|

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED December 31, 2013

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD OF _________ TO _________.

|

|

Canada

|

|

Not Applicable

|

|

State or other jurisdiction of incorporation or organization

|

|

(I.R.S. Employer Identification No.)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Shares, no par value

|

|

NYSE MKT

|

|

|

|

|

Page

|

|

PART I

|

|||

|

|

|

|

|

|

Items 1 and 2.

|

Business and Properties

|

|

5

|

|

Item 1A.

|

Risk Factors

|

|

19

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

25

|

|

Item 3.

|

Legal Proceedings

|

|

25

|

|

Item 4.

|

Mine Safety Disclosure

|

|

25

|

|

|

|

|

|

|

PART II

|

|||

|

|

|

|

|

|

Item 5.

|

Market for Registrant’s Common Equity and Related Stockholder Matters

|

|

26

|

|

Item 6.

|

Selected Financial Data

|

|

29

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

31

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

|

43

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

45

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

45

|

|

Item 9A.

|

Controls and Procedures

|

|

45

|

|

Item 9B.

|

Other Information |

|

|

|

|

|

|

|

|

PART III

|

|||

|

|

|

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

47

|

|

Item 11.

|

Executive Compensation

|

|

55

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder

Matters

|

|

70

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

71

|

|

Item 14.

|

Principal Accounting Fees and Services

|

|

72

|

|

|

|

|

|

|

PART IV

|

|||

|

|

|

|

|

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

|

73

|

|

|

Signatures

|

|

75

|

| 1 | ||

| 2 | ||

| Mineral Resource | is a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. CIM Definition Standards; Canadian National Instrument 43-101 (“NI 43-101”), Section 1.1. |

| Inferred Mineral Resource | is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. CIM Definition Standards; NI 43-101, Section 1.1. |

| Indicated Mineral Resource | is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. CIM Definition Standards; NI 43-101, Section 1.1. |

| Measured Mineral Resource | is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. CIM Definition Standards; NI 43-101, Section 1.1. | |

| Lithology |

is a description of a rock; generally its physical nature. The description would address such things as grain size, texture, rounding, and even chemical composition. A lithologic description would be: coarse grained well rounded quartz sandstone with 10% pink feldspar and 1% muscovite.

|

|

| PFN | is a modern geologic logging method known as Prompt Fission Neutron. PFN is considered a direct measurement of true uranium concentration (% U3O8) and is used to verify the grades of mineral intercepts previously reported by gamma logging. PFN logging is accomplished by a down-hole probe in much the same manner as gamma logs, however only the mineralized interval plus a buffer interval above and below are logged. |

| BLM | U.S. Bureau of Land Management |

| CERCLA | Comprehensive Environmental Response and Liability Act |

| CIM | Canadian Institute of Mining, Metallurgy and Petroleum |

| DDW | Deep Disposal Well |

| eU3O8 | equivalent U3O8 as measured by a calibrated gamma instrument |

| EMT | East Mineral Trend, located within our LC East Project (Great Divide Basin, Wyoming) |

| EPA | U.S. Environmental Protection Agency |

| GDB | Great Divide Basin, Wyoming |

| GPM | Gallons per minute |

| GT | Grade x Thickness product (% ft) of a mineral intercept (expressed without units) |

| IX | Ion Exchange |

| 3 | ||

| ISR | In Situ Recovery (literally, ‘in place’ recovery) |

| MMT | Main Mineral Trend, located within our Lost Creek Project (Great Divide Basin, Wyoming) |

| MU | Mine Unit (also referred to as wellfield) |

| NI 43-101 | Canadian National Instrument 43-101 (Standards of Disclosure for Mineral Properties) |

| NRC | U.S. Nuclear Regulatory Commission |

| PEA | Preliminary Economic Assessment |

| RCRA | Resource Conservation and Recovery Act |

| U | Uranium in its natural isotopic ratios |

| UIC | Underground Injection Control (pursuant to U.S. Environmental Protection Agency regulations) |

| U3O8 | A standard chemical formula commonly used to express the natural form of uranium mineralization. U represents uranium and O represents oxygen. |

| USFWS | U.S. Fish and Wildlife Service |

| WDEQ | Wyoming Department of Environmental Quality (and its various divisions, LQD/Land Quality Division, WQD/Water Quality Division; AQD/Air Quality Division; and Solid and Hazardous Waste Division) |

| WEQC | Wyoming Environmental Quality Council | |

| WGFD | Wyoming Game and Fish Department |

|

Imperial Measure

|

|

Metric Unit

|

|

Metric Unit

|

|

Imperial Measure

|

|

0.03215 troy ounces

|

|

1 gram

|

|

31.1035 grams

|

|

1 troy ounce

|

|

2.4711 acres

|

|

1 hectare

|

|

0.4047 hectares

|

|

1 acre

|

|

2.2046 pounds

|

|

1 kilogram

|

|

0.4536 kilograms

|

|

1 pound

|

|

0.6214 miles

|

|

1 kilometer

|

|

1.6093 kilometers

|

|

1 mile

|

|

3.2808 feet

|

|

1 meter

|

|

0.3048 meters

|

|

1 foot

|

|

1.1023 short tons

|

|

1 tonne

|

|

0.9072 tonnes

|

|

1 short ton

|

| 4 | ||

| 5 | ||

| 6 | ||

| 7 | ||

| 8 | ||

|

|

|

MEASURED

|

|

INDICATED

|

|

INFERRED

|

|

|||||||||||||||

|

|

|

AVG

|

|

SHORT

|

|

|

|

AVG

|

|

SHORT

|

|

|

|

AVG

|

|

SHORT

|

|

|

|

|||

|

PROJECT

|

|

GRADE

|

|

TONS

|

|

LBS

|

|

GRADE

|

|

TONS

|

|

LBS

|

|

GRADE

|

|

TONS

|

|

LBS

|

|

|||

|

|

|

% eU3O8

|

|

(X 1000)

