UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

|

|

|

|

|

Filed

by the Registrant ☒

|

|

Filed

by a Party other than the Registrant ☐

|

|

Check

the appropriate box:

|

|

|

|

Preliminary

Proxy Statement

|

|

|

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a–6(e)(2))

|

|

|

☒

|

Definitive

Proxy Statement

|

|

|

|

Definitive

Additional Materials

|

|

|

|

Soliciting

Material Pursuant to §240.14a–12

|

|

|

|

|

|

UR-ENERGY

INC.

|

|

(Name

of Registrant as Specified In Its Charter)

|

|

|

|

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant)

|

|

Payment

of Filing Fee (Check the appropriate box):

|

|

|

☒

|

No fee

required.

|

|

|

|

Fee

computed on table below per Exchange Act Rules 14a–6(i)(1)

and 0–11.

|

|

|

(1)

|

Title

of each class of securities to which transaction

applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0–11 (set forth the amount on

which the filing fee is calculated and state how it was

determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

Fee

paid previously with preliminary materials.

|

|

|

Check

box if any part of the fee is offset as provided by Exchange Act

Rule 0–11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by

registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing

Party:

|

|

|

(4)

|

Date

Filed:

|

UR-ENERGY INC.

10758

West Centennial Road, Suite 200

Littleton,

Colorado 80127

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 3, 2021

To the

Shareholders of Ur-Energy Inc.:

The

Annual and Special Meeting of Shareholders of Ur-Energy Inc. (the

“Company”), will be held in person at the Hampton Inn

& Suites, 7611 Shaffer Parkway, Littleton, Colorado 80127 on

Thursday, June 3, 2021 at 1:00 p.m. Mountain Time / 3:00 p.m.

Eastern Time to receive the audited consolidated financial

statements of the Company for the year ended December 31, 2020,

together with the report from the auditors thereon, and for the

purpose of considering and voting upon proposals to:

1.

Elect seven (7)

directors, each to serve until the next annual meeting of

shareholders of the Company or until their successors are elected

and appointed;

2.

Re-appoint

PricewaterhouseCoopers LLP, Chartered Professional Accountants, as

the independent auditors of the Company and to authorize the

directors to fix the remuneration of the auditors;

3.

Approve, in an

advisory (non-binding) vote, the compensation of the

Company’s named executive officers

(“say-on-pay”);

4.

Ratify, confirm and

approve amendments to the Amended and Restated Restricted Share

Unit and Equity Incentive Plan; and

5.

Transact such other

business as may lawfully come before the meeting or any

adjournment(s) or postponement(s) thereof.

The

Board of Directors recommends a vote “FOR” each of the

director nominees and “FOR” Proposals 2, 3 and 4. The

Board of Directors has fixed the close of business on April 13,

2021 as the record date

for determination of the shareholders entitled to vote at the

meeting and any adjournment(s) or postponement(s) thereof. This

Notice of Annual and Special Meeting of Shareholders and related

proxy materials are first being distributed or made available to

shareholders beginning on or about April 21, 2021.

We

cordially invite you to attend the Annual and Special Meeting of

Shareholders either in person or to listen by tollfree access as

described in the Management Proxy Circular. Whether or not you plan

to attend, it is important that your shares be represented and

voted at the meeting. Please refer to your proxy card for more

information on how to vote your shares at the meeting and return

your voting instructions as promptly as possible.

Important Notice Regarding Availability of Proxy Materials for the

2021 Annual and Special Meeting of Shareholders: The attached

Management Proxy Circular, proxy card, and the Company’s

Annual Report to Shareholders (including financial statements) for

the fiscal year ended December 31, 2020 are available at

www.envisionreports.com/URGQ2021 or can be found at

http://www.ur-energy.com.

Thank

you for your support.

|

|

BY

ORDER OF THE BOARD OF DIRECTORS,

|

|

|

/s/

Jeffrey T.

Klenda, Chairman

|

MANAGEMENT PROXY CIRCULAR

TABLE OF CONTENTS

|

|

1

|

|

|

2

|

|

|

2

|

|

|

3

|

|

|

3

|

|

|

4

|

|

|

4

|

|

|

4

|

|

|

4

|

|

|

5

|

|

|

6

|

|

|

6

|

|

|

9

|

|

|

10

|

|

|

10

|

|

|

13

|

|

|

14

|

|

|

22

|

|

|

24

|

|

|

28

|

|

|

31

|

|

|

33

|

|

|

34

|

|

|

44

|

|

|

44

|

|

|

45

|

|

|

45

|

|

|

45

|

|

|

45

|

|

|

46

|

|

|

46

|

|

|

46

|

|

|

A-1

|

UR-ENERGY INC.

10758

West Centennial Road, Suite 200

Littleton,

Colorado 80127

MANAGEMENT PROXY CIRCULAR

ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

JUNE 3, 2021

This

Management Proxy Circular (the “Circular”) is furnished

in connection with the solicitation by the management of Ur-Energy

Inc. (“we,” “us,” the “Company”

or “Ur-Energy”) of proxies for use at the annual and

special meeting of shareholders of the Company (the

“Meeting”) to be held in person at the Hampton Inn

& Suites, 7611 Shaffer Parkway, Littleton, Colorado 80127 on

Thursday, June 3, 2021 commencing at 1:00 p.m. Mountain Time / 3:00

p.m. Eastern Time, and at any adjournment thereof, for the purposes

set forth in the accompanying Notice of Meeting (the

“Notice”). The solicitation will be primarily by mail,

but proxies may also be solicited personally or by telephone by

directors, officers, employees or representatives of the Company.

All costs of solicitation will be borne by the Company. This

Circular and related proxy materials are being first distributed or

made available to shareholders beginning on or about April 21,

2021. The information contained herein is given as at April 13,

2021 unless otherwise indicated.

We expect to hold our annual meeting in person on June 3, 2021. We

continue to be mindful of the public health and travel concerns our

shareholders may have and recommendations that public health and

governmental officials have issued and may issue in light of the

continuing COVID-19 situation. As a result, if the current

public health situation in Colorado worsens, we may impose

additional procedures or limitations to assure the safety of

meeting attendees or may decide to hold the meeting in a different

location or solely by means of remote communication (i.e., a

virtual-only meeting). We currently plan to address COVID-19

concerns relating to the meeting by having directors and other

meeting participants whose physical presence at the meeting is not

essential attend and participate in the meeting via

teleconference.

In addition (i) shareholders and others who might otherwise attend

in person may instead listen to the meeting in real-time by calling

toll-free 877-407-9124 (international: 201-689-8584) and/or logging on to

https://agm.issuerdirect.com/urg and (ii) shareholders who have

questions they would like to pose at the meeting may send those

questions to our Corporate Secretary in advance of the meeting at

legaldept@Ur-Energy.com. Please include your name and return

email address when you convey your questions. We believe that these

procedures will reduce risks relating to COVID-19 and provide many

of the benefits of a virtual-only meeting while minimizing

associated costs of a virtual meeting.

As set forth below, if you are a registered shareholder and wish to

vote the day of the meeting or are a proxy appointee voting the day

of meeting, you must do so in person. We will continue to monitor

the COVID-19 situation and if changes to our current plan become

advisable, we will disclose the updated plan on our website and by

press release. We encourage you to check our website prior to

the meeting if you plan to attend in person. We look forward to

welcoming everyone in person next year.

All

dollar amounts in this Circular are in U.S. dollars, except where

indicated otherwise. On April 13, 2021, the noon exchange rate of

Canadian currency in exchange for United States currency, as

reported by the Bank of Canada, was US$1.00 =

C$1.2554.

