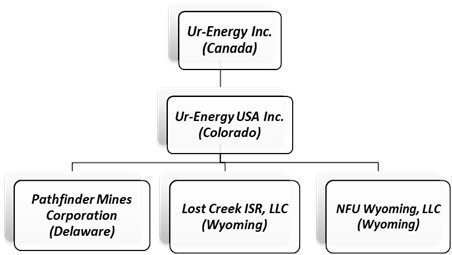

Ur-Energy has one direct wholly owned subsidiary: Ur-Energy USA Inc. (“Ur-Energy USA”), a company incorporated under the laws of the State of Colorado. It has offices in Colorado and Wyoming and has employees in both states.

Ur-Energy USA has three wholly-owned subsidiaries: Lost Creek ISR, LLC, a limited liability company formed under the laws of the State of Wyoming to hold and operate our Lost Creek Project and certain other of our Lost Creek properties and assets; NFU Wyoming, LLC (“NFU Wyoming”), a limited liability company formed under the laws of the State of Wyoming which acts as our land holding and exploration entity; and Pathfinder Mines Corporation (“Pathfinder”), a company incorporated under the laws of the State of Delaware, which holds, among other assets, the Shirley Basin and Lucky Mc properties in Wyoming. Lost Creek ISR, LLC employs personnel at the Lost Creek Project.

Currently, and at December 31, 2021, our principal direct and indirect subsidiaries, and affiliated entities, and the jurisdictions in which they were incorporated or organized, are as follows:

| 4 |

| Table of Contents |

Our wholly owned Lost Creek Project in Sweetwater County, Wyoming is our flagship property. The project has been fully permitted and licensed since October 2012. We received operational approval from the U.S. Nuclear Regulatory Commission (“NRC”) and started production operation activities in August 2013. Our first sales of Lost Creek production were made in December 2013.

From commencement of operations until 2020, we had multiple term uranium sales agreements in place with U.S. utilities for the sale of Lost Creek production or other yellowcake product at contracted pricing. We completed our sales contracts in 2020 when we sold 200,000 pounds of Uranium Oxide (“U3O8”), at an average price of approximately $42 per pound. Between 2017 and 2020, we took advantage of low market prices to enter into purchase agreements to acquire U3O8 at market prices for delivery into our contractual commitments.

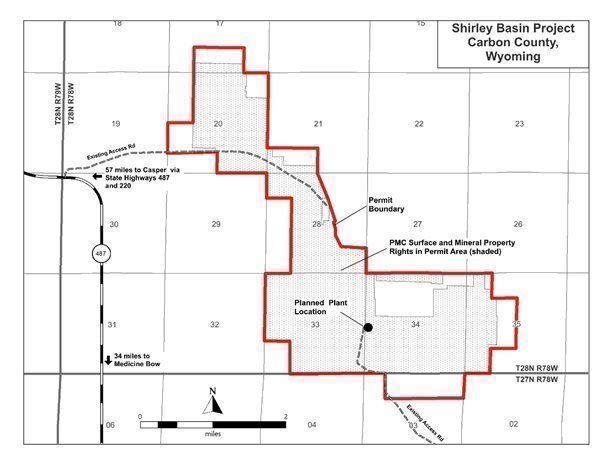

Our other material asset, Shirley Basin, is one of the assets we acquired as a part of the Pathfinder acquisition in 2013. We also acquired all the historic geologic and engineering data for the project. During 2014, we completed a drill program of a limited number of confirmatory holes to complete an NI 43‑101 mineral resource estimate which was released in August 2014; subsequently, an NI 43‑101 Preliminary Economic Assessment for Shirley Basin was completed in January 2015. Baseline studies necessary for the permitting and licensing of the project commenced in 2014 and were completed in 2015.

In December 2015, our applications for a permit and license to mine at Shirley Basin was submitted to the State of Wyoming Department of Environmental Quality (“WDEQ”). Wyoming Uranium Recovery Program (“URP”) issued our source material license and the Land Quality Division (“LQD”) issued the permit to mine for Shirley Basin in 2021 Q2. We received approval from the BLM in 2020. Therefore, all major authorizations to construct and operate at Shirley Basin have now been received. Work is well underway on initial engineering evaluations, designs and studies.

We utilize in situ recovery (“ISR”) of the uranium at Lost Creek and will do so at other projects where this is possible. The ISR technique is employed in uranium extraction because it allows for a lower cost and effective recovery of roll front mineralization. The ISR technique does not require the installation of tailings facilities or significant surface disturbance. This mining method utilizes injection wells to introduce a mining solution, called lixiviant, into the mineralized zone. The lixiviant is made of natural groundwater fortified with oxygen as an oxidizer, sodium bicarbonate as a complexing agent, and carbon dioxide for pH control. The complexing agent bonds with the uranium to form uranyl carbonate, which is highly soluble. The dissolved uranyl carbonate is then recovered through a series of production wells and piped to a processing plant where the uranyl carbonate is removed from the solution using ion exchange (“IX”) and captured on resin contained within the IX columns. The groundwater is re-fortified with the oxidizer and complexing agent and sent back to the wellfield to recover additional uranium. A small volume of water, called bleed, is permanently removed from the lixiviant flow to create an inward groundwater gradient. A reverse osmosis (“RO”) process is available to minimize the wastewater stream generated. Brine from the RO process, if used, and bleed are disposed of by means of injection into deep disposal wells. Each wellfield is made up of dozens of injection and production wells installed in patterns to optimize the areal sweep of fluid through the uranium deposit.

| 5 |

| Table of Contents |

Our Lost Creek processing facility includes all circuits for the capture, concentration, drying and packaging of uranium yellowcake for delivery into sales. Our processing facility, in addition to the IX circuit, includes dual processing trains with separate elution, precipitation, filter press and drying circuits (this contrasts with certain other uranium in situ recovery facilities which operate as a capture plant only, and rely on agreements with other producers for the finishing, drying and packaging of their yellowcake end-product). Additionally, a restoration circuit including an RO unit was installed during initial construction to complete groundwater restoration once mining is complete.

We have made great strides in reducing water consumption through the implementation of a Class V treatment system that includes water treatment and injection of the clean water into a shallow formation where it can be accessed by future generations. Since implementation of the Class V system, the generation of wastewater during production has been reduced by 18 percent. To further reduce water consumption and enhance IX effectiveness, a pre-IX filtration and wastewater treatment facility is being contemplated and lab tested. The system, as envisioned, will allow for more effective use of current and future deep disposal wells working in conjunction with the Class V water recycling system while preserving precious water resources. Our goal is to reduce wastewater generation by at least 70 percent.

The elution circuit (the first step after IX) is utilized to transfer the uranium from the IX resin and concentrate it to the point where it is ready for the next phase of processing. The resulting rich eluate is an aqueous solution containing uranyl carbonate, salt and sodium carbonate and/or sodium bicarbonate. The precipitation circuit follows the elution circuit and removes the carbonate from the concentrated uranium solution and combines the uranium with peroxide to create a yellowcake crystal slurry. Filtration and washing is the next step, in which the slurry is loaded into a filter press where excess contaminants such as chloride are removed and a large portion of the water is removed. The final stage occurs when the dewatered slurry is moved to a yellowcake dryer, which further reduces the moisture content, yielding the final dried, product. Refined, salable yellowcake is packaged in 55-gallon steel drums.

The restoration circuit may be utilized in the production as well as the post-mining phases of the operation. The RO is being utilized as a part of our Class V recycling circuit to minimize the wastewater stream generated during production. Once production is complete, the groundwater must be restored to its pre-mining class of use or better. The first step of restoration involves removing a small portion of the groundwater and disposing of it (commonly known as groundwater sweep). Following sweep, the groundwater is treated utilizing RO and re-injecting the clean water. Finally, the groundwater is homogenized and sampled to ensure the cleanup is complete, concluding the mining process.