|

|

(X 1000)

|

|

% eU3O8

|

|

(X 1000)

|

|

(X 1000)

|

|

% eU3O8

|

|

(X 1000)

|

|

(X 1000)

|

|

|||

|

LOST CREEK

|

|

0.058

|

|

|

3,117

|

|

3,590

|

|

0.052

|

|

|

2,350

|

|

2,444

|

|

0.057

|

|

|

1,836

|

|

2,085

|

|

|

LC EAST

|

|

0.054

|

|

|

1,175

|

|

1,260

|

|

0.040

|

|

|

1,690

|

|

1,361

|

|

0.046

|

|

|

1,666

|

|

1,533

|

|

|

LC NORTH

|

|

——

|

|

|

——

|

|

——

|

|

——

|

|

|

——

|

|

——

|

|

0.049

|

|

|

489

|

|

482

|

|

|

LC SOUTH

|

|

——

|

|

|

——

|

|

——

|

|

——

|

|

|

——

|

|

——

|

|

0.042

|

|

|

710

|

|

603

|

|

|

LC WEST

|

|

——

|

|

|

——

|

|

——

|

|

——

|

|

|

——

|

|

——

|

|

0.109

|

|

|

17

|

|

37

|

|

|

EN

|

|

——

|

|

|

——

|

|

——

|

|

——

|

|

|

——

|

|

——

|

|

——

|

|

|

——

|

|

——

|

|

|

GRAND TOTAL

|

|

0.057

|

|

|

4,292

|

|

4,850

|

|

0.048

|

|

|

4,039

|

|

3,805

|

|

0.051

|

|

|

4,718

|

|

4,740

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEASURED + INDICATED =

|

|

8,332

|

|

8,655

|

|

|

|

|

|

|

|

|

|||||

| 9 | ||

| 1. | Sum of Measured and Indicated tons and pounds may not add to the reported total due to rounding. |

| 2. |

Mineral resources that are not mineral reserves do not have demonstrated economic viability.

|

| 3. |

Based on grade cutoff of 0.02 percent eU3O8 and a grade x thickness cutoff of 0.3 GT.

|

| 4. | Typical ISR industry practice is to apply a GT cutoff in the range of 0.3 which has generally been determined to be a viable cut-off value. This 0.3 GT cutoff was used in this evaluation without direct relation to an associated price. |

| 5. | Measured, Indicated, and Inferred Mineral Resources as defined in Section 1.2 of NI 43-101 (CIM Definition Standards). |

| 6. | Resources are reported through August 31, 2013. |

| 10 | ||

| 11 | ||

| 12 | ||

| 13 | ||

| 14 | ||

|

December 31

of [year] |

|

2008

|

|

2009

|

|

2010

|

|

2011

|

|

2012

|

|

2013

|

|

||||||

|

Spot price (US$)

|

|

$

|

52.50

|

|

$

|

44.50

|

|

$

|

62.25

|

|

$

|

51.88

|

|

$

|

43.38

|

|

$

|

34.50

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LT price (US$)

|

|

$

|

70.00

|

|

$

|

61.00

|

|

$

|

66.00

|

|

$

|

62.00

|

|

$

|

56.50

|

|

$

|

50.00

|

|

|

End of [month]

|

|

Aug-13

|

|

Sep-13

|

|

Oct-13

|

|

Nov-13

|

|

Dec-13

|

|

Jan-14

|

|

Feb-14

(wk of 2.24.14) |

|

|||||||

|

Spot price (US$)

|

|

$

|

34.50

|

|

$

|

35.00

|

|

$

|

34.50

|

|

$

|

36.08

|

|

$

|

34.50

|

|

$

|

35.45

|

|

$

|

35.55

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LT price (US$)

|

|

$

|

54.00

|

|

$

|

50.50

|

|

$

|

50.00

|

|

$

|

50.00

|

|

$

|

50.00

|

|

$

|

50.00

|

|

$

|

50.00

|

|

| 15 | ||

| 16 | ||

| 17 | ||

| 18 | ||

| 19 | ||

| 20 | ||

| · | geological and engineering estimates that have inherent uncertainties and the assumed effects of regulation by governmental agencies; |

| · | the judgment of the engineers preparing the estimate; |

| · | estimates of future uranium prices and operating costs; |

| · | the quality and quantity of available data; |

| · | the interpretation of that data; and |

| · | the accuracy of various mandated economic assumptions, all of which may vary considerably from actual results. |

| 21 | ||

| 22 | ||

| 23 | ||

| 24 | ||

|

|

|

TSX

|

|

|||||||

|

|

|

Common Shares

|

|

|||||||

|

|

|

Volume

|

|

High

|

|

Low

|

|

|||

|

Quarter Ending

|

|

|

|

CDN$

|

|

|||||

|

March 31, 2012

|

|

|

10,271,200

|

|

|

1.49

|

|

|

0.86

|

|

|

June 30, 2012

|

|

|

3,882,400

|

|

|

1.23

|

|

|

0.75

|

|

|

September 30, 2012

|

|

|

10,524,400

|

|

|

1.21

|

|

|

0.64

|

|

|

December 31, 2012

|

|

|

6,227,000

|

|

|

1.04

|

|

|

0.70

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2013

|

|

|

4,510,300

|

|

|

0.98

|

|

|

0.73

|

|

|

June 30, 2013

|

|

|

8,373,000

|

|

|

1.37

|

|

|

0.76

|

|

|

September 30, 2013

|

|

|

8,248,800

|

|

|

1.41

|

|

|

0.96

|

|

|

December 31, 2013

|

|

|

7,312,500

|

|

|

1.57

|

|

|

1.02

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 1, 2014 to February 24, 2014