This Circular, the proxy (or voter information) card, and the

Company’s Annual Report to Shareholders (including financial

statements) for the fiscal year ended December 31, 2020 are

available at https://www.ur-energy.com.

The

persons named in the enclosed form of proxy are the Chairman of the

Board/Chief Executive Officer, Mr. Klenda, and our Corporate

Secretary, Penne Goplerud. Each shareholder has the

right to appoint a person other than the persons named in the

enclosed form of proxy, who need not be a shareholder of the

Company, to represent such shareholder at the Meeting or any

adjournment thereof. Such right may be exercised by

inserting such person’s name in the blank space provided in

the form of proxy and striking out the other names or by completing

another proper form of proxy.

Registered Shareholders

There

are two methods by which registered shareholders (“Registered

Shareholders”), whose names are shown on the books or records

of the Company as owning common shares no par value of the Company

(“Common Shares”), can vote their Common Shares at the

Meeting either in person at the Meeting or by proxy. Should a

Registered Shareholder wish to vote in person at the Meeting, the

Registered Shareholder should attend the Meeting where his or her

vote will be taken and counted. Although we are making a

toll-free number available to listen to the Meeting, if you wish to

vote the day of the Meeting, you must do so in person.

Should the Registered Shareholder not wish to attend the meeting or

not wish to vote in person, his or her vote may be cast by proxy

through one of the methods described below and the Common Shares

represented by the proxy will be voted or withheld from voting, in

accordance with the instructions as indicated in the form of proxy,

on any ballot that may be called for, and if a choice was specified

with respect to any matter to be acted upon, the shares will be

voted accordingly.

A

Registered Shareholder may vote by proxy by using one of the

following methods: (i) the paper form of proxy to be returned by

mail or delivery; (ii) by Internet; or (iii) by telephone. The

methods of using each of these procedures are as

follows:

Voting by Mail. A Registered Shareholder may vote by mail or

delivery by completing, dating and signing the enclosed form of

proxy and depositing it with Computershare Investor Services Inc.

(the “Transfer Agent”) using the envelope provided or

by mailing it to Computershare Investor Services Inc., Attention:

Proxy Department, 100 University Avenue, 8th Floor, Toronto,

Ontario M5J 2Y1 or to the Corporate Secretary of the Company at

10758 West Centennial Road, Suite 200, Littleton, Colorado

80127 for receipt no later than

11:59 p.m. (ET) on Monday, May 31, 2021, or if the Meeting

is adjourned, by no later than 1:00 p.m. Mountain Time on the last

business day preceding the reconvened Meeting.

Voting by Internet. A Registered Shareholder may vote by

Internet by accessing the following website:

www.envisionreports.com/URGQ2021, and going to “vote

now.” When you log on to the site you will be required to

input a control number as instructed on the form of proxy. Please

see additional information enclosed with the Circular on the form

of proxy. Registered Shareholders may vote by Internet for receipt no later than 11:59 p.m. (ET) on

Monday, May 31, 2021, or if the Meeting is adjourned, no

later than 1:00 p.m. Mountain Time on the last business day

preceding the reconvened Meeting.

Voting by Telephone. A Registered Shareholder may vote by

telephone by calling the toll free number 1-866-732-8683 from a

touch tone phone. When you telephone you will be required to input

a control number as instructed on the form of proxy. Please see

additional information enclosed with the Circular on the form of

proxy. Registered Shareholders may vote by telephone for receipt no later than 11:59 p.m. (ET) on

Monday, May 31, 2021, or if the Meeting is adjourned, no

later than 1:00 p.m. Mountain Time on the last business day

preceding the reconvened Meeting.

Voting

by mail or the Internet are the only methods by which a Registered

Shareholder may choose an appointee other than the management

appointees named on the proxy and must be completed by the

Registered Shareholder or by an attorney authorized in writing or,

if the Registered Shareholder is a corporation or other legal

entity, by an authorized officer or attorney.

Non-Registered Shareholders (Beneficial Owners)

If you

hold shares through a broker, bank or other nominee, you will

receive material from that firm asking how you want to vote and

instructing you of the procedures to follow in order for you to

vote your shares. If the nominee does not receive voting

instructions from you, it may vote only on proposals that are

considered “routine” matters under applicable rules.

Each of the proposals at the Meeting, other than Proposal No. 2,

are “non-routine” matters and therefore an intermediary

holding shares for a beneficial owner will not have the authority

to vote on those matters in the absence of instructions from the

beneficial owner. A nominee’s inability to vote on some

proposals because it lacks discretionary authority to do so is

commonly referred to as a “broker non-vote.” Broker

non-votes are not counted in the tabulation of votes cast on a

particular proposal and therefore will not have an effect on the

approval of that proposal.

Notice and Access

We

distribute our proxy materials to shareholders via the Internet

under the “Notice and Access” approach permitted by

rules of the SEC. This approach conserves natural resources and

reduces our distribution costs, while providing a timely and

convenient method of accessing the materials and voting. On or

before April 21, 2021, we mailed a Notice of Internet Availability

of Proxy Materials to participating shareholders, containing

instructions on how to access the proxy materials on the Internet

to vote your shares over the Internet or by telephone. You will not

receive a printed copy of the proxy materials unless you request

them. If you would like to receive a printed copy of our proxy

materials, including a printed proxy card on which you may submit

your vote by mail, then you should follow the instructions for

obtaining a printed copy of our proxy materials contained in the

Notice of Internet Availability of Proxy Materials.

A

shareholder who has given a proxy has the power to revoke it as to

any matter on which a vote shall not already have been cast

pursuant to the authority conferred by such proxy and may do so (i)

by delivering another properly executed proxy bearing a later date

and depositing it as aforesaid, including within the prescribed

time limits noted above; (ii) by depositing an instrument in

writing revoking the proxy executed by the shareholder or by the

shareholder’s attorney authorized in writing (A) at our head

office with the Corporate Secretary at 10758 West Centennial Road,

Suite 200, Littleton, Colorado 80127 at any time up to and

including the last business day preceding the day of the Meeting,

or any adjournment thereof, at which the proxy is to be used, or

(B) with the Chair of the Meeting, prior to its commencement, on

the day of the Meeting, or at any adjournment thereof; (iii) by

attending the Meeting in person and so requesting; or (iv) in any

other manner permitted by law.

If you

hold your shares through a broker, bank or other nominee, you must

follow their instructions to revoke your initial proxy vote or to

otherwise vote at the Meeting.

VOTING AND DISCRETION OF

PROXIES

On any

ballot that may be called for, the shares represented by proxies in

favor of the persons named by management of the Company will be

voted in the manner identified in the proxy, in each case in

accordance with the instructions of the shareholder. In the absence of any instructions on the

proxy, it is the intention of the persons named by management in

the accompanying form of proxy to vote

(1)

FOR the election of all of management’s nominees as

directors;

(2)

FOR the re-appointment of PricewaterhouseCoopers LLP, Chartered

Professional Accountants, as our independent auditors and the

authorization of the directors to fix the remuneration of the

auditors;

(3)

FOR the advisory resolution to approve, on an advisory

(non-binding) basis, the compensation of our Named Executive

Officers;

(4)

FOR the resolution to approve the amendments to the Amended and

Restated Restricted Share Unit and Equity Incentive Plan;

and

(5)

In accordance with management’s recommendations with respect

to amendments or variations of the matters set out in the Notice or

any other matters which may properly come before the

Meeting.