Our Lost Creek processing plant was constructed beginning in 2012, with production operations commencing in August 2013. Following receipt of amendments to our source material license in 2021, the licensed capacity of our Lost Creek processing plant allows for up to 2.2 million pounds U3O8 per year, of which approximately 1.2 million pounds U3O8 per year may be produced from our wellfields. The Lost Creek plant and the allocation of resources to mine units and resource areas were designed to generate approximately one million pounds of production per year at certain flow rates and uranium concentrations subject to regulatory and license conditions. The excess capacity in the design of the processing circuits of the plant is intended, first, to facilitate routine (and, non-routine) maintenance on any particular circuit without hindering production operational schedules. The capacity was also designed to permit us to process uranium from other mineral projects in proximity to Lost Creek if circumstances warrant in the future (e.g., Shirley Basin Project) or, alternatively, to be able to contract to toll mill/process product from other in situ uranium mine sites in the region. The design permits us to conduct either of these activities while Lost Creek is producing and processing uranium and/or in years following Lost Creek production from wellfields during final restoration activities.

The Lost Creek facility includes all circuits for the production, drying and packaging of uranium yellowcake for delivery into sales. We currently expect that the Lost Creek processing facility will be utilized for the drying and packaging of uranium from Shirley Basin, for which we anticipate the need only for a satellite plant. However, the Shirley Basin license and permit allows for the construction of a full processing facility, providing greater construction and operating flexibility as may be dictated by market conditions.

| 6 |

| Table of Contents |

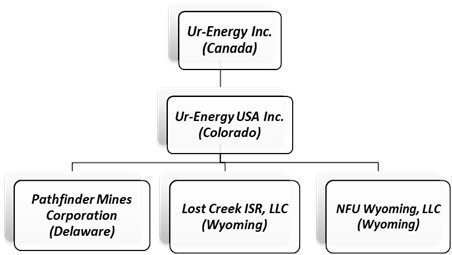

Our Mineral Properties

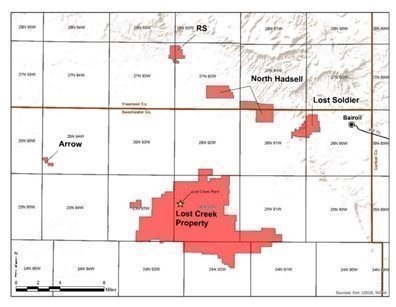

Below is a map showing our Wyoming projects and the geologic basins in which they are located.

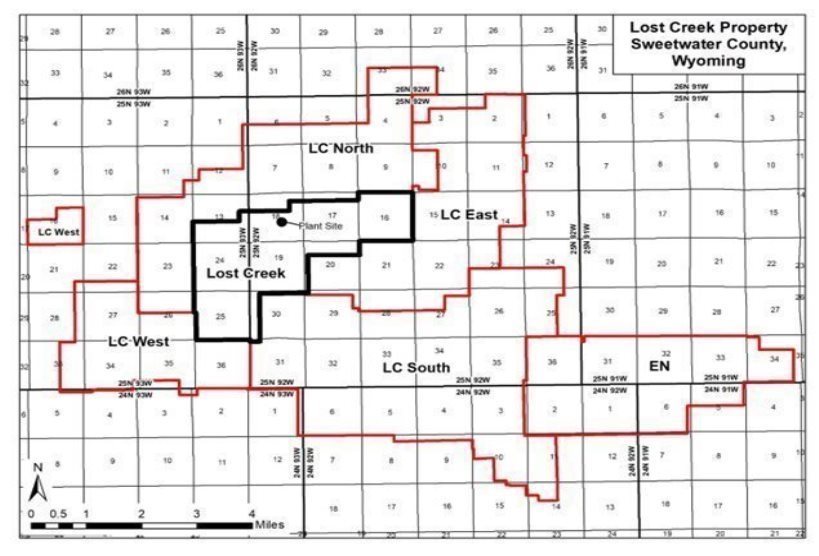

Our current land portfolio in Wyoming includes 12 projects. Ten of these projects are in the Great Divide Basin (“GDB”), Wyoming, including our flagship project, Lost Creek Project. We control nearly 1,800 unpatented mining claims and three State of Wyoming mineral leases for a total of approximately 35,400 acres at our Lost Creek Property, including the Lost Creek permit area (the “Lost Creek Project” or “Lost Creek”) and certain adjoining projects which we refer to as LC East, LC West, LC North, LC South and EN project areas (collectively, with the Lost Creek Project, the “Lost Creek Property”). Five of the projects at the Lost Creek Property contain reported mineral resources: Lost Creek, LC East, LC West, LC South and LC North.

Our Wyoming properties together total approximately 48,000 acres and include our Shirley Basin Project. Other non-material exploration stage projects are located in the GDB and the Lucky Mc Project is in the Gas Hills Uranium District, Wyoming. The Lost Creek Property and the Shirley Basin Project are the only two mineral properties that we deem to be individually material at this time.

Our mineral resources reported pursuant to S-K 1300 for our material properties at our Lost Creek Property and Shirley Basin Project are summarized here and discussed below at “Lost Creek ISR Uranium Property S-K 1300 Report” and “Shirley Basin ISR Uranium Project S-K 1300 Report.” Variable pricing for each, based upon projections of market analysts and assumptions for operations at each property are as shown, and set forth in the respective S-K 1300 Initial Assessments for each.

| 7 |

| Table of Contents |

| Measured | Indicated | Inferred |

| ||||||

Project | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) | Assumed Pricing |

Wyoming Uranium Projects | ||||||||||

Lost Creek Property (after production as set forth herein) | 0.048 | 7,115 | 6,887 | 0.046 | 5,523 | 5,027 | 0.044 | 7,512 | 6,607 | Variable: $50.80 to $66.04 |

Shirley Basin Project | 0.275 | 1,367 | 7,521 | 0.118 | 549 | 1,295 |

-

| - | - | Variable: $63.04 to $66.04 |

|

| MEASURED + INDICATED = | 14,554 | 20,730 | INFERRED = | 6,607 |

| |||

| Notes: (please also see notes related to each of the mineral resource summary tables below, for the Lost Creek Property and the Shirley Basin Project) | |

|

|

|

| 1. | Sum of Measured and Indicated tons and pounds may not add to the reported total due to rounding. |

| 2. | Table shows resources based on grade cutoff of 0.02 % eU3O8 and a grade x thickness cutoff of 0.20 GT. |

| 3. | Mineral processing tests have been conducted historically and by the Company and indicate that recovery should be at or about 80%, which is consistent with industry standards. Recovery at Lost Creek to date has exceeded the industry standard of 80%. |

| 4. | Measured, Indicated, and Inferred (where estimated) Mineral Resources as defined in S-K 1300. |

| 5. | Resources are reported through December 31, 2021. |

| 6. | All reported resources occur below the static water table at Lost Creek and below the historical, pre-mining static water table at Shirley Basin. |

| 7. | 2.735 million lbs. of U3O8 have been produced from the Lost Creek Project HJ Horizon as of December 31, 2021. |

| 8. | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

Mineralization at our uranium properties in Wyoming typically occurs at depth and does not outcrop. Therefore, investigation of the mineralization is accomplished by drilling and related sampling and logging procedures. We maintain standards to routinely calibrate our logging tools (and require similar standards of our logging contractors), as well as utilizing established quality control procedures for sample collection, and detailed logging of drill cuttings by Company geologists to gain an understanding of redox conditions within host sandstones. The security and controls over the preparation of samples and analytical procedures data is typical among U.S. uranium industry professionals. In turn, the controls inherent in the calculation of mineral resources once the data is obtained and analyzed are recognized professional standards, and our methods have routinely been assessed and verified by third party qualified professionals through the preparation of our technical reports.