|

|

|

2,874,600

|

|

|

1.67

|

|

|

1.36

|

|

|

|

|

NYSE MKT

|

|

|||||||

|

|

|

Common Shares

|

|

|||||||

|

|

|

Volume

|

|

High

|

|

Low

|

|

|||

|

Quarter Ending

|

|

|

|

|

US$

|

|

||||

|

March 31, 2012

|

|

|

28,016,400

|

|

|

1.50

|

|

|

0.85

|

|

|

June 30, 2012

|

|

|

31,766,700

|

|

|

1.24

|

|

|

0.72

|

|

|

September 30, 2012

|

|

|

22,025,600

|

|

|

1.23

|

|

|

0.63

|

|

|

December 31, 2012

|

|

|

11,971,600

|

|

|

1.08

|

|

|

0.70

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2013

|

|

|

11,184,300

|

|

|

0.98

|

|

|

0.72

|

|

|

June 30, 2013

|

|

|

33,595,300

|

|

|

1.34

|

|

|

0.74

|

|

|

September 30, 2013

|

|

|

30,110,900

|

|

|

1.39

|

|

|

0.92

|

|

|

December 31, 2013

|

|

|

35,868,000

|

|

|

1.48

|

|

|

1.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 1, 2014 to February 24, 2014

|

|

|

17,691,200

|

|

|

1.51

|

|

|

1.22

|

|

| 25 | ||

|

|

|

|

Number of

Common Shares to be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

|

|

Weighted Average

Exercise Price of Outstanding Options, Warrants and Rights (C$) |

|

|

Number of Common

Shares Remaining for Future Issuance (Excluding Common Shares to be Issued Upon Exercise of Outstanding Options, Warrants and Rights) |

|

|

Equity compensation plans approved by securityholders(1)

|

|

|

9,965,2269

|

|

$

|

1.27

|

(2)

|

|

1,352,811

|

(3)

|

|

Equity compensation plans not approved by securityholders

|

|

|

-

|

|

|

-

|

|

|

-

|

|

| 26 | ||

| (1) |

Our shareholders have approved both the Ur-Energy Inc. Amended and Restated Stock Option Plan 2005, as amended, and the Ur-Energy Inc. Amended Restricted Share Unit Plan.

|

| (2) |

The exercise price represents the weighted exercise price of the 9,273,659 outstanding stock options.

|

|

| (3) |

Represents 1,065,872 Common Shares remaining available for issuance under the Ur-Energy Inc. Amended and Restated Stock Option Plan 2005 and 286,939 Common Shares available under the Ur-Energy Amended Restricted Share Unit Plan.

|

| 27 | ||

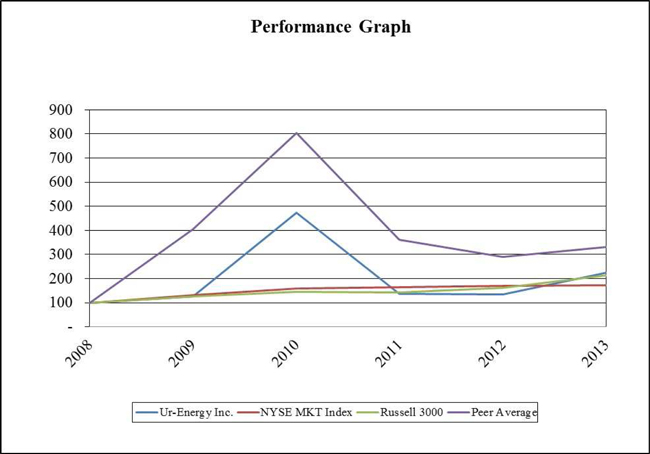

|

|

|

2008

|

|

2009

|

|

2010

|

|

2011

|

|

2012

|

|

2013

|

|

||||||

|

Ur-Energy Inc.

|

|

|

100

|

|

|

125

|

|

|

474

|

|

|

137

|

|

|

133

|

|

|

223

|

|

|

NYSE MKT Index

|

|

|

100

|

|

|

131

|

|

|

158

|

|

|

163

|

|

|

169

|

|

|

174

|

|

|

Russell 3000

|

|

|

100

|

|

|

125

|

|

|

144

|

|

|

143

|

|

|

163

|

|

|

213

|

|

|

Peer Average

|

|

|

100

|

|

|

404

|

|

|

805

|

|

|

360

|

|

|

290

|

|

|

331

|

|

| 28 | ||

|

|

|

As of December 31

|

|

|||||||||||||

|

|

|

2013

|

|

2012

|

|

2011

|

|

2010

|

|

2009

|

|

|||||

|

Working capital

|

|

|

2,266

|

|

|

15,608

|

|

|

22,541

|

|

|

33,216

|

|

|

40,492

|

|

|

Current assets

|

|

|

10,432

|

|

|

18,210

|

|

|

23,566

|

|

|

34,047

|

|

|

41,490

|

|

|

Total assets

|

|

|

105,336

|

|

|

69,469

|

|

|

64,565

|

|

|

75,991

|

|

|

79,777

|

|

|

Current liabilities

|

|

|

8,166

|

|

|

2,602

|

|

|

1,025

|

|

|

831

|

|

|

998

|

|

|

Long-term liabilities

|

|

|

58,506

|

|

|

1,244

|

|

|

551

|

|

|

503

|

|

|

480

|

|

|

Shareholders equity

|

|

|

38,664

|

|

|

65,623

|

|

|

62,989

|

|

|

74,657

|

|

|

78,299

|

|

|

|

|

|

Years ended December 31

|

|

||||||||||||

|

|

|

2013

|

|

2012

|

|

2011

|

|

2010

|

|

2009

|

|

|||||

|

Revenue

|

|

|

7,616

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Net loss for the period

|

|

|

(30,353)

|

|

|

(17,597)

|

|

|

(16,443)

|

|

|

(15,934)

|

|

|

(16,872)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per common share:

Basic and diluted |

|

|

(0.25)

|

|

|

(0.15)

|

|

|

(0.16)

|

|

|

(0.16)

|

|

|

(0.18)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per common share

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

| 29 | ||

| 30 | ||

|

Highlights

|

|

Unit

|

|

2013

|

|

2012 1

|

|

Change

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pounds captured within the plant

|

|

|

lb

|

|

|

190,365

|

|

n/a

|

|

n/a

|

|

|

Cash cost per pound captured

|

|

|

$/lb

|

|

$

|

4.82

|

|

n/a

|

|

n/a

|

|

|

Non-cash cost per pound captured

|

|

|

$/lb

|

|

$

|

8.36

|

|

n/a

|

|

n/a

|

|

|

Wellfield cash cost 2

|

|

|

$000

|

|

$

|

917

|

|

n/a

|

|

n/a

|

|

|

Wellfield non-cash cost 2

|

|

|

$000

|

|

$

|

1,592

|

|

n/a

|

|

n/a

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pounds packaged in drums

|

|

|

lb

|

|

|

131,216

|

|

n/a

|

|

n/a

|

|

|

Cash cost per pound drummed

|

|

|

$/lb

|

|

$

|

16.73

|

|

n/a

|

|

n/a

|

|

|

Non-cash cost per pound drummed

|

|

|

$/lb

|

|

$

|

1.19

|

|

n/a

|

|

n/a

|

|

|

Plant cash cost 3

|

|

|

$000

|

|

$

|

2,196

|

|

n/a

|

|

n/a

|

|

|

Plant non-cash cost 3

|

|

|

$000

|

|

$

|

156

|

|

n/a

|

|

n/a

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pounds shipped to conversion facility

|

|

|

lb

|

|

|

94,827

|

|

n/a

|

|

n/a

|

|

|

Cash cost per pound shipped

|

|

|

$/lb

|

|

$

|

0.34

|

|

n/a

|

|

n/a

|

|

|

Non-cash cost per pound shipped

|

|

|

$/lb

|

|

|

nil

|

|

n/a

|

|

n/a

|

|

|

Distribution cash cost 4

|

|

|

$000

|

|

$

|

33

|

|

n/a

|

|

n/a

|

|

|

Distribution non-cash cost 4

|

|

|

$000

|

|

|

nil

|

|

n/a

|

|

n/a

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pounds sold

|

|

|

lb

|

|

|

90,000

|

|

n/a

|

|

n/a

|

|

|

Average spot price 5

|

|

|

$/lb

|

|

|

n/a

|

|

n/a

|

|

n/a

|

|

|

Average long-term contract price

|

|

|

$/lb

|

|

$

|

62.92

|

|

n/a

|

|

n/a

|

|

|

Average price

|

|

|

$/lb

|

|

$

|

62.92

|

|

n/a

|

|

n/a

|

|

|

Average realized price 6

|

|

|

$/lb

|

|

$

|

55.34

|

|

n/a

|

|

n/a

|

|

|

Net sales 6

|

|

|

$000

|

|

$

|

4,981

|

|

n/a

|

|

n/a

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash cost per pound sold

|

|

|

$/lb

|

|

$

|

21.98

|

|

n/a

|

|

n/a

|

|

|

Non-cash cost per pound sold

|

|

|

$/lb

|

|

$

|

12.41

|

|

n/a

|

|

n/a

|

|

|

Total cost per pound sold

|

|

|

$/lb

|

|

$

|

34.40

|

|

n/a

|

|

n/a

|

|

|

Cost of sales 7

|

|

|

$000

|

|

$

|

3,096

|

|

n/a

|

|

n/a

|

|

| 31 | ||

|

1

|

Lost Creek commenced production in 2013. There was no production in 2012

|

|

2

|

Wellfield costs include all wellfield operating costs plus amortization of the related mineral property acquisition costs and depreciation of the related asset retirement obligation costs. Wellfield construction and development costs, which include wellfield drilling, header houses, pipelines, power lines, roads, fences and disposal wells, are treated as development expense and are not included in wellfield operating costs.

|

|

3

|

Plant costs include all plant operating costs, site overhead costs and depreciation of the related plant construction and asset retirement obligation costs.

|

|

4

|

Distribution costs include all shipping costs and costs charged by the conversion facility for weighing, sampling, assaying and storing the U3O8 prior to sale.

|

|

5

|

There were no spot sales in 2013.

|

|

6

|

Net sales revenues and the average realized price are net of county ad valorem and state severance taxes and do not include $2,635,000 recognized from the gain on assignment of deliveries under long-term contracts because the additional revenue would distort the average realized price per pound.

|

|

7

|

Cost of sales include all production costs (notes 2, 3 and 4) adjusted for changes in inventory values.

|

|

Average Price Realized Per Pound Reconciliation

|

|

Unit

|

|

2013

|

|

2012

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Sales 1

|

|

|

$000

|

|

$

|

5,663

|

|

n/a

|

|

|

Ad valorem and severance taxes

|

|

|

$000

|

|

$

|

(682)

|

|

n/a

|

|

|

Net sales (a)

|

|

|

$000

|

|

$

|

4,981

|

|

n/a

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pounds sold (b)

|

|

|

lb

|

|

|

90,000

|

|

n/a

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average price realized per pound (a ÷ b)

|

|

|

$/lb

|

|

$

|

55.34

|

|

n/a

|

|

|

|

1

|

Does not include $2,635,000 recognized from the gain on assignment of deliveries under long-term contracts because the additional revenue would distort the average realized price per pound.