The

form of proxy confers discretionary authority upon the persons

named therein with respect to amendments or variations of the

matters identified in the Notice or any other matters that may

properly come before the Meeting. As at the date of this Circular,

management of the Company knows of no such amendments, variations

or other matters that may properly come before the Meeting other

than the matters referred to in the Notice.

COMMON SHARES ENTITLED TO

VOTE

As at

April 13, 2021, the authorized capital of the Company consisted of

an unlimited number of Common Shares, of which 189,389,100 Common

Shares were issued and outstanding, and an unlimited number of

Class A Preference Shares, issuable in series, of which none has

been issued. A holder of record of Common Shares as at the close of

business on April 13, 2021 (the “Record Date”) is

entitled to one vote for each Common Share held by the shareholder.

In accordance with the Canada

Business Corporations Act, the Company will prepare a list

of holders of Common Shares on the Record Date. Each holder of

Common Shares named in the list at the close of business on the

Record Date will be entitled to vote the Common Shares shown

opposite his or her name on the list at the Meeting.

The

directors nominated for election pursuant to Proposal No. 1 will be

elected by plurality vote, meaning that the seven nominees who

receive the most votes, whether in person or by proxy, will be

elected. Broker non-votes will have no effect on the election of

Directors. The Company has adopted a majority voting policy

pursuant to which any director who fails to receive a majority of

the votes cast will be required to tender their resignation. See

“Statement of Corporate

Governance – Majority Voting

Policy.”

With

respect to Proposal No. 2, the affirmative vote of a majority of

the votes cast at the meeting (either in person or by proxy) will

be required for approval.

With

respect to Proposal No. 3, the affirmative vote of a majority of

the Common Shares present at the meeting (either in person or by

proxy) and entitled to vote on this matter will be required for

approval. Broker non-votes will have no effect on the vote on

Proposal No. 3. Because your vote on this proposal is advisory, it

will not be binding on the Board of Directors or the Company.

However, the Board will review the voting results and take them

into consideration when making future decisions regarding executive

compensation.

With

respect to Proposal No. 4, the affirmative vote of a majority of

the votes cast at the meeting (either in person or by proxy) will

be required for approval, however, the TSX rules provide that all

eligible insiders in order to participate in the RSU&EI Plan

may not vote on the proposed amendments. Accordingly, the

RSU&EI Plan resolution must be passed by a majority of votes

cast at the meeting (either in person or by proxy), excluding

5,674,838 Common Shares held by certain insiders of the Company and

their affiliates. Broker non-votes will have no effect on the

outcome of this proposal.

The

presence, in person or by proxy, of two shareholders holding not

less than 10% of the Common Shares entitled to vote as of the

Record Date constitutes a quorum for the transaction of business at

the Meeting. In the event there is not a quorum present to approve

any proposals at the time of the Meeting, the Meeting shall be

adjourned to a date no less than seven days later than the

scheduled Meeting date in order to permit further solicitation of

proxies. The scrutineer will treat Common Shares represented by a

properly signed and returned proxy as present at the Meeting for

purposes of determining a quorum, without regard to whether the

proxy is marked as casting a vote or abstaining.

Pursuant

to the Canada Business

Corporations Act, there are no rights of dissent in respect

of the resolutions to be voted on by the shareholders at this

Meeting.

CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

Security Ownership of Management

As of

April 13, 2021, our Record Date, we had 189,389,100 Common Shares

issued and outstanding, and 4,888,345 stock options which may be exercised currently or

within the sixty (60) days following April 13,

2021.

|

|

Number of

|

Percentage of Issued and

|

|

|

Common Shares of

|

Outstanding Common Shares of

|

|

Name of Holder

|

Ur-Energy

|

Ur-Energy

|

|

Directors and Named Executive

Officers (1)(2)

|

|

|

|

W. William Boberg (3)

|

1,191,219

|

*

|

|

John W. Cash

|

448,870

|

*

|

|

Rob Chang

|

350,631

|

*

|

|

James M. Franklin(4)

|

991,192

|

*

|

|

Penne A. Goplerud

|

754,269

|

*

|

|

Steven M. Hatten

|

456,611

|

*

|

|

Gary C. Huber

|

439,690

|

*

|

|

Jeffrey T. Klenda (5)

|

3,516,421

|

1.81%

|

|

Thomas H. Parker

|

586,504

|

*

|

|

Roger L. Smith

|

830,508

|

*

|

|

Kathy E. Walker

|

535,150

|

*

|

|

All Directors and executive officers, as a group (11

persons)

|

10,101,065

|

5.20%

|

* Less

than one percent

(1)

Address

for each of our directors and executive officers: 10758 West

Centennial Road, Suite 200, Littleton, Colorado 80127.

(2)

The

beneficial ownership shown for all holders in this table represents

Common Shares and all options which may be exercised currently or

within sixty (60) days following April 13, 2021. For our Directors

and executive officers, this represents the following: Boberg

(808,615 Common Shares, 382,604 options); Cash (187,560 Common

Shares, 261,310 options); Chang (16,027 Common Shares, 334,604

Options); Franklin (608,588 Common Shares, 382,604 options);

Goplerud (224,580 Common Shares, 529,689 options); Hatten (182,428

Common Shares, 274,183 options); Huber (185,086 Common Shares,

254,604 options); Klenda (2,836,172 Common Shares, 680,249

options); Parker (203,900 Common Shares, 382,604 options); Smith

(341,336 Common Shares, 489,172 options); and Walker

(80,546 Common Shares, 454,604 options). As of the Record

Date, April 13, 2021, the number of the Company’s Common

Shares beneficially owned by all of the Directors and executive

officers as a group and entitled to be voted at the meeting is

5,674,838.

(3)

Of

the shares identified, Mr. Boberg holds 118,796 Common Shares

jointly with his wife.

(4)

Of

the shares identified, Mr. Franklin holds 50,000 Common Shares

indirectly through his ownership in Franklin Geosciences

Ltd.

(5)

Of

the total number of Common Shares held by Mr. Klenda, he has

pledged 1,706,640 Common Shares on a multi-purpose equity line of

credit. Mr. Klenda’s Common Shares are held jointly with his

wife.

Security Ownership of Certain Beneficial Owners

The following table sets forth the beneficial ownership of the

Company’s Common Shares as of April 13, 2021 by each person

(other than the Directors and executive officers of the Company)

who owned of record, or was known to own beneficially, more than 5% of the outstanding

voting shares of Common Shares.

|

|

|

|

|

|

Number

of

|

Percentage of

Issued and

|

|

|

Common Shares

of

|

Outstanding

Common Shares of

|

|

Name of

Holder

|

Ur-Energy

|

Ur-Energy

|

|

Major Shareholders

|

|

|

|

MMCAP International Inc. SPC(1)

|

18,749,520

|

9.9%

|

(1)

MMCAP International

Inc. SPC filed a Schedule 13G dated February 8, 2021, indicating

holdings as at February 4, 2021, of 15,354,074 Ur-Energy Common

Shares as between itself and its affiliate, MM Asset Management

Inc. (“MMCAP”). Additionally, the filing reports the

ownership of Warrants exercisable for the purchase of up to

8,835,000 Common Shares. The Warrants include a beneficial

ownership limitation that would preclude exercise of the Warrants

if, as a result of the exercise, the holder’s share ownership

would exceed 9.9% of the Company’s outstanding Common

Shares.

PARTICULARS OF MATTERS TO BE ACTED

UPON

Proposal

No. 1: Election of

Directors

The

articles of the Company provide that the Board of Directors of the

Company (the “Board of Directors” or the

“Board”) shall consist of a minimum of one and a

maximum of ten directors, the number of which is currently fixed at

seven. Election of directors will be conducted on an individual

basis, and will include Jeffrey T. Klenda, James M. Franklin, W.