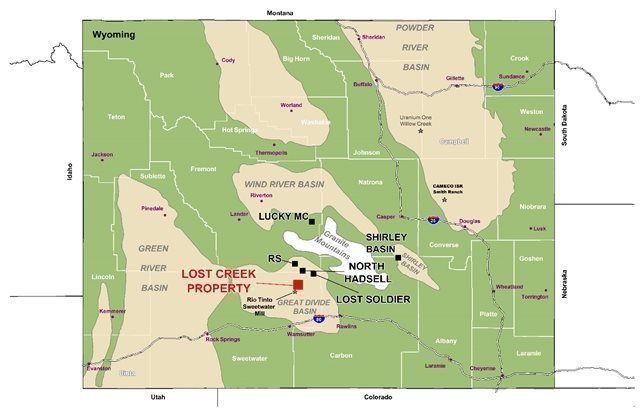

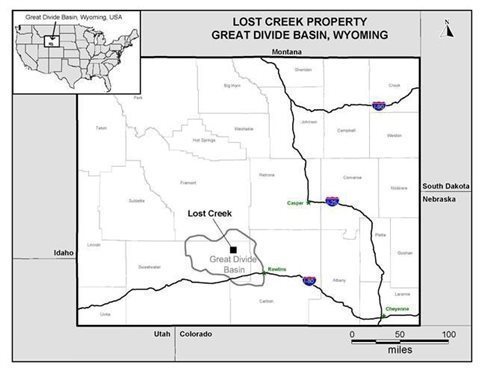

Lost Creek Property - Great Divide Basin, Wyoming

We acquired the Lost Creek Project area in 2005. Lost Creek is located in the GDB, Wyoming. The permit area of the Lost Creek Project covers 4,254 acres (1,722 hectares), comprising 201 lode mining claims and one State of Wyoming mineral lease section. Regional access relies almost exclusively on existing public roads and highways. The local and regional transportation network consists of primary, secondary, local and unimproved roads. Direct access to Lost Creek is mainly on two crown-and-ditched gravel paved access roads to the processing plant. One road enters from the west from Sweetwater County Road 23N (Wamsutter-Crooks Gap Road); the other enters from the east off of U.S. Bureau of Land Management (“BLM”) Sooner Road.

On a wider basis, from population centers, the Lost Creek property area is served by an Interstate Highway (Interstate 80), a US Highway (US 287), Wyoming state routes (SR 220 and 73 to Bairoil), local county roads, and BLM roads. The nearest airport to the Project is Casper-Natrona County International Airport located just north and west of Casper. Both Laramie and Rawlins also have smaller regional airports.

| 8 |

| Table of Contents |

The basic infrastructure (power, water, and transportation) necessary to support our ISR operation is located within reasonable proximity. Generally, the proximity of Lost Creek to paved roads is beneficial with respect to transportation of equipment, supplies, personnel and product to and from the property. Existing regional overhead electrical service is aligned in a north-to-south direction along the western boundary of the Lost Creek Project. An overhead power line, approximately two miles in length, was constructed to bring power from the existing Pacific Power line to the Lost Creek plant. Power drops have been made to the property and distributed to the plant, offices, wellfields, and other facilities. Additional power drops will be installed as we continue to expand the wellfield operations.

The Lost Creek Property is located as shown here:

Production Operations

Following receipt of the final regulatory authorization in October 2012, we commenced construction at Lost Creek. Construction included the plant facility and office building, installation of all process equipment, installation of two access roads, additional power lines and drop lines, deep disposal wells, construction of two holding ponds, warehouse building, and drill shed building. In August 2013 we received operational approval from the NRC and commenced production operations. See also discussion of the operational methods used at Lost Creek, above, under “Business and Properties.”

All the wells to support the originally planned 13 header houses (“HHs”) in Mine Unit 1 (“MU1”) have been completed and have operated, as have the first three HHs in Mine Unit 2 (“MU2”). The first HHs in MU2 have been producing since 2017. Since 2020 Q3 we have maintained reduced production operations at Lost Creek. During 2021, 251 pounds U3O8 were captured in the Lost Creek plant. We did not dry and package product during 2021.

| 9 |

| Table of Contents |

The production at Lost Creek, for the past three years is set forth here:

| 2021 | 2020 | 2019 |

Pounds U3O8 Captured | 251 | 10,789 | 47,957 |

Lost Creek ISR Uranium Property S-K 1300 Report

Contemporaneous with this annual report on Form 10-K/A, we are filing an amended Initial Assessment Technical Report Summary on the Lost Creek Property ISR Uranium Sweetwater County, Wyoming (the “Lost Creek Report”)(as amended, September 19, 2022). The Lost Creek Report was prepared by WWC Engineering.

For the Lost Creek Report to accurately reflect existing mineral resources, all mineral resources produced through December 31, 2021 (2.735 million pounds) were subtracted from earlier totals of Measured Resources at Lost Creek where recovery has occurred to date.

There is no material change in mineral resources estimated on a year-over-year basis, as we have conducted no drilling or exploration reflected in the newest resources and we remain on reduced production operations, with minimal production to be reconciled to the reconciled figure presented as of December 31, 2020. The Lost Creek Report discloses changes for the Lost Creek Property in the form of updated mineral resource estimates, production operations, and operational and development costs to December 31, 2021. The Lost Creek Report does not consider any data from the ongoing development and construction program in MU2 at Lost Creek, as those drilling results from late Q4 have not been analyzed at this time. The Lost Creek Report supersedes and replaces the last NI 43-101 preliminary economic analysis for the Lost Creek Property (as amended February 8, 2016).

| 10 |

| Table of Contents |

The mineral resources at the Lost Creek Property reported in the Lost Creek Report are as follows:

Lost Creek Property - Resource Summary (December 31, 2021)

| Measured | Indicated | Inferred | ||||||

Project | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) |

LOST CREEK | 0.048 | 8,572 | 8,173 | 0.048 | 3,412 | 3,295 | 0.046 | 3,261 | 3,013 |

Production through 12/31/2021 | 0.048 | -2,849 | -2,735 |

|

|

|

|

|

|

LC EAST | 0.052 | 1,392 | 1,449 | 0.041 | 1,891 | 1,567 | 0.042 | 2,954 | 2,484 |

LC NORTH | - | - | - | - | - | - | 0.045 | 644 | 580 |

LC SOUTH | - | - | - | 0.037 | 220 | 165 | 0.039 | 637 | 496 |

LC WEST | - | - | - | - | - | - | 0.109 | 16 | 34 |

EN | - | - | - | - | - | - | - | - | - |

GRAND TOTAL | 0.048 | 7,115 | 6,887 | 0.046 | 5,523 | 5,027 | 0.044 | 7,512 | 6,607 |

|

|

| MEASURED + INDICATED = | 12,638 | 11,914 |

|

|

| |

Notes:

| 1. | Sum of Measured and Indicated tons and pounds may not add to the reported total due to rounding. |

| 2. | % eU3O8 is a measure of gamma intensity from a decay product of uranium and is not a direct measurement of uranium. Numerous comparisons of eU3O8 and chemical assays of Lost Creek rock samples, as well as PFN logging, indicate that eU3O8 is a reasonable indicator of the chemical concentration of uranium. |

| 3. | Table shows resources based on grade cutoff of 0.02 % eU3O8 and a grade x thickness cutoff of 0.20 GT. |

| 4. | Mineral processing tests have been conducted historically and by the Company and indicate that recovery should be at or about 80%, which is consistent with industry standards. Recovery at Lost Creek to date has exceeded the industry standard of 80%. |

| 5. | Measured, Indicated, and Inferred Mineral Resources as defined in S-K 1300. |

| 6. | Resources are reported through December 31, 2021. |

| 7. | All reported resources occur below the static water table. |

| 8. | 2.735 million lbs. of U3O8 have been produced from the Lost Creek Project HJ Horizon as of December 31, 2021. |

| 9. | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| 10. | The point of reference for resources is in situ at the Property. |

Information shown in the table above may differ from the disclosure requirements of the Canadian Securities Administrators. See Cautionary Note to Investors Concerning Disclosure of Mineral Resources, above.