|

|

Cost Per Pound Sold Reconciliation

|

|

Unit

|

|

2013

|

|

2012

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Wellfield costs

|

|

|

$000

|

|

$

|

2,509

|

|

n/a

|

|

|

Plant costs

|

|

|

$000

|

|

$

|

2,352

|

|

n/a

|

|

|

Distribution costs

|

|

|

$000

|

|

$

|

33

|

|

n/a

|

|

|

Inventory change

|

|

|

$000

|

|

$

|

(2,053)

|

|

n/a

|

|

|

Cost of sales (a)

|

|

|

$000

|

|

$

|

3,096

|

|

n/a

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pounds sold (b)

|

|

|

lb

|

|

|

90,000

|

|

n/a

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost per pound sold (a ÷ b)

|

|

|

$/lb

|

|

$

|

34.40

|

|

n/a

|

|

| 32 | ||

| 33 | ||

| 34 | ||

| 2013 Corporate Objectives | Results | |||||

| Advance the Lost Creek Project | ||||||

| · | Achieve production | · | Wellfield production was achieved in Q3. Drummed production was achieved in Q4 | |||

| · | NI 43-101 resource expansion | · | Lost Creek Updated Preliminary Economic Assessment completed in Q4 with resource expansion | |||

| · | Removed only privately-held production royalty in non-cash purchase agreement | |||||

| Pathfinder Mines Corporation | ||||||

| · | Complete acquisition | · | Transaction closed in Q4. The acquisition was completed at a cash cost 50% below the original purchase price. | |||

| · | Bring resources into NI 43-101 compliance | · | Resources not brought into NI 43-101 compliance following Q4 closing, but work is currently in progress | |||

| Production Profile | ||||||

| · | Rationalize project holdings | · | Existing holdings held, reduced or abandoned accordingly | |||

| · | Identify project priorities | · | Projects were re-prioritized following the Pathfinder acquisition | |||

| Corporate Finance | ||||||

| · | Maintain adequate cash position to advance Lost Creek | · | A combination of debt and equity financings was used to meet cash requirements | |||

| Investor and Public Relations | ||||||

| · | Develop event plans and budgets | · | Events were planned, selected and budgeted | |||

| · | Measure event results | · | Metrics recorded, evaluation in progress. | |||

| Corporate Branding | ||||||

| · | Develop and implement internal corporate branding program | · | Program selected and partially implemented | |||

| 35 | ||

| · | Stabilize operations and production rates |

| · | Establish spending patterns and reduce costs |

| · | Implement reverse osmosis and water management modifications |

| · | Timely manage all permitting activities |

| · | Integrate operations and regulatory activities |

| · | Bring Shirley Basin resources into NI 43-101 compliance |

| · | Initiate mine planning and permitting activities |

| · | Initiate organization and analysis of acquired data |

| · | Rationalize and prioritize project holdings |

| · | Identify expansion opportunities |

| · | Forecast and manage cash resources |

| · | Enhance operating and cost reporting systems |

| · | Review compensation & benefit programs |

| · | Complete internal corporate branding program and develop external program |

| · | Strive for no lost-time accidents and reduce injury frequency rates |

| · | Comply with or exceed regulatory compliance requirements |

| · | Achieve budgeted production, earnings and cash flow targets |

|

|

|

Year ended December 31,

|

|

||

|

|

|

2013

|

|

2012

|

|

|

|

|

$

|

|

$

|

|

|

Revenue

|

|

7,616

|

|

Nil

|

|

|

Cost of revenues

|

|

3,096

|

|

Nil

|

|

|

Gross profit

|

|

4,520

|

|

Nil

|

|

|

Exploration and evaluation expense

|

|

2,385

|

|

3,285

|

|

|

Development expense

|

|

18,465

|

|

8,979

|

|

|

General and administrative expense

|

|

5,592

|

|

6,107

|

|

|

Write-off of mineral properties

|

|

1,430

|

|

-

|

|

|

Net loss from operations

|

|

(23,352)

|

|

(18,371)

|

|

|

Interest income (Expense) (net)

|

|

(6,138)

|

|

307

|

|

|

Loss from equity investment

|

|

(1,022)

|

|

(64)

|

|

|

Foreign exchange gain (loss)

|

|

164

|

|

(385)

|

|

|

Other income (loss)

|

|

(5)

|

|

955

|

|

|

Net loss

|

|

(30,353)

|

|

(17,558)

|

|

|

|

|

|

|

|

|

|

Loss per share – basic and diluted

|

|

(0.25)

|

|

(0.15)

|

|

| 36 | ||

| 37 | ||

| 38 | ||

|

|

Year ended December 31,

|

|

|||||

|

|

2012

|

2011

|

|

||||

|

|

$

|

$

|

|

||||

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

Nil

|

|

|

Nil

|

|

|

Exploration and evaluation expense

|

|

|

3,285

|

|

|

5,126

|

|

|

Development expense

|

|

|

8,979

|

|

|

3,769

|

|

|

General and administrative

|

|

|

6,107

|

|

|

7,585

|

|

|

Net loss from operations

|

|

|

(18,371)

|

|

|

(16,480)

|

|

|

Interest income

|

|

|

307

|

|

|

243

|

|

|

Loss from equity investment

|

|

|

(64)

|

|

|

(314)

|

|

|

Foreign exchange loss

|

|

|

(385)

|

|

|

186

|

|

|

Other income (loss)

|

|

|

955

|

|

|

(78)

|

|

|

Net loss

|

|

|

(17,558)

|

|

|

(16,443)