William Boberg, Thomas H. Parker, Gary C. Huber, Kathy E. Walker

and Rob Chang. As discussed in the description of the

Company’s Majority Voting

Policy, below, each Director must receive a majority of the

votes cast (in person or by proxy) as to his or her election or

will be required to submit his or her resignation pursuant to the

policy.

Nominees: Each of the seven persons named above is a

nominee for election as a director at the Annual and Special

Meeting for a term of one year or until his or her successor is

elected and qualified. Unless authority is withheld, the proxies

will be voted for the election of such nominees. Each of the

nominees is currently serving as a director of the Company. All the

nominees were elected to the Board of Directors at the last annual

meeting of shareholders. Management does not anticipate that any of

the nominees for election as directors will be unable to serve as a

director, but if that should occur for any reason prior to the

Meeting, the persons named in the accompanying form of proxy

reserve the right to vote for another nominee in their discretion

or for the election of only the remaining nominees.

The

Board of Directors has delegated to the Corporate Governance and

Nominating Committee the responsibility for reviewing and

recommending nominees for director. The Board determines which

candidates to nominate or appoint, as appropriate, after

considering the recommendation of the Corporate Governance and

Nominating Committee.

Certain

of our directors have historically and do currently serve on boards

of directors of other companies. We view this to be beneficial to

the Company, provided there is no conflict of interest, nor

restrictions on time which are disadvantageous to our Board’s

interests. Current service on the boards of other public companies

is set forth, below, under “Service on Additional

Boards.” The Company believes that service on other

boards allows for broader experience and expertise which benefits

the individual and the companies served, including Ur-Energy. None

of our directors sits on more than three public company boards or,

alternatively, is the CEO of a public company and sits on the board

of more than two public companies besides the one for which he/she

is the CEO (i.e., none of

our directors is “overboarded”).

Qualifications: In evaluating a director candidate, the

Corporate Governance and Nominating Committee considers the

candidate’s independence, character, business experience,

industry-specific experience including technical expertise,

corporate governance skills and abilities, training and education,

commitment to performing the duties of a director, and other

skills, abilities, or attributes that fill specific needs of the

Board or its committees. Each nominee brings a strong and unique

background and set of skills to the Board, giving the Board, as a

whole, competence and experience in a wide variety of areas,

including natural resources exploration and development, mining

operations, executive management, board service, corporate

governance, finance, financial markets, government, employment, and

international business. These varied and substantial backgrounds,

skills and qualifications, as described in more detail below, and

the contributions of each to the development and current operations

of the Company as described below under the heading “Board Composition – Including

Tenure and Outlook on Set Retirement Age,” led the

Corporate Governance and Nominating Committee and the Board of

Directors to the conclusion that each of the nominees should serve

as a Director.

Recommendation of Ur-Energy’s Board of Directors

The Board of Directors recommends that the shareholders vote FOR

the election of all of the named nominees for director and, unless

a shareholder gives instructions on the proxy card to the

contrary, the proxies named thereon intend to so vote.

|

Jeffrey T. Klenda, 64, B.A.

|

Chairman, President & CEO

|

Mr.

Klenda graduated from the University of Colorado in 1980 and began

his career as a stockbroker specializing in venture capital

offerings. Prior to founding Ur-Energy in 2004, he worked as a

Certified Financial Planner and was a member of the International

Board of Standards and Practices. In 1986, he started Klenda

Financial Services, an independent financial services company

providing investment advisory services to high-end individuals and

corporate clients as well as providing venture capital to

corporations seeking entry to the U.S. securities markets. In the

same year, Mr. Klenda formed Independent Brokers of America, Inc.,

a national marketing organization. He also served as President of

Security First Financial, a company he founded to provide

consultation to individuals and corporations seeking investment

management and early stage funding. Over the last 35 years, Mr.

Klenda has acted as an officer and/or director for numerous

publicly-traded companies, having taken his first company public at

28 years of age. Mr. Klenda has served as the Chairman of the Board

of Directors of the Company since 2006. He served as Executive

Director from January 2006 to May 2015. Thereafter, he served as

Acting Chief Executive Officer until being named President and

Chief Executive Officer by our Board of Directors in December

2016.

The

Board of Directors has concluded that Mr. Klenda is well qualified

and should serve as a director on the basis of his numerous

contributions to the Company since its inception, his nearly 40

years of experience in the financial markets and in service to

numerous publicly traded companies as an officer and

director.

|

James M. Franklin, 78, PhD, FRSC, P.Geo

|

Director & Chair of the HSE & Technical

Committee

|

Dr.

Franklin has over 50 years’ experience as a geologist. He is

a Fellow of the Royal Society of Canada. Since 1998, he has been an

Adjunct Professor at Queen’s University, since 2001, at

Laurentian University and since 2006 at the University of Ottawa.

He is a past President of the Geological Association of Canada and

of the Society of Economic Geologists. He retired in 1998 as Chief

Geoscientist of the Geological Survey of Canada, Earth Sciences

Sector. Since that time, he has been a consulting geologist and is

currently a director of Gold79 Mines Ltd. (formerly, Aura Resources

Inc.) (since October 2003), and Nuinsco Resources Ltd. (since June

2018). Dr. Franklin’s lifetime achievements have been honored

by several professional organizations: among his honors, Dr.

Franklin has been awarded GAC’s Logan and Duncan R. Derry

medals, CIM’s Selwyn Blaylock, A.O. Dufresne, Distinguished

Lecturer and Julian Boldy Memorial awards and the Society of

Economic Geologists Thayer Lindsley and Distinguished Lecturer

awards. He has also received the R.A.F. Penrose Gold Medal from SEG

for his many contributions to a broad cross section of geosciences.

In 2017 he was made a Fellow of Lakehead University, honoring his

contributions to education and economic development in northern

Ontario. Dr. Franklin was inducted into the Canadian Mining Hall of

Fame in 2019 for his many contributions to the mining

industry.

The

Board of Directors has concluded that Dr. Franklin is well

qualified and should serve as a director on the basis of his

contributions as a director to the Company since its inception and

his more than 50 years of experience in geosciences and mineral

resource work in industry, governmental service and

academia.

|

W. William (Bill) Boberg, 81, M.Sc., P. Geo

|

Director

|

Mr.

Boberg has served as a director of the Company since January 2006.

Mr. Boberg served as the Company’s President and Chief

Executive Officer (2006 to 2011). Prior to that time, Mr. Boberg

was the Company’s senior U.S. geologist and Vice President

U.S. Operations (2004 to 2006). Before his initial involvement with

the Company, he was a consulting geologist having over 40

years’ experience investigating, assessing and developing a

wide variety of mineral resources in diverse geologic environments

in western North America, South America and Africa. Mr. Boberg

worked for Gulf Minerals, Hecla Mining, Anaconda, Continental Oil

Minerals Department, Wold Nuclear, Kennecott, Western Mining,

Canyon Resources and Africa Mineral Resource Specialists. Mr.

Boberg has over 30 years of experience exploring for uranium in the

continental U.S. He discovered the Moore Ranch Uranium Deposit and

the Ruby Ranch Uranium Deposit as well as several smaller deposits

in Wyoming’s Powder River Basin. He received his

Bachelor’s Degree in Geology from Montana State University

and his Master’s Degree in Geology from the University of

Colorado. He is a registered Wyoming Professional Geologist and

fellow of the Society of Economic Geologists. He is a member of the

Society for Mining, Metallurgy & Exploration Inc., American

Institute of Professional Geologists (for which he is a Certified

Professional Geologist), the Denver Regional Exploration Society

and the American Association of Petroleum Geologists. Mr. Boberg is

also a director for Gold79 Mines Ltd. (formerly, Aura Resources

Inc.) (since June 2008).