The economic analysis upon which the mineral resources were evaluated assumes a variable price per pound U3O8 over the life of the Lost Creek Property, as known today and discussed in the Lost Creek Report. The projected pricing for anticipated sales ranges from $50.80 to $66.04 per pound U3O8. The sale price for the produced uranium is based on consensus using an annual average of the projections of long-term pricing made by expert market analysts. We do not have current sales agreements related to production at Lost Creek.

The Lost Creek Property includes six individual contiguous Projects: Lost Creek Project, LC East Project, LC West Project, LC North Project, LC South Project and EN Project. The fully-licensed and operating Lost Creek Project is considered the core project while the others are collectively referred to as the Adjoining Projects in the Lost Creek Report. The Adjoining Projects were acquired by the Company as exploration targets to provide resources supplemental to those recognized at the Lost Creek Project. Most were initially viewed as stand-alone projects but expanded over time such that, collectively, they represent a contiguous block of land along with the Lost Creek Project.

| 11 |

| Table of Contents |

The Main Mineral Trend of the Lost Creek uranium deposit (the “MMT”) is located within the Lost Creek Project. The East Mineral Trend (the “EMT”) is a second mineral trend of significance, in addition to the MMT, identified by historic drilling on the lands forming LC East. Although geologically similar, it appears to be a separate, but closely related, trend from the MMT.

The Lost Creek Report mineral resource estimate includes drill data and analyses of approximately 3,400 historic and current holes and over 1.95 million feet of drilling at the Lost Creek Project alone. With the acquisition of the Lost Creek Project, we acquired logs and analyses from 562 historic holes representing approximately 360,000 feet of data. Since our acquisition of the project, 2,826 holes and wells have been drilled at Lost Creek. Additionally, drilling from the Adjoining Projects, both historical and our drill programs, is included in the mineral resource estimate. This represents ~2,300 additional drill holes (1.3 million feet).

Regulatory Authorizations and Land Title of Lost Creek

Beginning in 2007, we completed all necessary applications and related processes to obtain the required permitting and licenses for the Lost Creek Project, of which the three most significant are a Source and Byproduct Materials License from the NRC (August 2011); a Plan of Operations with the BLM (Record of Decision (“ROD”))(October 2012); and a Permit and License to Mine from the WDEQ (October 2011)(“WDEQ Permit”). The WDEQ Permit includes the approval of MU1, as well as the Wildlife Management Plan, including a positive determination of the protective measures at the project for the greater sage-grouse species.

Potential risks to the accessibility of the estimated mineral resource may include changes in the designation of the greater sage-grouse (sage grouse) as an endangered species by the USFWS because the Lost Creek Property lies within a sage grouse core area as defined by the state of Wyoming. In 2015, the USFWS issued its finding that the greater sage grouse does not warrant protection under the Endangered Species Act (ESA). The USFWS reached this determination after evaluating the species’ population status, along with the collective efforts by the BLM and U.S. Forest Service, state agencies, private landowners and other partners to conserve its habitat.

After a thorough analysis of the best available scientific information and considering ongoing key conservation efforts and their projected benefits, the USFWS determined the species does not face the risk of extinction in the foreseeable future and therefore does not need protection under the ESA. Should future decisions vary, or state or federal agencies alter their management of the species, there could potentially be an impact on future expansion operations. However, the Company continues to work closely with the Wyoming Game and Fish Department (“WGFD”) and the BLM to mitigate impacts to the sage grouse. Long-term monitoring of sage grouse populations has shown that the “affected” populations at Lost Creek are on a parallel trend with “reference” populations located beyond the potential influence of the project. Trends vary considerably based on a variety of environmental factors including, most importantly, annual moisture.

The State of Wyoming has developed a “core-area strategy” to help protect the sage grouse within certain core areas of the state. The Lost Creek property is within a designated core area and is thus subject to work activity restrictions from March 1 to July 15 of each year. The timing restriction precludes exploration drilling and other non-operational based activities which may disturb the sage grouse. The sage grouse timing restrictions relevant to ISR production and operational activities at Lost Creek are somewhat different because the State has recognized that mining projects within core areas must be allowed to operate year-round. As a result, there are no calendar restrictions on operational activities in pre-approved disturbed areas within our permit to mine. In a related regulatory process, the BLM prepared and issued environmental impact statements for, and issued amendments to, Resource Management Plans (“RMPs”), related to the sage grouse, which have subsequently been amended from time to time and are undergoing further review currently.

Additional authorizations from federal, state and local agencies for the Lost Creek project include: WDEQ-Air Quality Division Air Quality Permit and WDEQ-Water Quality Division Class I Underground Injection Control (“UIC”) Permit. Following the plugging of one of our deep disposal wells in 2019, the UIC permit allows Lost Creek to operate up to four Class I injection wells to meet the anticipated disposal requirements for the life of the Lost Creek Project. The Environmental Protection Agency (“EPA”) issued an aquifer exemption for the Lost Creek project. The WDEQ’s separate approval of the aquifer reclassification is a part of the WDEQ Permit. We also received approval from the EPA and the Wyoming State Engineer’s Office for the construction and operation of two holding ponds at Lost Creek.

| 12 |

| Table of Contents |

In 2014, applications for amendments to the Lost Creek license were submitted to federal regulatory agencies, NRC and BLM, for the development and mining of the LC East Project. The BLM issued its ROD authorizing the plan in 2019. The NRC participated in this review as a cooperating agency. In 2018, Wyoming assumed responsibility from the NRC for the regulation of radiation safety at uranium recovery facilities like Lost Creek. The Wyoming State Uranium Recovery Program (“URP”), a part of the WDEQ, oversees the licensing process for source material licenses as well as the operations of licensees in Wyoming. The URP has demonstrated that its integration into the overall WDEQ oversight of uranium recovery streamlines the process of licensing, offers greater consistency in authorizations and oversight, and results in reduced costs in the licensing phase. The URP issued a source material license for LC East in March 2021. In 2021, we submitted our request for extension of our Lost Creek source material license; it is currently in timely review by URP.

A permit amendment requesting approval to mine at the LC East Project was also submitted to the WDEQ. Approval will include an aquifer exemption. The air quality permit for Lost Creek will be revised to account for additional surface disturbance. Certain of our earlier Sweetwater County approvals have been amended. Numerous well permits from the State Engineer’s Office will be required. It is anticipated that the remaining permits to mine amendment will be completed in 2022.

During 2016, we received all authorizations for the operation of Underground Injection Control (UIC) Class V wells at Lost Creek, and operation of the circuit began in early 2017. This allows for the onsite reinjection of fresh permeate (i.e., clean water) into relatively shallow Class V wells. Site operators use the RO circuits, which were installed during initial construction of the plant, to treat process wastewater into brine and permeate streams. The brine stream continues to be disposed of in the UIC Class I deep wells while the clean permeate stream is injected into the UIC Class V wells after treatment for radium. These operational procedures continue to significantly enhance wastewater capacity at the site, ultimately reducing the injection requirements of our Class I deep disposal wells and extending the life of those valuable assets.

Through our subsidiaries Lost Creek ISR, LLC and NFU Wyoming, we control the federal unpatented lode mining claims and State of Wyoming mineral leases which make up the Lost Creek Property. Title to the mining claims is subject to rights of pedis possessio against all third-party claimants so long as the claims are maintained. The mining claims do not have an expiration date. Affidavits have been timely filed with the BLM and recorded with the Sweetwater County Recorder attesting to the payment for the Lost Creek Property mining claims of annual maintenance fees to the BLM as established by law from time to time.