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share – basic and diluted

|

|

|

(0.15)

|

|

|

(0.16)

|

|

| 39 | ||

| 40 | ||

| 41 | ||

|

|

|

Payments due (by period) in thousands

|

|

|||||||||||||

|

|

|

|

|

|

|

Less than

|

|

|

|

|

|

|

|

|

More than

|

|

|

|

|

Total

|

|

1 year

|

|

1 to 3 years

|

|

3 to 5 years

|

|

5 years

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes payable

|

|

|

39,153

|

|

|

5,153

|

|

|

8,371

|

|

|

9,384

|

|

|

16,245

|

|

|

Interest on notes payable

|

|

|

9,628

|

|

|

2,087

|

|

|

3,498

|

|

|

2,485

|

|

|

1,558

|

|

|

Operating leases

|

|

|

703

|

|

|

203

|

|

|

400

|

|

|

100

|

|

|

-

|

|

|

Environmental remediation

|

|

|

85

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

85

|

|

|

Asset retirement obligations

|

|

|

17,279

|

|

|

-

|

|

|

-

|

|

|

7,370

|

|

|

9,909

|

|

|

Development agreement

|

|

|

167

|

|

|

167

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

67,015

|

|

|

7,610

|

|

|

12,269

|

|

|

19,339

|

|

|

27,797

|

|

|

|

December 31, 2013

|

|

December 31, 2012

|

|

Change

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Common shares

|

|

|

127,559,743

|

|

121,134,276

|

|

6,425,467

|

|

|

Warrants

|

|

|

8,374,112

|

|

150,000

|

|

8,224,112

|

|

|

RSUs

|

|

|

691,610

|

|

826,425

|

|

(134,815)

|

|

|

Stock options

|

|

|

9,273,659

|

|

8,511,722

|

|

761,937

|

|

|

|

|

|

|

|

|

|

|

|

|

Fully diluted shares outstanding

|

|

|

145,899,124

|

|

130,622,423

|

|

15,276,701

|

|

|

|

As at

|

As at

|

|

||||

|

|

December 31,

|

December 31,

|

|

||||

|

|

2013

|

2012

|

|

||||

|

|

$

|

$

|

|

||||

|

|

|

|

|

|

|

|

|

|

Cash on deposit at banks

|

|

|

296

|

|

|

262

|

|

|

M oney market funds

|

|

|

1,331

|

|

|

11,274

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,627

|

|

|

11,536

|

|

| 42 | ||

|

|

As at

|

As at

|

|

||||

|

|

December 31,

|

December 31,

|

|

||||

|

|

2013

|

2012

|

|

||||

|

|

$

|

$

|

|

||||

|

|

|

|

|

|

|

|

|

|

Guaranteed investment certificates

|

|

|

-

|

|

|

6,450

|

|

|

Certificates of deposit

|

|

|

-

|

|

|

10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

|

|

|

6,460

|

|

|

|

|

2013

|

|

||||||

|

|

|

Quarter ended

|

|

||||||

|

|

|

Dec. 31

|

|

Sep. 30

|

|

Jun. 30

|

|

Mar. 31

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

7,616

|

|

-

|

|

-

|

|

-

|

|

|

Net loss for the period

|

|

(6,161)

|

|

(7,336)

|

|

(9,661)

|

|

(7,195)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share – basic and diluted

|

|

(0.05)

|

|

(0.06)

|

|

(0.08)

|

|

(0.06)

|

|

|

|

|

2012

|

|

||||||

|

|

|

Quarter ended

|

|

||||||

|

|

|

Dec. 31

|

|

Sep. 30

|

|

Jun. 30

|

|

Mar. 31

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

Nil

|

|

Nil

|

|

Nil

|

|

Nil

|

|

|

Net loss for the period

|

|

(8,146)

|

|

(4,508)

|

|

(2,515)

|

|

(2,389)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share – basic and diluted

|

|

(0.03)

|

|

(0.04)

|

|

(0.02)

|

|

(0.02)

|

|

| 43 | ||

| 44 | ||

| (a) | Evaluation of Disclosure Controls and Procedures |

| 45 | ||

| (b) | Management’s Report on Internal Control over Financial Reporting |

| 46 | ||

|

Name and

Province or State and Country of

Residence |

|

Position with Ur-Energy and

Principal Occupation Within the Past Five Years |

|

Period(s) of Service as a Director

|

|

Jeffrey T. Klenda

Colorado, USA

|

|

Chair and Executive Director

|

|

August 2004 – present

|

|

|

|

|

|

|

|

Wayne W. Heili(5)

Wyoming, USA

|

|

President and CEO, and Director

(formerly, Vice-President, Mining and Engineering)

|

|

May 2011 – present

|

|

|

|

|

|

|

|

W. William Boberg(5)

Colorado, USA

|

|

Director

(formerly President and CEO of Ur-Energy)

|

|

January 2006 – present

|

|

|

|

|

|

|

|

James M. Franklin(1)(2)(3)(5)

Ontario, Canada

|

|

Director

Consulting Geologist / Adjunct Professor of Geology Queen’s University, Laurentian University and University of Ottawa

|

|

March 2004 – present

|

|

|

|

|

|

|

|

Paul Macdonell(1)(2)(3)(4)(5)

Ontario, Canada

|

|

Director

Private Mediator (2014 – date)

Senior Mediator, Government of Canada (2000 – 2014)

|

|

March 2004 – present

|

|

|

|

|

|

|

|

Thomas Parker(1)(2)(3)(4)(5)