The

Board of Directors has concluded that Mr. Boberg is well qualified

and should serve as a director on the basis of his contributions to

the Company since 2004 (since 2006 as a director and, from 2006

until 2011, as the President and CEO), as well as his more than 40

years of experience in mineral resources exploration and

development.

|

Thomas H. Parker, 78, M.Eng., P.E.

|

Lead Director, Chair of Audit Committee & Chair of Treasury

& Investment Committee

|

Mr.

Parker has worked extensively in senior management positions in the

mining industry, having begun his career in the mining industry 56

years ago. Mr. Parker is a mining engineer graduate from South

Dakota School of Mines, with a Master’s Degree in Mineral

Engineering Management from Penn State. Mr. Parker was President

and CEO, and a director of U.S. Silver Corporation until his

retirement in 2012. Prior to that, Mr. Parker was President

and CEO of Gold Crest Mines, Inc., before which he was the

President and CEO of High Plains Uranium, Inc., a junior uranium

mining company acquired by Energy Metals in 2007. Mr. Parker also

served for 10 years as Executive Vice President of Anderson and

Schwab, a management consulting firm. Prior to Anderson and Schwab,

Mr. Parker held many executive management positions including with

Costain Minerals Corporation, ARCO, Kerr McGee Coal Corporation and

Conoco. He also has worked in the potash, limestone, talc,

coal and molybdenum industries and has extensive experience working

in Niger, France and Venezuela.

The

Board of Directors has concluded that Mr. Parker is well qualified

and should serve as a director on the basis of his contributions to

the Company as a director since 2007 and, most recently, as our

Lead Director since 2014, as well as his more than 55 years of

experience in the mining industry and in executive management

positions.

|

Gary C. Huber, 69, PhD, P.Geo

|

Director, Chair of Compensation Committee & Chair of Corporate

Governance and Nominating Committee

|

Dr.

Huber is a mining executive with over 40 years of natural resources

experience. Previously, Dr. Huber served as a director for

Ur-Energy during 2007. Dr. Huber returned to serve as a director

for Ur-Energy in 2015. In the interim, Dr. Huber served as

President and CEO of Neutron Energy, Inc. (2007-2012), a privately

held uranium company which was conducting project feasibility

analyses as well as permitting of two uranium mines and a mill

complex. Dr. Huber is the founder, in 2006, and managing member of

Rangeland E&P, LLC, a private company established for oil and

gas exploration. Dr. Huber recently served as an independent

director of Gold Resource Corporation, a precious metal mining

company. He was chairman of its audit committee and a member of the

compensation committee. He also has served as an independent

director of Capital Gold Corp., a gold mining company with

operations in Mexico, and served on its audit and corporate

governance committees. Dr. Huber was one of the founders of

Canyon Resources Corporation in 1979, and served in various

capacities there until 2006, including as director, chief financial

officer, vice president of finance, treasurer and secretary. He

also served as the president and chief executive officer of CR

Minerals Corporation, an industrial minerals subsidiary of Canyon

Resources, from 1987 to 1998. Dr. Huber holds a PhD in geology

from Colorado School of Mines and received a Bachelor of Science in

geology from Fort Lewis College. He is a fellow of the Society of

Economic Geologists, where he previously served as the chairman of

its audit and investment committees; a member of the Society for

Mining, Metallurgy and Exploration, where he previously served as

the chairman of the audit committee. Dr. Huber served as a director

and treasurer of The Society of Independent Professional Earth

Scientists, a not-for-profit professional group. He also has served

as President of the Society of Independent Earth Scientists

Foundation, which awards scholarships to undergraduate and graduate

students majoring in the earth sciences fields. Dr. Huber

formerly was a director of the Denver Gold Group, a not-for-profit

industry association for publicly traded precious metal companies.

Dr. Huber is a Utah registered Professional Geologist.

The

Board of Directors has concluded that Dr. Huber is well

qualified and should serve as a director of the Company on the

basis of his earlier contributions to the Company as a director (in

2007, and since his return to the Board in 2015), and because of

his extensive mining industry experience including in areas of

natural resources development and mining operations, and executive

management and finance, developed by serving as an executive

officer and director of publicly-traded natural resource

companies.

|

Kathy E. Walker, 62, MBA

|

Director

|

Ms.

Walker is the President and Chief Executive Officer of Elm Street

Resources Inc., an energy marketing company based in Paintsville,

Kentucky. Ms. Walker is also the Director of the eKentucky Advanced

Manufacturing Institute, Inc., a workforce development training

facility in Eastern Kentucky. She brings more than 30 years’

experience in various energy and financial related business

endeavors to our Board. Ms. Walker holds an MBA from Xavier

University. Prior to starting Elm Street Resources, she served as

Secretary and Controller of Agip Coal, USA, a subsidiary of the

Italian National Energy Agency ENI. She is currently a member of

the National Coal Council; a member of the Kentucky Coal

Association; a member of the Kentucky Judicial Campaign Conduct

Committee; and the Chair of the Morehead State University Board of

Regents. Ms. Walker was a founder and board member of First

Security Bank, Lexington, Kentucky and of Great Nations Bank,

Norman, Oklahoma.

The

Board of Directors has concluded that Ms. Walker is well qualified

and should serve as a director of the Company on the basis of her

contributions to the Company as a director since 2017, and because

of her extensive energy-related business experience including in

areas of sales and marketing, executive management and finance,

developed by serving as an executive officer and director of

various entities.

|

Rob Chang, 43, MBA

|

Director

|

Rob

Chang has 26 years of experience in the financial services industry

and is a sought after expert in uranium markets. An experienced

senior executive, he currently sits on the boards of publicly

traded mineral resource companies. He is currently the Co-Founder

and Chief Executive Officer of Gryphon Digital Mining and his past

roles include serving as the Managing Director and Head of Metals

& Mining at Cantor Fitzgerald where he provided research

coverage in precious metals, base metals, lithium, and uranium. He

is well familiar with the uranium mining industry and is considered

a subject matter expert by several media outlets. He was recognized

by Bloomberg as the “Best Precious Metals Analyst” in

Q1 2016. Mr. Chang is frequently quoted by and a regular guest of

several media outlets including Bloomberg, Reuters, CNBC, and the

Wall Street Journal. Mr. Chang previously served as a Director of

Research and Portfolio Manager at Middlefield Capital, a Canadian

investment firm which managed $3 billion in assets. He was also on

a five-person multi-strategy hedge fund team where he specialized

in equity and derivative investments. Mr. Chang completed his MBA

at the University of Toronto’s Rotman School of Management.

Mr. Chang also serves as a director on the boards of Fission

Uranium Corp. (since April 2018) and Shine Mineral Corp. (since

November 2018).

The

Board of Directors has concluded that Mr. Chang is well qualified

and should serve as a director of the Company on the basis of his

contributions to the Board since 2018, and his extensive knowledge

of the financial markets and financial services industry, as well

as his knowledge of the uranium mining industry.

Re-Appointment

of PricewaterhouseCoopers LLP, Chartered Professional Accountants,

as our Independent Auditors and Approval for the Directors to Fix

the Remuneration of the Auditors

Appointment of Auditor

The

Audit Committee selected and has recommended the independent

accounting firm of PricewaterhouseCoopers LLP with respect to the

audit of our financial statements for the year ended December 31,

2021. At the Meeting, it is proposed to re-appoint

PricewaterhouseCoopers LLP, Chartered Professional Accountants, as

auditors of the Company, to serve until the next annual meeting of

shareholders with their remuneration to be fixed by the Board of

Directors.