The state leases have a ten-year term, subject to renewal for successive ten-year terms. The surface of all the unpatented mining claims is controlled by the BLM, and we have the right to use as much of the surface as is necessary for exploration and mining of the claims, subject to compliance with all federal, state and local laws and regulations. Surface use on BLM lands is administered under federal regulations. Similarly, access to state-controlled land is largely inherent within a State of Wyoming mineral lease, with certain additional obligations to those holding surface rights on a lease-specific basis.

There are no royalties at the Lost Creek Project, except on the State of Wyoming mineral lease as provided by law. Currently, there is only limited production planned from the State lease. There is a production royalty of one percent on certain claims of the LC East Project, and other royalties on certain claims at the LC South and EN Projects, as well as the other State of Wyoming mineral leases (LC West and EN projects).

| 13 |

| Table of Contents |

Together with the Lost Creek Project, Five Adjoining Projects Form the Lost Creek Property

The map below shows the Lost Creek Property, including the Adjoining Projects.

The LC East Project (5,750 acres) was added to the Lost Creek Property in 2011-2012. We located additional unpatented lode mining claims in 2014. Our LC East Project, as discussed elsewhere in this report, now has a source material license and awaits only the WDEQ permit to mine before all major authorizations are in hand to recover uranium at the project. The Lost Creek Report recommends that we continue to progress all remaining permit amendments to allow for future uranium recovery.

The LC West Project (3,840 acres) was also added to the Lost Creek Property in 2011-2012. The land position here includes one State of Wyoming mineral lease, in addition to the unpatented lode mining claims. We possess data related to historical exploration programs of earlier operators.

The LC North Project (6,260 acres) is located to the north and to the west of the Lost Creek Project. Historical wide-spaced exploration drilling on this project consisted of 175 drill holes. We have conducted two drilling programs at the project. We may conduct exploration drilling at LC North to pursue the potential of an extension of the MMT of the Lost Creek Project.

The LC South Project (10,200 acres) is located to the south and southeast of the Lost Creek Project. Historical drilling on the LC South Project consisted of 488 drill holes. In 2010, we drilled 159 exploration holes (total, 101,270 feet (30,867 meters)) which confirmed numerous individual roll front systems occurring within several stratigraphic horizons correlative to mineralized horizons in the Lost Creek Project. Also, a series of wide-spaced drill holes were part of this exploration program which identified deep oxidation (alteration) that represents the potential for several additional roll front horizons.

| 14 |

| Table of Contents |

The EN Project (5,160 acres) is adjacent to and east of LC South, including unpatented lode mining claims and one State of Wyoming mineral lease. We have over 50 historical drill logs from the EN project. Some minimal, deep, exploration drilling has been conducted at the project. No mineral resource is yet reported due to the limited nature of the data.

History and Geology of the Lost Creek Property

Uranium was discovered in the Great Divide Basin, where Lost Creek is located, in 1936. Exploration activity increased in Wyoming in the early 1950s after the Gas Hills District discoveries, and continued to increase in the 1960s, with the discovery of numerous additional occurrences of uranium. Wolf Land and Exploration (which later became Inexco), Climax (Amax) and Conoco Minerals were the earliest operators in the Lost Creek area and made the initial discoveries of low-grade uranium mineralization in 1968. Kerr-McGee, Humble Oil, and Valley Development, Inc. were also active in the area. Drilling within the current Lost Creek Project area from 1966 to 1976 consisted of approximately 115 wide-spaced exploration holes by several companies including Conoco, Climax (Amax), and Inexco.

Texasgulf acquired the western half of what is now the Lost Creek Project in 1976 through a joint venture with Climax and identified what is now referred to as the MMT. In 1978, Texasgulf optioned into a 50% interest in the adjoining Conoco ground to the east and continued drilling, fully identifying the MMT eastward to the current Project boundary; Texasgulf drilled approximately 412 exploration holes within what is now the Lost Creek Project. During this period Minerals Exploration Company (a subsidiary of Union Oil Company of California) drilled approximately eight exploration holes in what is currently the western portion of the Lost Creek Project. Texasgulf dropped the project in 1983 due to declining market conditions. The ground was subsequently picked up by Cherokee Exploration, Inc. which conducted no field activities.

In 1987, Power Nuclear Corporation (also known as PNC Exploration) acquired 100% interest in the project from Cherokee Exploration, Inc. PNC Exploration conducted a limited exploration program and geologic investigation, as well as an evaluation of previous in situ leach testing by Texasgulf. PNC Exploration drilled a total of 36 holes within the current Project area.

In 2000, New Frontiers Uranium, LLC acquired the property and database from PNC Exploration, but conducted no drilling or geologic studies. New Frontiers Uranium, LLC later transferred the Lost Creek Project-area property along with its other Wyoming properties to its successor NFU Wyoming. In June 2005, Ur‑Energy USA purchased 100% ownership of NFU Wyoming.

The Lost Creek Property is situated in the northeastern part of the GDB which is underlain by up to 25,000 ft. of Paleozoic to Quaternary sediments. The GDB lies within a unique divergence of the Continental Divide and is bounded by structural uplifts or fault displaced Precambrian rocks, resulting in internal drainage and an independent hydrogeologic system. The surficial geology in the GDB is dominated by the Battle Spring Formation of Eocene age. The dominant lithology in the Battle Spring Formation is coarse arkosic sandstone, interbedded with intermittent mudstone, claystone and siltstone. Deposition occurred as alluvial-fluvial fan deposits within a south-southwest flowing paleodrainage. The sedimentary source is considered to be the Granite Mountains, approximately 30 miles to the north. Maximum thickness of the Battle Spring Formation sediments within the GDB is 6,000 ft.

Uranium mineralization identified throughout the Property occurs as roll front type deposits, typical in most respects of those observed in other Tertiary Basins in Wyoming. Uranium deposits in the GDB are found principally in the Battle Spring Formation, which hosts the Lost Creek Property deposit. Lithology within the Lost Creek deposit consists of approximately 60% to 80% poorly consolidated, medium to coarse arkosic sands up to 50 ft. thick, and 20% to 40% interbedded mudstone, siltstone, claystone and fine sandstone, each generally less than 25 ft. thick. This lithological assemblage remains consistent throughout the entire vertical section of interest in the Battle Spring Formation.

| 15 |

| Table of Contents |

Outcrop at Lost Creek is exclusively that of the Battle Spring Formation. Due to the soft nature of the formation, the Battle Spring Formation occurs largely as sub-crop beneath the soil. The alluvial fan origin of the formation yields a complex stratigraphic regime which has been subdivided throughout Lost Creek into several thick horizons dominated by sands, with intervening named mudstones. Lost Creek is currently licensed and permitted to produce from the HJ horizon. The LC East license amendments include authorizations to recover uranium from the HJ and KM horizons, while the amendment to the Lost Creek Project will allow expansion of recovery into additional HJ horizon resource areas.

Shirley Basin Mine Site (Shirley Basin, Wyoming)

As a result of the Pathfinder acquisition, we now own the Shirley Basin Project, from which Pathfinder and its predecessors historically produced more than 28 million pounds of U3O8, primarily from the 1960s until the early 1990s. Pathfinder’s predecessors included COGEMA, Lucky Mc Uranium Corporation, and Utah Construction/Utah International. Shirley Basin conventional mine operations were suspended in the 1990s due to low uranium pricing, and facility reclamation was substantially completed. After the cessation of open pit uranium mining operations at Shirley Basin in 1992, two historical resource areas on the Project were identified as potentially suitable for ISR mining. These two areas are the FAB Resource Area or FAB Trend and Area 5.

We control approximately 3,536 acres of property interests in the general area of the project which is located in central southeast Wyoming, approximately 40 miles south of the city of Casper. The project is accessed by travelling west from Casper, on Highway 220. After travelling 18 miles, turn south on Highway 487 and travel an additional 35 miles; the entrance to Shirley Basin Mine is to the east. The project is in an unpopulated area located in the northeastern portion of Carbon County, Wyoming. It is centered at approximately 42 degrees, 22 minutes north latitude and 106 degrees, 11 minutes west longitude, in T28N, R78W, within the 6th principal meridian.