Montana, USA

|

|

Director

Mining Company Executive

|

|

July 2007 – present

|

|

|

|

|

|

|

|

Roger L. Smith

Colorado, USA

|

|

Chief Financial Officer and Chief Administration Officer

(formerly, CFO and Vice President, Finance, IT and Administration)

|

|

N/A

|

|

|

|

|

|

|

|

Steven M. Hatten

Wyoming, USA

|

|

Vice President Operations

(formerly, Director, Engineering & Operations; Engineering Manager)

|

|

N/A

|

|

|

|

|

|

|

|

John W. Cash

Wyoming, USA

|

|

Vice President, Regulatory Affairs, Exploration and Geology

(formerly, Director Regulatory Affairs; Environment, Health, Safety and Regulatory Affairs Manager)

|

|

N/A

|

|

|

|

|

|

|

|

Penne A. Goplerud

Colorado, USA

|

|

Corporate Counsel and General Counsel

(formerly, Associate General Counsel)

|

|

N/A

|

| 47 | ||

| (1) | Member of the Audit Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Corporate Governance and Nominating Committee. |

| (4) | Member of Treasury and Investment Committee. |

| (5) | Member of the Technical Committee. |

|

Jeffrey T. Klenda, 57, B.A.

|

Chair & Executive Director

|

|

Wayne W. Heili, 48, B.Sc

|

President, Chief Executive Officer and Director

|

| 48 | ||

|

W. William (Bill) Boberg, 74, M.Sc., P Geo

|

Director

|

|

James M. Franklin, 71, Ph. D., FRSC, P. Geo

|

Director & Chair of the Technical Committee

|

|

Paul Macdonell, 61, Diploma Public Admin.

|

Director, Chair of Compensation Committee &Chair

|

|

|

of Corporate Governance and Nominating Committee

|

| 49 | ||

|

Thomas Parker, 71, M.Sc., P.E.

|

Director, Chair of Audit Committee &

|

|

|

Chair of Treasury & Investment Committee

|

|

Roger L. Smith, 55, CPA, MBA, CGMA

|

Chief Financial Officer and Chief Administrative Officer

|

|

Steven M. Hatten, 50, B.Sc.

|

Vice President Operations

|

|

John W. Cash, 41, M.Sc.

|

Vice President Regulatory Affairs, Exploration & Geology

|

| 50 | ||

|

Penne A. Goplerud, 52, JD

|

General Counsel & Corporate Secretary

|

| · | our strategic planning and budgeting process; |

| · | the identification of the principal risks to our business and the implementation of systems to manage these risks; |

| · | succession planning, including appointing, training and monitoring senior management; |

| · | our public communications policies and continuous disclosure record; and |

| · | our internal controls and management information systems. |

| 51 | ||

| · | reviewing for recommendation to the Board of Directors for its approval the principal documents comprising our continuous disclosure record, including interim and annual financial statements and management’s discussion and analysis; |

| · | recommending to the Board of Directors a firm of independent auditors for appointment by the shareholders and reporting to the Board of Directors on the fees and expenses of such auditors. The Audit Committee has the authority and responsibility to select, evaluate and if necessary replace the independent auditor. The Audit Committee has the authority to approve all audit engagement fees and terms and the Audit Committee, or a member of the Audit Committee, must review and pre-approve any non-audit services provided to Ur-Energy by our independent auditor and consider the impact on the independence of the auditor; |

| 52 | ||

| · | reviewing periodic reports from the Chief Financial Officer; |

| · | discussing with management and the independent auditor, as appropriate, any audit problems or difficulties and management’s response; and |

| · | establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, including through the Whistleblower program. |

| · | reviewing our annual financial statements and management’s discussion and analysis prior to filing with the regulatory authorities; |

| · | reviewing our quarterly interim financial statements and management’s discussion and analysis prior to filing with regulatory authorities; |

| · | reviewing periodic reports from the Chief Financial Officer; |

| · | reviewing applicable corporate disclosure reporting and control processes, including Chief Executive Officer and Chief Financial Officer certifications; |

| · | approving retention of an external firm for testing of internal controls and subsequently reviewing reports made by the firm; |

| · | reviewing Audit Committee governance practices to ensure its terms of reference incorporate all regulatory requirements; and |

| · | reviewing the engagement letter with the independent auditors and annual audit fees prior to approval by the Board of Directors, as well as pre-approving non-audit services and their cost prior to commencement. |

| · | reviewed and discussed the audited financial statements with management and the independent accountants; |

| · | discussed with the independent accountants the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU section 380), as modified by SAS 89 and SAS 90; and |

| · | received the written disclosures and the letter from the independent accountants required by PCAOB Rule 3526, as may be modified or supplemented, and discussed with the independent accountant the accountants’ independence. |

| 53 | ||

| 54 | ||

|

Name and principal position

|

|

Year

|

|

Salary

($) |

|

Bonus

($) |

|

Stock

awards(2) ($) |

|

Option

awards(2) ($) |

|

Non-equity

incentive plan compensation (3) ($) |

|

Change in

pension value and nonqualified deferred compensation ($) |

|

All other

compensation ($) |

|

Total

($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wayne W. Heili (4) (5)

|

|

2013

|

|

258,284

|

|

50,000

|

|

25,727

|

|

67,890

|

|

Nil

|

|

Nil

|

|

Nil

|

|

401,901

|

|

|

Director, President, and

|

|

2012

|

|

256,882

|

|

Nil

|

|

50,492

|

|

98,688

|

|

17,025

|

|

Nil

|

|

Nil

|

|

423,087

|

|

|

Chief Exectuve Officer

|

|

2011

|

|

240,997

|

|

Nil

|

|

74,255

|

|

344,286

|

|

Nil

|

|

Nil

|

|

Nil

|

|

659,538

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Roger L. Smith (6) (7)