In the

interests of safety, and in light of ongoing travel and gathering

conditions related to COVID-19, we currently expect that our Audit

Partner from PricewaterhouseCoopers LLP will participate in our

Meeting by telephone.

Independent Accountant Fees and Services

PricewaterhouseCoopers

LLP and its affiliates have been the auditors of Ur-Energy since

December 2004. The fees accrued for audit and audit-related

services performed by PricewaterhouseCoopers LLP in relation to our

financial years ended December 31, 2020 and 2019, paid and shown

below in C$, were as follows:

|

|

December 31,

2020

|

December 31,

2019

|

|

Audit

fees (1)

|

$171,200

|

$

209,475

|

|

Audit

related fees (2)

|

$

55,300

|

$

57,750

|

|

All

other fees (3)

|

$

59,810

|

$

21,129

|

|

Total

|

$286,310

|

$ 288,354

|

(1)

Audit fees

consisted of audit services, reporting on internal control over

annual financial reporting and review of such documents filed with

the securities regulators.

(2)

Audit related fees

were for services in connection with quarterly reviews of the

consolidated financial statements and review of such documents

filed with the securities regulators.

(3)

All other fees

include fees related to financing activities, if any, and our shelf

registration and at-market sales agreement. We have not incurred

audit fees billed for tax compliance, tax advice, and tax planning

services during either 2019 or 2020.

Audit Committee’s Pre-Approval Practice

All

services reflected in the preceding table for 2020 and 2019 were

pre-approved in accordance with the policy of the Audit Committee

of the Board of Directors

It is

proposed to approve an ordinary resolution to re-appoint the firm

of PricewaterhouseCoopers LLP, Chartered Professional Accountants,

as auditors of the Company to hold office until the close of the

next annual meeting of shareholders or until PricewaterhouseCoopers

LLP is removed from office or resigns, and to authorize the Board

of Directors of the Company to fix the remuneration of

PricewaterhouseCoopers LLP as auditors of the Company.

Recommendation of Ur-Energy’s Board of Directors

The Board of Directors recommends that the shareholders vote FOR

the re-appointment of PricewaterhouseCoopers LLP, Chartered

Professional Accountants, and to authorize the Board of Directors

of the Company to fix the remuneration of PricewaterhouseCoopers

LLP as auditors and, unless a shareholder gives

instructions on the proxy card to the contrary, the proxies

named thereon intend to so vote.

The

approval of Proposal No. 2 requires the approval of a majority of

the votes cast by shareholders (either in person or by proxy) at

the Meeting.

Proposal No. 3: Approval, on an Advisory Basis, of the

Compensation of the Company’s Named Executive

Officers

Advisory Vote on Named Executive Officer Compensation

In

accordance with SEC rules, our shareholders will be asked at the

Meeting to cast a non-binding advisory vote on the compensation of

our Named Executive Officers as disclosed in this Circular,

including the disclosures under “Compensation Program”

and “Executive Compensation” and the compensation

tables and related narrative disclosure. This vote is not intended

to address any specific item of compensation, but rather the

overall compensation of our Named Executive Officers and the

policies and practices described in this Circular.

We

conducted a similar advisory vote in 2020 and approximately 86% of

the votes cast at that meeting voted in favor of the compensation

of our Named Executive Officers. For the past five years, our

advisory “say on pay” vote has averaged above 90%. This

vote is advisory, which means that its outcome is not binding on

the Company, the Board of Directors or the Compensation Committee

of the Board of Directors.

We are

continuing our practice of having an annual say-on-pay advisory

vote, so the next advisory vote will occur at our annual meeting in

2022.

The

Compensation Committee and the Board of Directors believe that our

compensation policies and procedures are effective in achieving our

goals. As described under “Compensation Program” our

compensation program is designed to motivate executive officers and

employees to achieve pre-determined objectives without taking

excessive risks; provide competitive compensation and benefit

programs to attract and retain highly-qualified executives and

employees; encourage an ownership mentality; and, fundamentally, to

support the achievement of results. We believe that the

Company’s compensation program, with its balance of (i)

short-term incentives (including cash bonus awards and performance

conditions for such awards), (ii) long-term incentives (including

equity awards of stock options and restricted share units which

vest over varied periods of two to three years), and (iii) share

ownership guidelines for executive officers, reward sustained

performance that is aligned with long-term shareholder interests.

Shareholders are encouraged to read both “Compensation Program” and

“Executive

Compensation” sections below, as well as the

compensation tables and related narrative disclosure. Shareholders

will be asked to approve the following ordinary resolution (the

“Advisory Vote on Named Executive Officer Compensation

Resolution”) at the Meeting:

BE IT RESOLVED THAT the Company’s shareholders

approve, on an advisory basis, the compensation of the Named

Executive Officers, as disclosed in the Company’s Management

Proxy Circular for this annual and special meeting of shareholders,

including the “Compensation Program” and

“Executive Compensation” sections and the compensation

tables and related narrative disclosure.

Recommendation of Ur-Energy’s Board of Directors

The Board of Directors recommends that shareholders vote FOR

approval of the Advisory Vote on Named Executive Officer

Compensation Resolution.

The

approval of the advisory vote on Proposal No. 3 requires the

affirmative vote of a majority of the Common Shares present at the

meeting (either in person or by proxy). Although the advisory vote

is non-binding, the Board will review the results of the vote and

will take the results of the vote into account in determinations

concerning executive compensation.

Proposal No.

4: Approval of the

Amendments to the Ur-Energy Inc. Amended and Restated Restricted

Share Unit and Equity Incentive Plan (the “RSU&EI

Plan”)

At the

Meeting, shareholders will be asked to consider and pass a

resolution substantially in the form set out below, to approve and

ratify amendments to the Ur-Energy Inc. Amended and Restated

Restricted Share Unit and Equity Incentive Plan (the

“RSU&EI Plan”).

The

amendments to be approved allow for grants of (a) performance share

units (“PSUs”) and (b) direct issuance of Common Shares

(with or without conditions of vesting), as well as to change the

name of the plan. The amendments do not request any increase in the

percentage number of shares available for issuance under the

RSU&EI Plan. The RSU&EI Plan, including these recent

amendments, as approved by the Board of Directors, is summarized in

more detail under the heading “Stock Options and Amended and Restated

Restricted Share Unit and Equity Incentive Plan,”

below.

A copy

of the RSU&EI Plan is attached to this Circular as Schedule A. A

shareholder may also obtain a copy of the plan from the Secretary

of the Company upon request at 10758 West Centennial Road, Suite

200, Littleton, Colorado, 80127, telephone

720-981-4588.

As

amended, the RSU&EI Plan continues to include directors and

employees, including executive officers, of Ur-Energy as possible

eligible participants. As at April 13, 2021, there are 10 employees

and six non-executive directors who are eligible to participate in

the plan. As at April 13, 2021, the closing price of our Common

Shares on the NYSE American was $1.10 and on the TSX was

C$1.37.

The

Board of Directors believes that it is in the best interests of the

Company to amend the RSU&EI Plan in these ways to enhance our

compensation program and specifically our bonus programs, to

continue to permit the Board of Directors to grant RSUs and to

expand our long-term incentives to include PSUs and direct share

issuances of Common Shares (“DSIs”) to directors and

employees, including executive officers, of the Company and its

subsidiaries. The additional bonus alternatives that these

amendments provide also supports our continuing efforts to attract

and retain highly qualified directors and employees, including

executive officers, who will be motivated towards the success of

the Company. The RSU&EI Plan, including these amendments,

encourages share ownership in the Company by directors and

employees, including officers, who work on behalf of the

Company.