The nearest airport to the project is Casper-Natrona County International Airport located just north and west of Casper, Wyoming. Both Laramie and Rawlins also have smaller regional airports. The BNSF Railroad runs through Casper, and the Union Pacific railroad runs through Medicine Bow.

Site infrastructure is excellent. A well-graded road which traverses the project and provides access from the south will be upgraded. Several support facilities remain from the historical operations, including a modular field office building and a large, heated wash and lubrication bay which is currently used for storage and equipment maintenance. A regional power transmission line (69 kV) passes through the northern portions of the project. An existing energized power line leads to a substation near the field office, and from there a currently inactive powerline (power poles only) extends to the FAB Trend. A licensed active waste disposal site for 11e.(2) byproduct material is currently operating adjacent to the fully reclaimed tailings complex.

| 16 |

| Table of Contents |

Water supply needs are currently limited to drilling water, which is supplied by one water well capable of producing over 25 gallons per minute (gpm). Several backup water wells are also present but have not been utilized to date. The existing water wells are capable of providing sufficient supply for domestic and other potential operational requirements. Additional new and appropriately sited water source wells may be considered for future needs. Water impounded in the reclaimed mine pits is suitable for use in drilling and other non-potable uses would be available pending construction of approach ramps.

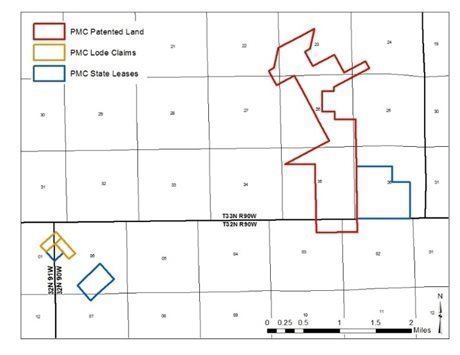

Within the project, the now permitted area (2,605 acres) consists of 1,770 acres of locatable mineral lands that we control, and which will allow us to recover uranium from both the FAB and Area 5 Resource Areas. This total consists of 1,330 acres of U.S. lode mining patents (nine patents), 370 acres of federal unpatented lode mining claims (29 claims), and 70 acres (two tracts) of fee minerals. Together with these mineral rights, we control 280 acres of additional surface access rights necessary to develop the project.

As with the Lost Creek mining claims, title to the unpatented mining claims at Shirley Basin is subject to rights of pedis possessio against all third-party claimants as long as the claims are maintained. The mining claims do not have an expiration date. Affidavits have been timely filed with the BLM and recorded with the Carbon County Clerk attesting to the payment for the mining claims of annual maintenance fees to the BLM as established by law from time to time. The surface of all the unpatented mining claims is controlled by the BLM, and we have the right to use as much of the surface as is necessary for exploration and mining of the claims, subject to compliance with all federal, state and local laws and regulations. Surface use on BLM lands is administered under federal regulations.

| 17 |

| Table of Contents |

There are no production royalties at the FAB Resource Area. Within Area 5, approximately 202 acres are subject to a formulaic royalty interest which totals approximately 0.5%. On two other tracts at Area 5 (30 acres in the southern portion and 40 acres in the southeastern portion), uranium and associated minerals are subject to different formulaic royalties which are approximately 1%. Currently, there is no known mineral resource on these 70 acres. A 0.5% royalty was included for the resources in Area 5. Additionally, certain use fees are in place on some lands in Area 5, based upon an annual disturbance-level calculation.

All major authorizations, permits and licenses for the project have been received. Additional minor permits/authorizations will be required before operations begin; each of the remaining authorizations is routine and may commonly be obtained in days or weeks.

Shirley Basin ISR Uranium Project S-K 1300 Report

Contemporaneous with this annual report on Form 10-K/A, we are filing an amended Initial Assessment Technical Report Summary on Shirley Basin ISR Uranium Project, Carbon County Wyoming (the “Shirley Basin Report”)(as amended, September 19, 2022). The Shirley Basin Report was prepared by WWC Engineering.

Mineral resources at the Shirley Basin Project at the effective date of the Shirley Basin Report are as follows:

Shirley Basin Project - Resource Summary (December 31, 2021)

RESOURCE AREA | MEASURED | INDICATED | ||||

AVG GRADE % eU3O8 | SHORT TONS (X 1000) | POUNDS U3O8 (X 1000) | AVG GRADE % eU3O8 | SHORT TONS (X 1000) | POUNDS U3O8 (X 1000) | |

FAB TREND | 0.280 | 1,172 | 6,574 | 0.119 | 456 | 1,081 |

AREA 5 | 0.243 | 195 | 947 | 0.115 | 93 | 214 |

TOTAL | 0.275 | 1,367 | 7,521 | 0.118 | 549 | 1,295 |

MEASURED & INDICATED | 0.230 | 1,915 | 8,816 | |||

Notes:

| 1. | Sum of Measured and Indicated tons and pounds may not add to the reported total due to rounding. |

| 2. | Based on grade cutoff of 0.020 % eU3O8 and a grade x thickness (GT) cutoff of 0.25 GT. |

| 3. | Mineral processing tests have been conducted historically and by the Company and indicate that recovery should be at or about 80%, which is consistent with industry standards. |

| 4. | Measured and Indicated mineral resources as defined in S-K 1300. |

| 5. | All reported resources occur below the historical, pre-mining static water table. |

| 6. | Average grades are calculated as weighted averages. |

| 7. | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| 8. | The point of reference for resources is in situ at the project. |

|

|

|

Information shown in the table above may differ from the disclosure requirements of the Canadian Securities Administrators. See Cautionary Note to Investors Concerning Disclosure of Mineral Resources, above.

| 18 |

| Table of Contents |

The Shirley Basin mineral resource estimate includes drill data and analyses of approximately 3,200 holes and nearly 1.2 million feet of historic drilling at the Shirley Basin Project. In 2014, we drilled 14 confirmation holes representing approximately 6,600 feet which were included in the mineral resource estimate. Because of the density of the historical drill programs, estimates were able to be made entirely in Measured and Indicated categories of resources. There is no Inferred resource category included in the estimate for Shirley Basin. Studies we conducted in 2014, as well as previous studies by Pathfinder in the late 1990s, indicate that this mineralization is amenable to ISR extraction. There is not a material change in the mineral resources estimated in the Shirley Basin report, and no material change to the mineral resource estimate year-over-year as we have neither conducted additional drilling, nor begun production operations. The Shirley Basin Report supersedes and replaces the last NI 43-101 preliminary economic analysis for the Shirley Basin Project (January 2015).

The economic analysis upon which the mineral resources were evaluated assumes a variable price per pound for U3O8 over the life of the Shirley Basin Project, as known today and discussed in the Shirley Basin Report. The projected pricing for anticipated sales ranges from $63.04 to $66.04 per pound U3O8. The sale price for the produced uranium is based on consensus using an annual average of the projections of long-term pricing made by expert market analysts. We do not have current sales agreements related to production at Shirley Basin.

Additional Shirley Basin History and Geology

The Shirley Basin Project lies in the northern half of the historic Shirley Basin uranium mining district (the “District”), which is the second most prolific uranium mining district in Wyoming. Earliest discoveries were made in 1954 by Teton Exploration. This was followed by an extensive claim staking and drilling rush by several companies in 1957. Several important discoveries were made, and the first mining was started in 1959 by Utah Construction Corp. (predecessor to Pathfinder). Underground mining methods were initially employed but encountered severe groundwater inflow problems, so in 1963 Utah Construction switched to solution mining methods. This was the first commercially successful application of in situ solution mining recovery (ISR) for uranium in the U.S. In 1968 market and production needs caused Utah Construction to move to open-pit mining and a conventional mill. All production within the District after 1968 was by open-pit methods.