|

|

2013

|

|

252,668

|

|

40,000

|

|

22,650

|

|

59,772

|

|

Nil

|

|

Nil

|

|

Nil

|

|

375,090

|

|

|

Chief Financial Officer and

|

|

2012

|

|

251,297

|

|

Nil

|

|

44,457

|

|

86,888

|

|

15,325

|

|

Nil

|

|

Nil

|

|

397,967

|

|

|

Chief Administrative Officer

|

|

2011

|

|

243,665

|

|

Nil

|

|

79,557

|

|

349,487

|

|

Nil

|

|

Nil

|

|

Nil

|

|

672,709

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jeffrey T. Klenda (8) (9)

|

|

2013

|

|

258,284

|

|

50,000

|

|

25,727

|

|

67,890

|

|

Nil

|

|

Nil

|

|

Nil

|

|

401,901

|

|

|

Chair and

|

|

2012

|

|

256,882

|

|

Nil

|

|

50,492

|

|

98,688

|

|

17,025

|

|

Nil

|

|

Nil

|

|

423,087

|

|

|

Executive Director

|

|

2011

|

|

233,724

|

|

Nil

|

|

94,292

|

|

256,588

|

|

Nil

|

|

Nil

|

|

Nil

|

|

584,604

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Penne A. Goplerud(10) (11)

|

|

2013

|

|

227,162

|

|

40,000

|

|

20,364

|

|

53,739

|

|

Nil

|

|

Nil

|

|

Nil

|

|

341,265

|

|

|

General Counsel and

|

|

2012

|

|

205,651

|

|

Nil

|

|

35,282

|

|

68,228

|

|

10,599

|

|

Nil

|

|

Nil

|

|

319,760

|

|

|

Corporate Secretary

|

|

2011

|

|

163,053

|

|

Nil

|

|

26,793

|

|

177,345

|

|

Nil

|

|

Nil

|

|

Nil

|

|

367,191

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steven M. Hatten(12) (13)

|

|

2013

|

|

181,090

|

|

35,000

|

|

16,234

|

|

42,840

|

|

Nil

|

|

Nil

|

|

Nil

|

|

275,164

|

|

|

Vice President, Operations

|

|

2012

|

|

180,101

|

|

Nil

|

|

31,860

|

|

62,270

|

|

10,982

|

|

Nil

|

|

Nil

|

|

285,213

|

|

|

|

|

2011

|

|

165,417

|

|

Nil

|

|

29,268

|

|

183,854

|

|

Nil

|

|

Nil

|

|

Nil

|

|

378,539

|

|

| 55 | ||

| 56 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Grant

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All other

|

|

|

|

|

|

date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All other

|

|

option

|

|

|

|

|

|

fair

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

stock

|

|

awards:

|

|

|

|

|

|

value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

awards

|

|

Number

|

|

|

Exercise

|

|

|

of

|

|

|

|

|

|

|

|

Estimated future payouts

|

|

|

|

|

|

|

|

|

|

|

Number of

|

|

of

|

|

|

of base

|

|

|

stock

|

|

||||||

|

|

|

|

|

|

under non-equity

|

|

|

Estimated future payouts under

|

|

shares of

|

|

securities

|

|

|

price of

|

|

|

and

|

|

||||||||||||

|

|

|

|

|

|

incentive plan awards

|

|

|

equity incentive plan awards

|

|

stock or

|

|

underlying

|

|

|

option

|

|

|

option

|

|

||||||||||||

|

|

|

|

|

|

Threshold

|

|

|

Target

|

|

|

Maximum

|

|

|

Threshold

|

|

|

Target

|

|

|

Maximum

|

|

units

|

|

options

|

|

|

awards

|

|

|

awards

|

|

|

Name

|

|

Grant date

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

(#)

|

|

(#)

|

|

|

(Cdn$/Sh)

|

|

|

(US$)

|

|

|

Wayne W. Heili

|

|

4/25/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

Nil

|

|

57,249

|

|

$

|

0.77

|

|

$

|

0.34

|

|

|

|

|

12/27/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

Nil

|

|

88,203

|

|

$

|

1.20

|

|

$

|

0.55

|

|

|

|

|

12/27/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

22,076

|

|

Nil

|

|

|

Nil

|

|

$

|

1.17

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Roger L. Smith

|

|

4/25/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

Nil

|

|

50,403

|

|

$

|

0.77

|

|

$

|

0.34

|

|

|

|

|

12/27/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

Nil

|

|

77,744

|

|

$

|

1.20

|

|

$

|

0.55

|

|

|

|

|

12/27/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

19,436

|

|

Nil

|

|

|

Nil

|

|

$

|

1.17

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jeffrey T. Klenda

|

|

4/25/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

Nil

|

|

57,249

|

|

$

|

0.77

|

|

$

|

0.34

|

|

|

|

|

12/27/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

Nil

|

|

88,203

|

|

$

|

1.20

|

|

$

|

0.55

|

|

|

|

|

12/27/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

22,076

|

|

Nil

|

|

|

Nil

|

|

$

|

1.17

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Penne A. Goplerud

|

|

4/25/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

Nil

|

|

45,315

|

|

$

|

0.77

|

|

$

|

0.34

|

|

|

|

|

12/27/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

Nil

|

|

69,896

|

|

$

|

1.20

|

|

$

|

0.55

|

|

|

|

|

12/27/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

17,474

|

|

Nil

|

|

|

Nil

|

|

$

|

1.17

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steven M. Hatten

|

|

4/25/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

Nil

|

|

36,125

|

|

$

|

0.77

|

|

$

|

0.34

|

|

|

|

|

12/27/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

Nil

|

|

55,720

|

|

$

|

1.20

|

|

$

|

0.55

|

|

|

|

|

12/27/2013

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

|

Nil

|

|

13,930

|

|

Nil

|

|

|

Nil

|

|

$

|

1.17

|

|

| 57 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All other:

|

|

All other

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

stock

|

|

option

|

|

|

|

|

|

Grant

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|