If at

the Meeting, the shareholders of the Company do not approve the

amendments as proposed, all currently outstanding RSUs and the

existing Amended and Restated Restricted Share Unit Plan (the

“Existing RSU Plan”) as previously approved by the

shareholders on May 2, 2019, will be unaffected, and future grants

will be made under the Existing RSU Plan in its form prior to the

amendments by the Board of Directors on April 13,

2021.

Because

the RSU&EI Plan participants and the amounts of any awards are

determined in the absolute discretion of the Board of Directors,

the benefits to be delivered under the amended RSU&EI Plan at

this time are indeterminable at this time.

BE

IT RESOLVED THAT:

1.

The amendments to

the Ur-Energy Inc. Amended and Restated Restricted Share Unit and

Equity Incentive Plan, as set forth fully in Schedule A to this

Circular (the “RSU&EI Plan”), be and are hereby

ratified, confirmed and approved; and

2.

Any director or

officer of the Company be and each of them is hereby authorized,

for and on behalf of the Company, to do such things and to sign,

execute and deliver all such documents that such director or

officer may, in their discretion, determine to be necessary or

useful in order to give full effect to the intent and purpose of

this resolution.

The

Board of Directors recommends that the shareholders vote FOR the

RSU&EI Plan Amendments Resolution.

The

TSX rules provide that all eligible insiders in order to

participate in the RSU&EI Plan may not vote on these

amendments. Accordingly, the RSU&EI Plan resolution must be

passed by a majority of votes cast by shareholders present in

person or represented by proxy at the meeting, excluding 5,674,838

Common Shares held by certain insiders of the Company and their

affiliates.

Identification of Executive Officers

|

Jeffrey T. Klenda, 64, B.A.

|

Chairman, President & Chief Executive Officer

|

Mr.

Klenda graduated from the University of Colorado in 1980 and began

his career as a stockbroker specializing in venture capital

offerings. Prior to founding Ur-Energy in 2004, he worked as a

Certified Financial Planner and was a member of the International

Board of Standards and Practices. In 1986, he started Klenda

Financial Services, an independent financial services company

providing investment advisory services to high-end individuals and

corporate clients as well as providing venture capital to

corporations seeking entry to the U.S. securities markets. In the

same year, Mr. Klenda formed Independent Brokers of America, Inc.,

a national marketing organization. He also served as President of

Security First Financial, a company he founded to provide

consultation to individuals and corporations seeking investment

management and early-stage funding. Over the last 35 years, Mr.

Klenda has acted as an officer and/or director for numerous

publicly traded companies, having taken his first company public at

28 years of age. Mr. Klenda has served as the Chairman of the Board

of Directors of the Company since 2006. He served as Executive

Director from January 2006 to May 2015. Thereafter, he served as

Acting Chief Executive Officer until being named President and

Chief Executive Officer by our Board of Directors in December

2016.

|

Roger L. Smith, 63, CPA,

MBA, CGMA

|

Chief Financial Officer and Chief Administrative

Officer

|

Mr.

Smith has 35 years of mining and manufacturing experience including

finance, accounting, IT, ERP and systems implementations, mergers,

acquisitions, audit, tax and public and private reporting in

international environments. Mr. Smith served as

Ur-Energy’s Chief Financial Officer and Vice President

Finance, IT and Administration until May 2011, when he assumed

the title and responsibilities of Chief Administrative Officer as

well as Chief Financial Officer. Mr. Smith joined Ur-Energy in

May 2007, after having served as Vice President, Finance for

Luzenac America, Inc., a subsidiary of Rio Tinto PLC and Director

of Financial Planning and Analysis for Rio Tinto Minerals, a

division of Rio Tinto PLC, from September 2000 to May 2007. Mr.

Smith has also held such positions as Vice President Finance,

Corporate Controller, Accounting Manager, and Internal Auditor with

companies such as Vista Gold Corporation, Westmont Gold Inc. and

Homestake Mining Corporation. He has a Master of Business

Administration and Bachelor of Arts in Accounting from Western

State Colorado University, Gunnison, Colorado.

|

Steven M. Hatten, 58, B.Sc.

|

Vice President Operations

|

Mr.

Hatten has served as Ur-Energy’s Vice President Operations

since 2011. Prior to that, Mr. Hatten was Ur-Energy’s

Engineering Manager from 2007 to 2010 and Director of Engineering

and Operations 2010 to 2011. He has over 25 years of experience

with a strong background in in

situ recovery uranium design and operations. He previously

worked as a Project Engineer for Power Resources, Inc., the Manager

Wellfield Operations for Rio Algom Mining Corp. and Operations

Manager at Cameco’s Smith Ranch – Highland Facility.

Mr. Hatten has a Bachelor of Science in petroleum Engineering from

Texas Tech University.

|

John W. Cash, 48, M.Sc.

|

Vice President Regulatory Affairs

|

Mr.

Cash has been our Vice President Regulatory Affairs since 2014.

Previously, he was named Vice President Regulatory Affairs,

Exploration & Geology in 2011 and served in that capacity until

March 2014. Prior to 2011, Mr. Cash was our Environment, Health,

Safety and Regulatory Affairs Manager from 2007 to 2010 and

Director of Regulatory Affairs 2010 to 2011. He previously worked

for Crow Butte Resources, Inc. a subsidiary of Cameco, from 2002 to

2007, including as Senior Environmental/Safety Superintendent,

Safety Director/Wellfield Supervisor and Operations Superintendent.

Prior to that time, Mr. Cash also worked in uranium exploration. He

is a Fellow of the World Nuclear University Summer Institute, 2005.

Mr. Cash has a Master of Science in geology and geophysics from the

University of Missouri-Rolla.

|

Penne A. Goplerud, 59, JD

|

General Counsel & Corporate Secretary

|

Ms.

Goplerud has 25 years of diverse legal experience in complex

litigation, business matters and natural resources transactions.

She was named General Counsel and Corporate Secretary of the

Company in 2011, having joined Ur-Energy as its Associate General

Counsel in 2007. While in private practice, she represented clients

in commercial litigation, arbitration and mediation involving

mining, oil and gas, commercial and corporate disputes, securities

and environmental law. She also has counseled business clients and

represented clients in the negotiation of business transactions.

Prior to joining Ur-Energy, much of Ms. Goplerud’s practice

focused on natural resources work in the U.S. and abroad. Ms.

Goplerud obtained her JD from the University of Iowa College of

Law.

We are

a “smaller reporting company” as defined by SEC

regulations. As a result, we are not required to include a

comprehensive Compensation Discussion and Analysis in this

Circular. We are providing, voluntarily, certain of the information

that would typically be contained in a Compensation Discussion and

Analysis section in an effort to provide our shareholders with

additional information regarding our executive compensation

policies, practices and plans, and in order to provide context for

your consideration of our advisory ‘say on pay’

proposal.

Compensation Program

We

believe that the caliber and commitment of our executive officers

are critical to our continued success and performance, and the

overall commitment of all of our employees. The Compensation

Committee reviews and makes recommendations to the Board with

respect to the overall approach to compensation for all of our

employees, and specifically with respect to our executive officers,

including the Chief Executive Officer, Jeffrey Klenda, and the

remuneration of directors.