As described, several companies operated uranium mines within the District, however three companies were dominant. Utah Construction/Pathfinder’s efforts were focused on the northern portion of the District, while Getty was largely in the central portion, and Kerr-McGee was in the southern portion. The last mining in the District concluded in 1992 when Pathfinder shut down production due to market conditions. Total production from the Shirley Basin District was 51.3 million pounds of U3O8, of which 28.3 million pounds U3O8 came from the Utah Construction/Pathfinder operations. The uranium resources which we are planning to produce through ISR represent unmined extensions of mineral trends addressed in past open-pit mines. These extensions were targeted for recovery years ago but were not developed prior to the end of operations in 1992.

The District lies in the north-central portions of the Shirley Basin geologic province, which is one of several inter-montane basins in Wyoming created 35-70 million years ago (mya) during the Laramide mountain building event. The Basin is floored by folded sedimentary formations of Cretaceous age (35-145 mya). In the northern half of the District the Cretaceous units were later covered by stream sediments of the Wind River Formation of Eocene age (34-56 mya) which filled paleo-drainages cut into a paleo-topographic surface. The Wind River Formation was subsequently covered by younger volcanic ash-choked stream sediments of the White River and Arikaree Formations of Oligocene age (23-34 mya) and Miocene age (5-23 mya), respectively. Uranium occurs as roll front type deposits along the edge of large regional alteration systems within sandstone units of the Wind River Formation. The source of the uranium is considered to be the volcanic ash content within the overlying White River Formation and also granitic content within the Wind River Formation itself.

In the project area, the primary hosts for uranium mineralization are arkosic sandstones of the Eocene-age Wind River Formation. The White River Formation unconformably overlies the Wind River Formation and outcrops on the surface throughout most of the project, with thicknesses ranging from a thin veneer in the FAB Resource Area to over 250 ft. in Area 5. The Wind River sediments in the project area were deposited as part of a large fluvial depositional system. The lithology of the Wind River Formation is characterized by thick, medium to coarse-grained, arkosic sandstones separated by thick claystone units. Sandstones and claystones are typically 20 - 75 ft. thick. Minor thin lignite and very carbonaceous shale beds occur locally. These fluvial sediments are located within a large northwest-trending paleochannel system with a gentle 1° dip to the north (Bailey and Gregory, 2011). The average thickness of the Wind River Formation within the project is approximately 230 ft. The Main and Lower Sands of the Wind River Formation are the primary hosts to mineralization which we are currently targeting for ISR development.

| 19 |

| Table of Contents |

The Lower Sand represents the basal sand unit of the Wind River Formation and in places lies directly above the underlying Cretaceous formations. The Main Sand typically lies approximately 15 - 25 ft. above the Lower Sand. Locally, the two sands merge where the intervening claystone unit is absent. Typical thickness of the Lower Sand ranges from 25 - 50 ft. and that of the Main Sand from 40 - 75 ft. Less dominant sands are common within the Wind River Formation. One in particular has been referred to as the Upper Sand and is present within much of the FAB Trend, lying approximately 25 ft. above the Main Sand. Claystone units are normally at least 10 ft. thick and commonly are 20 - 50 ft. thick.

Summary Information Concerning Additional Non-Material Exploration Stage Projects

In addition to the Lost Creek Property and Shirley Basin Project, the Company controls mineral properties for six additional projects in the GDB (four) and the Gas Hills Uranium District (one) in Wyoming and in Mineral County, Nevada (one, proximate to the Camp Douglas and Candelaria Mining Districts).

Each of the following described uranium exploration stage projects is 100% owned and controlled by our exploration and land holding company, NFU Wyoming, except the Lucky Mc project which is held by Pathfinder. Current mineral resource estimations for the following projects pursuant to S-K 1300 have not been completed at this time. Each of the uranium projects contains roll-front style uranium mineralization and appear to be amenable to ISR, pending further exploration and analysis at each. We have historical data on each of the properties, as well as drill data and/or other exploration data from our exploration work at several of the projects. Future exploration activities for the Wyoming uranium projects would be anticipated to be further drilling, which would proceed pursuant to Drilling Notices obtained from the WDEQ and BLM. There is no ongoing production at any of the following mineral projects. And, because of the persistent downturn in the uranium market, we have maintained our focus on operations at Lost Creek and the permitting process and development of Shirley Basin, while deferring costs of exploration at other projects.

The map below provides the location of each of the additional projects in the GDB, Wyoming, including their proximity to the Lost Creek Property.

Arrow Project is an exploration stage uranium project (10 unpatented lode mining claims; approximately 185 acres) located in Sections 30-31, T26N, R94W (Sweetwater County, Wyoming).

| 20 |

| Table of Contents |

Lost Soldier is an exploration stage uranium project located in Sweetwater County, Wyoming on 105 unpatented lode mining claims. Located in Sections 5-8 and 17-18, T26N, R90W and Sections 1 and 11-14, T26N, R91W, the project covers approximately 1,960 acres.

North Hadsell Project is an exploration stage uranium project, comprising 203 unpatented lode mining claims located in Sections 3-5 and 8-10, T26N, Range 91W (Sweetwater County) and Sections 31-34, T 27N, R91W and Sections 21-23, 25-28, 33-34 and 36 T27N, R92W (Fremont County) in Wyoming. The project controls approximately 3,970 acres.

RS Project is an exploration stage uranium project of 54 unpatented lode mining claims totaling an area of approximately 920 acres, located in Sections 6 and 7, T27N, R92W and Sections 1 and 2, T27N, R93W.

Our Lucky Mc Project is located in the Gas Hills Uranium District, Fremont County, Wyoming. An historic mine site, Pathfinder holds 100% mineral interests at the project through three mineral patents (totaling approximately 970 acres) located in Sections 2 and 3, T32N, R90W, and Sections 21, 22-27 and 35, T33N, R90W; two State of Wyoming mineral leases (together, approximately 410 acres) located in Section 36, T33N, R90W, Section 1, T32N, R91W; and Sections 6 and 7, T32N, R90W; and two unpatented lode mining claims (together, approximately 40 acres) located in Section 6, T32N, R90W and Section 1, T32N, R91W. In 2021, the historic permit to mine was terminated and related reclamation bond and obligations released. Further exploration or development would be accomplished through Drill Notices and routine permitting and licensing through the WDEQ and/or BLM.

Our exploration stage gold project, the Excel Project, is located in west-central Nevada, and currently comprises 118 unpatented lode mining claims (~2,400 acres) in Sections 9, 10, 20-22, 26-29, T5N, R34E. The Excel Project is also 100% held by NFU Wyoming. The project is located within the Excelsior Mountains, in Mineral County, Nevada. We have historical geologic data, as well as data obtained through early-stage field programs including rock sampling, geochemical soil sampling and drill programs, together with geophysical studies. Further drilling would require additional notice-level permits or plan of operations obtained from the BLM.

| 21 |

| Table of Contents |

Royalty Interest

The Company holds a one percent uranium mineral royalty interest related to the Lance Uranium ISR Project, held by Strata Energy, and other lands in Crook County, Wyoming. The Lance Project has been in production since 2015, though at considerably reduced operations levels in recent years due to the current uranium market. No royalty payments were received in 2020 or 2021; payments were received twice in 2019. Although the Lance Project has been in production for several years, it would be considered an exploration stage property as the parent company (not a U.S. registrant) reports only mineral resources and not mineral reserves.

Competition and Mineral Prices

The uranium industry is highly competitive, and our competition includes larger, more established companies with longer operating histories that not only explore for and produce uranium, but also market uranium and other products on a regional, national or worldwide basis. On a global basis, this competition also includes a significant number of state-owned or sponsored entities. Because of the greater financial resources of these companies, competitive bid processes on off-take sales agreements remain difficult. Beyond that, in the U.S., the competitive bid process for other contracts and opportunities is and will be challenging; this competition extends to the further acquisition and development of properties. Additionally, these larger (or state-owned) companies have greater resources to continue with their operations during periods of depressed market conditions.

Unlike other commodities, uranium does not trade on an open market. Contracts are negotiated privately by buyers and sellers. Our original term agreements for sales of uranium have been completed. Uranium prices are published by two of the leading industry-recognized independent market consultants, UxC, LLC and TradeTech, LLC, who publish on their respective websites. The following information reflects an average of the per pound prices published by these two consulting groups for the end of the periods indicated:

End of year: | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

Spot price (US$) | $ 20.25 | $ 23.75 | $ 27.75 | $ 24.93 | $ 30.20 | $ 42.05 |

LT price (US$) | $ 30.00 | $ 31.00 | $ 32.00 | $ 32.50 | $ 35.00 | $ 42.75 |

End of month: | 30-Sep-21 | 31-Oct-21 | 30-Nov-21 | 31-Dec-21 | 31-Jan-22 | 28-Feb-22 | 03-Mar-22 |

Spot price (US$) | $ 42.60 | $ 45.20 | $ 45.75 | $ 42.05 | $ 43.08 | $48.75 | $50.75 |

LT price (US$) | $ 42.50 | $ 43.00 | $ 43.00 | $ 42.75 | $ 42.88 | $43.88 | $43.88 |

The long-term price as defined by UxC, LLC includes conditions for escalation (from current quarter) delivery timeframe (≥ 36 months), and quantity flexibility (up to ±10%) considerations.

Strong competition in the uranium industry is also felt in the pursuit of qualified personnel and contractors, drill companies and equipment, and other equipment and materials. As the industry is revitalized through changes in market pricing, establishment of the national uranium reserve or other fundamental changes in the uranium market, this type of competition for expertise, staffing and equipment is anticipated to become more serious. Additionally, in Wyoming, competition for qualified labor inter-industry will become more challenging if oil prices remain high and other renewable energy projects maintain or increase staffing levels.

Government Regulations

As set forth above, our operations at Lost Creek and our other projects in Wyoming and elsewhere where exploration, development and operations are taking place, are subject to extensive laws and regulations which are overseen and enforced by multiple federal, state and local authorities. These laws and regulations govern exploration, development, production, various taxes, labor standards, occupational health and safety including radiation safety, waste disposal, protection and remediation of the environment, protection of endangered and protected species, toxic and hazardous substances and other matters. Uranium minerals exploration is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production.

| 22 |

| Table of Contents |

Compliance with these laws and regulations imposes substantial costs on us and may subject us to significant potential liabilities. Changes in these regulations could require us to expend significant resources to comply with new laws or regulations or changes to current requirements and could have a material adverse effect on our business operations. Compliance with all current regulations, including but not limited to the environmental and safety regulatory schemes, is an integral part of our day-to-day business, management and staff commitment and expenditures. The costs attendant to compliance are understood and routinely budgeted and are generally comparable to those of other U.S. uranium companies and other natural resources companies in the U.S. and Canada. It should be noted that environmental protections and regulatory oversight thereof vary significantly outside North America, particularly in Kazakhstan and Russia, where state-owned enterprises operate with only very limited regulatory oversight related to environmental and worker safety.

Mineral exploration and development activities, as well as our uranium recovery operations, are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated, causing an adverse effect on our business operations. Mineral exploration operations are also subject to federal and state laws and regulations which seek to maintain health and safety standards. Various permits from government bodies are required for drilling operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal and state authorities may be changed and any such changes may have material adverse effects on our activities. Mineral extraction operations are subject to federal and state laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. The posting of a performance bond and the costs associated with our permitting and licensing activities requires a substantial budget and ongoing cash commitments. In addition to pursuing ongoing permitting and licensure for new projects and additions to our existing Lost Creek Project, these expenditures include ongoing monitoring (e.g., wildlife, groundwater and effluent monitoring) and other activities to ensure regulatory and legal compliance, as well as compliance with our permits and licenses. Costs for these activities may increase and we may be required to increase compliance activities in the future, which might further affect our ability to expand or maintain our operations.

Environmental Regulations

As set forth above, our mineral projects are the subject of extensive environmental regulation at federal and state levels. Exploration, development and production activities are subject to certain environmental regulations which may prevent or delay the commencement or continuance of our operations. The National Environmental Protection Act (“NEPA”) affects our operations as it requires federal agencies to consider the significant environmental consequences of their proposed programs and actions and inform the public about their decision making. The required process of NEPA may take many months or even years to complete. While the NEPA regulations were extensively revised and modernized in 2020 (the “2020 Rules”) in generally positive and pragmatic ways, they are the subject of several litigation challenges as well as new, phased amendment to the 2020 Rules. In October 2021, the Council on Environmental Quality (“CEQ”) published its Phase 1 Notice of Proposed Rulemaking which has been followed by public comment. The intent of the phased revisions is to generally restore regulatory provisions that were in effect prior to the 2020 Rules. CEQ also issued an Interim Final Rule in June 2021 which delays the deadline for federal agencies to develop their NEPA implementing procedure for the 2020 Rules.

In general, our exploration and production activities are subject to certain federal and state laws and regulations relating to environmental quality and pollution control. Such laws and regulations increase the costs of these activities substantially and may prevent or delay the commencement or continuance of a given operation. Because compliance with current laws and regulations is an integral part of our industry and business it has not had a materially adverse effect on our operations or financial condition to date in relation to our U.S. peers. Specifically, we are subject to legislation and regulations regarding radiation safety, emissions into the environment, water discharges, and storage and disposition of hazardous wastes. In addition, the law requires well and facility sites to be abandoned and reclaimed to the satisfaction of state and federal authorities.

| 23 |

| Table of Contents |

State of Wyoming

As discussed elsewhere in this report, we are regulated by multiple divisions of the State of Wyoming Department of Environmental Quality (LQD, WQD, AQD and URP), the State Engineer’s Office and other State agencies. As a State program with delegated authority of the NRC, the URP will adopt future regulations and rulemakings of the NRC on a time-to-time basis. On December 16, 2019, NRC staff issued SECY‑19‑0123 Regulatory Options for Uranium In Situ Recovery Facilities which provided recommendations to the NRC Commissioners on how to regulate the in situ uranium mining industry. Following review, the NRC Commissioners instructed staff to begin a narrowly focused rulemaking for in situ milling. NRC staff, in close consultation with agreement state programs, including Wyoming’s, drafted a rule for Commission review and, thereafter, public comment. Once promulgated, all agreement state programs which regulate uranium milling will be required to adopt the final rule. The timing of the final rule is unknown but is expected within the next one to two years. The rulemaking is expected to be narrow in scope and consistent with current practices and is therefore not expected to have a material effect on our operations.

Waste Disposal

The Resource Conservation and Recovery Act ("RCRA"), and comparable state statutes, affect minerals exploration and production activities by imposing regulations on the generation, transportation, treatment, storage, disposal and cleanup of hazardous wastes and on the disposal of non-hazardous wastes. Under the auspices of the U.S. Environmental Protection Agency (the "EPA"), the individual states administer some or all the provisions of RCRA, sometimes in conjunction with their own, more stringent requirements.

Underground Injection Control ("UIC") Permits

The federal Safe Drinking Water Act (“SDWA”) creates a nationwide regulatory program protecting groundwater. This act is administered by the EPA. However, to avoid the burden of dual federal and state regulation, the SDWA allows for the UIC permits issued by states to satisfy the UIC permit required under the SDWA under two conditions. First, the state's program must have been granted primacy, as is the case in Wyoming. Second, the EPA must have granted, upon request by the state, an aquifer exemption. The EPA may delay or decline to process the state's application if the EPA questions the state's jurisdiction over the mine site. From time to time, EPA has promulgated rulemaking processes to expand and/or clarify its jurisdiction and the rules under which the UIC and other programs operate; while no such rulemaking is currently in process, there may be additional such rulemakings at any time.

CERCLA