Pursuant

to our obligations of disclosure as a smaller reporting company,

our named executive officers (“Named Executive

Officers” or “NEOs”) for 2020 were:

●

Jeffrey T. Klenda,

Chairman, President and CEO

●

Roger L. Smith,

Chief Financial Officer and Chief Administrative

Officer

●

Penne A. Goplerud,

General Counsel and Corporate Secretary

We

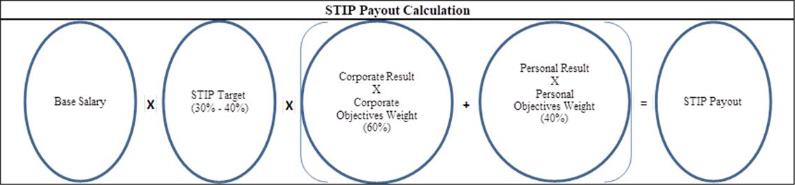

maintain a compensation program in which both performance and

compensation are routinely evaluated. Further, we maintain a

program in which (a) pay for performance is supported by a

significant percentage of executive pay being at risk (50% of CEO

compensation; 45% of other executive officers); (b) motivating

executive officers to create shareholder value by using total

shareholder return as a part of the Company’s “Total

Company” objectives; (c) performance by all employees on

personal objectives and corporate objectives is evaluated, with

executive officers’ short-term incentive bonus awards being

more closely aligned to performance on corporate objectives (60%)

based upon the greater opportunity, and responsibility, to shape

corporate performance (hourly and non-managerial staff bonuses are

more heavily weighted to their personal objectives) with generally

80% of an executive’s long-term incentive is based upon stock

options; (d) certain defined thresholds must be reached as a

minimum level of performance, typically 50% of the target (or, a

score of 2 on our 1-4 scale), before eligibility for payout on any

objective and, by contrast, short-term incentive bonuses are

effectively capped, as the maximum level of performance for each

objective is typically set at 150% of the target (or, a score of 4

on our 1-4 scale); (e) reasonable salaries and overall compensation

packages are based upon regularly updated compensation surveys and

ongoing review of peer comparators’ practices; (f) compliance

with executive stock ownership guidelines is routinely monitored;

(g) we have no multi-year contracts with executive employees, and

our employment agreements with executive officers protect

specialized and proprietary information, and contacts with

personnel obtained while employed with the Company; (h) we do not

permit repricing of stock options; (i) executives are not

permitted to hedge their beneficially-held Company’s shares;

and (j) we have adopted a clawback policy, all as discussed further

below.

Our

compensation program is designed to effectively link compensation

to performance as demonstrated by the completion by our executive

officers of corporate and personal objectives that are designed to

drive creation of shareholder value. The Compensation Committee

believes that it is important to maintain a clear link between the

achievement of these objectives and compensation payout. We have

thoughtfully reviewed the metrics and priorities most appropriately

used to establish and maintain that connection. In doing so, we

consider:

●

the

selection of corporate and personal objectives that are measurable

and tied to shareholder value creation, which is fundamental to our

success as a company;

●

executive

officers should be evaluated and paid based on performance and

achievement of both corporate and personal objectives;

and

●

executive

officers should have a clear understanding of how their performance

and the achievement of pre-determined objectives may influence

their compensation.

The

objectives of our compensation program are to support the

achievement of results; motivate executive officers to achieve

pre-determined objectives without taking excessive risks; provide

competitive compensation and benefit programs to attract and retain

highly qualified executives; and encourage an ownership mentality,

which is further augmented through share ownership guidelines for

all executive officers.

Our

compensation program continues to follow the same progression

throughout the year:

●

Setting Objectives: Establishment of

department and corporate objectives, followed by personal

objectives being approved, in conjunction with the approved budget

and our key performance objectives.

●

LTIP Awards to Incentivize: As a part

of this step, the Compensation Committee recommends, and the Board

considers and approves the annual grant of stock options and RSUs

to those eligible for consideration. If its amendments are approved

by the shareholders at the Meeting, the RSU&EI Plan will permit

the Compensation Committee to grant other equity incentive awards

to eligible participants. See also “Equity Incentive Plans,”

below.

●

Performance Review: Annually, in the

first quarter, we review our performance during the past year,

initially with a determination of performance on corporate

objectives (reviewed by the Compensation Committee and our Board).

Performance of all staff is reviewed; executive officers are

evaluated by the Chief Executive Officer and the Compensation

Committee; and, the Chief Executive Officer is evaluated by the

Compensation Committee and the Board of Directors. Based upon these

performance assessments, bonuses are determined and awarded, in the

discretion of the Compensation Committee and Board. See further

discussion under “Short Term

Incentive Plan” below.

●

COLA and Salary Revies: Cost-of-living

adjustments to salaries are typically considered mid-year when best

data are available. Contemporaneously, a salary survey is

completed, with staff salaries adjusted to the findings of the

survey, as necessary, and/or for merit increases.

Compensation Structure

Our

compensation program consists of base salary, short- and long-term

incentives, and other perquisites. The components of total direct

compensation relate to performance as follows:

Employment Agreements with Named Executive Officers

We have

employment agreements with each of our current executive officers.

The agreements contain standard employment provisions, as well as

salary, entitlement to a cash bonus to be determined in the

discretion of the Board, and statements of eligibility for Company

benefits (health and wellness benefits, paid time off, 401(k)

plan), and equity compensation plans (stock option and RSU plans).

The agreements also provide for post-termination obligations of the

executives (one-year non-solicitation provisions applicable to all

executive officers; and one-year non-competition provisions in the

agreements of Messrs. Hatten and Cash). Post-termination

obligations of the Company with respect to the NEOs, including in

an event of change of control, are discussed and summarized below

under the heading “Potential

Payments Upon Termination or Change of Control.” The

Compensation Committee reviews the employment agreements of and

compensation program for the executive officers on a periodic

basis.

Objectives to be Met Through “Pay Mix”

The

compensation program is designed to provide motivation and

incentives to our executive officers and employees with a view

toward enhancing shareholder value and successfully implementing

our corporate objectives. The compensation program accomplishes

this by rewarding performance that is designed to create

shareholder value. The portion of variable, at-risk,

performance-based compensation is commensurate to an executive

officer’s or employee’s position and increases as their

respective level of responsibility increases. Further, the mix and

structure of compensation is designed to strike an appropriate

balance to achieve pre-determined objectives without motivating

excessive risk taking.

Our

share price may be heavily influenced by changes in uranium and

other commodity prices, which are outside of our control. As a

result, the compensation program is designed to focus on areas

where the executive officers and employees have the most influence.

To achieve this, a combination of operational, financial and share

price criteria are utilized when selecting corporate and personal

objectives and establishing an appropriate combination of

pay.

The

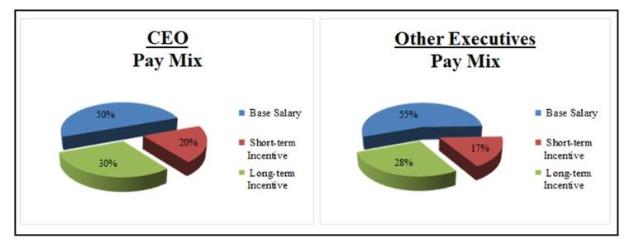

compensation structure and “pay mix” in place for 2020

for our CEO and other executive officers was as

follows:

The

characteristics of the compensation program’s mix of pay, as

they relate to the executive officers, include:

●

a

significant portion of executive pay is at-risk;

●

executive

officers have a higher percentage of at-risk compensation relative

to other employees, because they have the greatest ability to

influence corporate performance;

●

60% of an executive’s short-term incentive

is based on corporate performance; and

●

80%

of an executive’s long-term incentive is composed of stock

options, which are highly leveraged to our share price

performance.

The